Investment bank and financial services company Morgan Stanley (MS) is scheduled to report its earnings for the first quarter of 2025 on Friday, April 11. It has surpassed Wall Street’s earnings expectations for four consecutive quarters. While analysts expect solid growth in Q1 revenue and earnings, focus will be on Morgan Stanley’s outlook and management’s commentary about the state of the economy and its impact on the bank’s major businesses, including investment banking and wealth management.

Claim 50% Off TipRanks Premium and Invest with Confidence

- Unlock hedge-fund level data and powerful investing tools designed to help you make smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis so your portfolio is always positioned for maximum potential

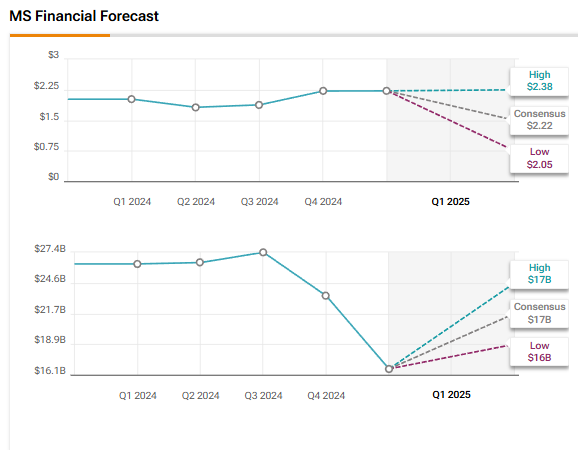

Wall Street expects Morgan Stanley to report EPS (earnings per share) of $2.22 for Q1 2025, up about 10% year over year. Revenue is estimated to grow 10% to $16.61 billion.

The ongoing trade wars are expected to result in an economic slowdown, which could impact investment banking and trading activity. Moreover, a potential recession could also result in higher credit risk and weigh on the performance of banks.

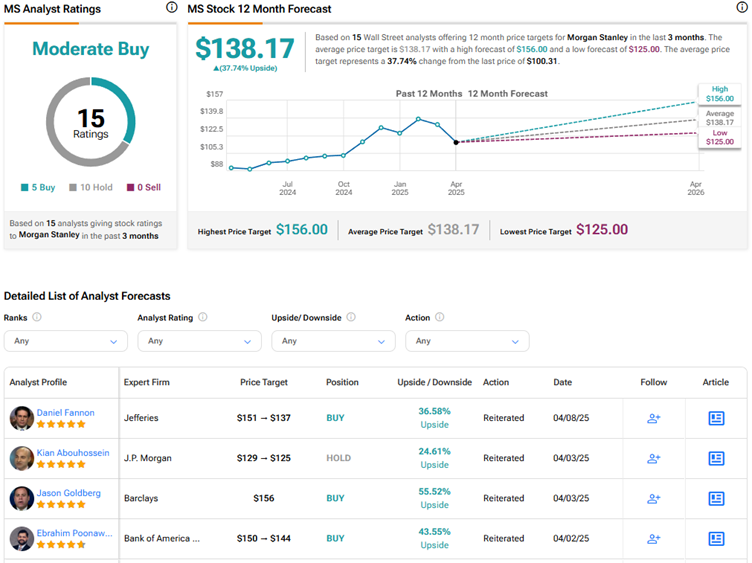

Analysts’ Views Ahead of Morgan Stanley’s Q1 Results

Recently, Erste Group analyst Hand Engel downgraded Morgan Stanley stock from Buy to Hold, as he expects revenue and profit growth to be significantly lower in 2025 compared to the previous year. Engle noted that the Investment Banking segment, which is a key business for Morgan Stanley, is witnessing increased uncertainty due to the U.S. tariff policy and weakening economic growth.

Moreover, the analyst expects the bank’s smaller segment of interest-based income to see a rise in loan loss provisions. Engel contended that since MS stock is trading at a higher P/E (price-to-earnings) multiple than the sector average, it can offer only limited upside potential in the medium term.

Meanwhile, Bank of America analyst Ebrahim Poonawala lowered the price target for MS stock to $144 from $150 and reaffirmed a Buy rating. The 5-star analyst expects banks to have a cautious tone during Q1 earnings calls, highlighting downside risks due to policy uncertainties. While Poonawala thinks that it is “too soon to expect meaningful credit cracks,” he sees potential for macro-led rise in reserves due to the increased possibility of downside scenarios.

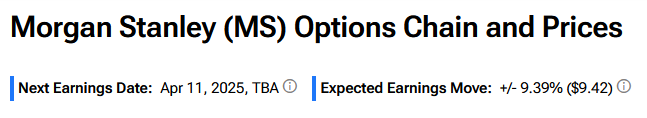

Options Traders Anticipate Major Move on Morgan Stanley’s Q1 Earnings

Using TipRanks’ Options tool, we can see what options traders are expecting from the stock immediately after its earnings report. The expected earnings move is determined by calculating the at-the-money straddle of the options closest to expiration after the earnings announcement. If this sounds complicated, don’t worry, the Options tool does this for you.

Indeed, it currently says that options traders are expecting about a 9.4% move in either direction in MS stock in reaction to Q1 2025 results.

Is MS Stock a Good Buy?

Overall, Wall Street is cautiously optimistic on Morgan Stanley stock ahead of Q1 results. The Moderate Buy consensus rating on MS stock is based on five Buys and 10 Holds. The average MS stock price target of $138.17 implies about 38% upside potential from current levels. Morgan Stanley stock is down 20% year to date.