Chinese tech giant JD.com (JD) is scheduled to announce its third-quarter results on November 13. Ahead of the results, Morgan Stanley analyst Eddy Wang downgraded JD.com stock from Hold to Sell, with a price target of $28, citing margin pressure and the fading of benefits from China’s trade-in policy aimed at boosting domestic consumption. Notably, the trade-in policy offers subsidies to consumers who trade in old products for new ones.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

JD stock is down 8% year-to-date, as intense competition and investments in businesses like delivery are impacting the company’s margins.

Meanwhile, Wall Street expects JD.com to report earnings per share (EPS) of $0.39 on revenue of $41.4 billion for Q3 2025.

Morgan Stanley Turns Bearish on JD Stock

Wang noted that compared to e-commerce peers like Alibaba (BABA) and PDD Holdings (PDD), JD.com has gained the most from the trade-in policy since late August 2024, given that its gross merchandise