Morgan Stanley (MS) is reinforcing its dual focus on profitability and public perception through a blend of strategic financial results, digital innovation, and opportunistic real estate investment. The firm’s latest performance figures and its continued expansion into sustainable, student-focused housing projects demonstrate how the giant bank is positioning itself for the long term while emphasizing social and community impact.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

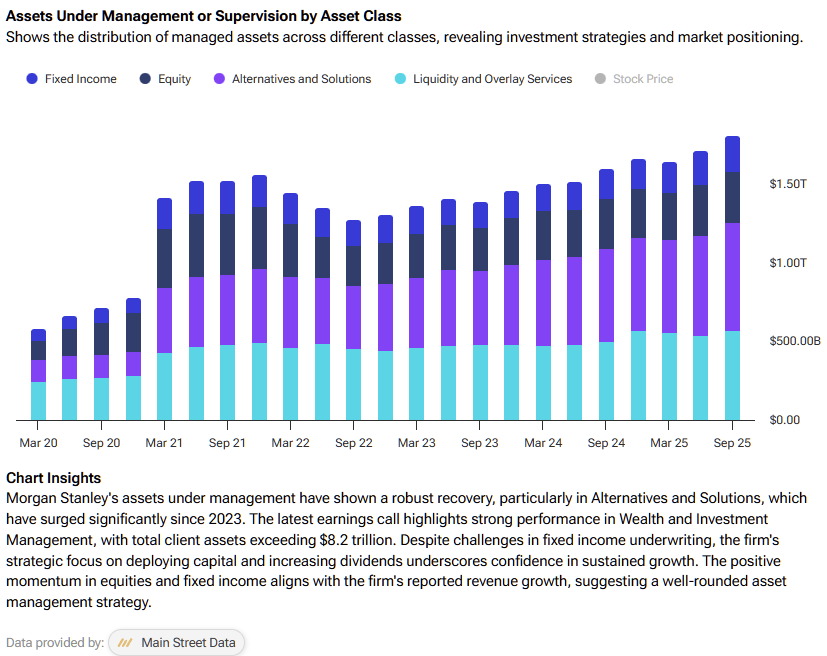

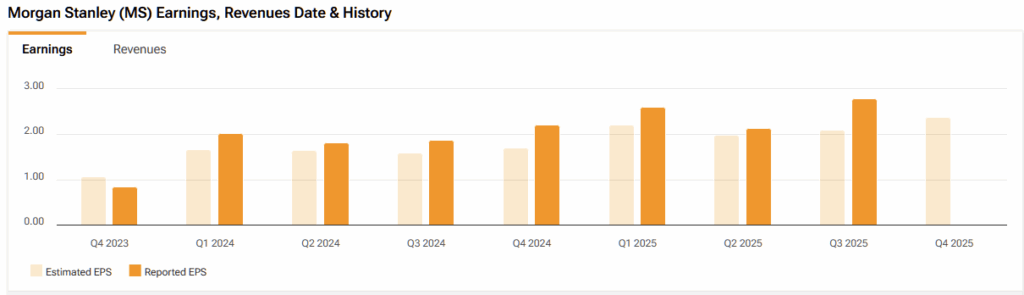

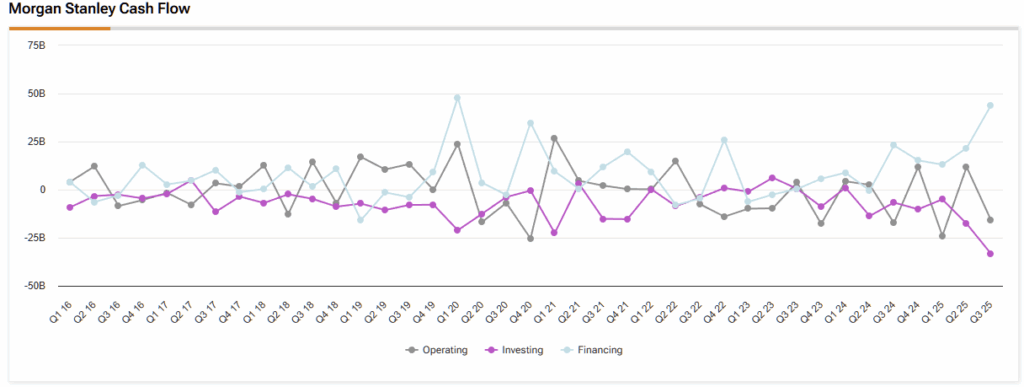

Just a few weeks ago, the bank reported record quarterly revenues of $18.2 billion, with total client assets almost reaching $9 trillion. Earnings per share (EPS) hit $2.80, and the firm delivered an impressive 23.5% return on tangible common equity (ROTCE), thereby underscoring the strength of its diversified business model.

If the robust performance wasn’t awe-inspiring enough, the firm’s wealth management division celebrated reaching the $7 trillion mark in client assets, supported by $81 billion in net new inflows and $42 billion in fees, marking consistent growth in client engagement and retention.

Meanwhile, Morgan Stanley’s investment banking shows clear signs of recovery, generating $2.1 billion in revenue—an 80% year-over-year rise in equity underwriting fueled by renewed IPO activity and robust advisory performance. The firm’s strategic emphasis on AI-driven productivity, through initiatives such as DevGen AI and LeadIQ, further demonstrates its intent to modernize operations and enhance client interactions.

In fact, according to independent consulting firm ThoughtLinks, AI is on track to “redefine” 44% of the daily tasks done by banks within the next five years. If so, MS is already getting started.

Real Estate Division Also Shines

Complementing its strong financial standing, Morgan Stanley’s Real Estate Investing division (MSREI) also grew its global footprint in 2025. Earlier today, the unit announced a partnership with Global Student Accommodation (GSA), following the acquisition of eight premium student housing assets located at Tier 1 U.S. universities.

Valued at over $1 billion, the transaction has been touted as one of the largest in the global student housing sector this year, adding 6,200 beds across seven states, serving institutions such as the University of Virginia, University of Florida, Texas A&M, and Penn State University.

According to MSREI, the acquisition expands its presence in key states, enabling MSREI and GSA to manage a portfolio of 50 properties in 36 cities across 23 states, serving nearly 24,000 students. The properties are set to be “rebranded” and managed by Yugo, GSA’s global student housing operator, known for creating “vibrant and sustainable student communities.”

Skeptics Take Their Stand

Although MS investors will likely appreciate the recent news of the bank’s strong earnings and conservative real estate strategy, skeptics note that beneath the celebratory headlines, not everyone is convinced that the bank’s motives are as community-driven as they appear. The partnership with GSA, Yugo, and the Abu Dhabi Investment Authority (ADIA)—all major players with deep institutional ties—suggests that this billion-dollar acquisition may serve multiple interests beyond just “enhancing student experiences.”

The properties in the acquired portfolio are noted to be high-quality assets in prime university cities where enrollment demand continues to climb and new development opportunities are limited. With a guaranteed 100% occupancy rate across 6,200 premium-rate beds, the acquisition provides an immediate and sustainable revenue stream—an appealing prospect in an era when commercial real estate faces broader market pressures. While MSREI describes the purchase as a feature of a “long-term strategy” to support education and sustainability, skeptics note that such portfolios are as much about dependable cash flow as they are about social good.

Moreover, by framing the deal around student welfare and community investment, Morgan Stanley and its partners are arguably seizing an opportunity to improve and sustain their public image at a time when large financial institutions face increasing scrutiny and the excesses of the GFC are still echoing in people’s minds. Focusing on acquisitions within education—a universally positive theme—offers a powerful narrative tool, one that conveniently aligns with the bank’s recent string of record-breaking earnings and its push to position itself as a tech-forward, socially engaged enterprise.

In that light, the “sustainability” messaging surrounding the transaction could just as easily double as strategic public relations—a chance for Morgan Stanley to present itself as both profitable and principled without breaking from its core pursuit of generating higher-than-expected returns for its clients. Whether this latest venture ultimately benefits students, universities, or simply the bottom line of Morgan Stanley, GSA, Yugo, and ADIA remains to be seen. But for now, it’s clear that the deal is as much about optics and opportunity as it is about impact.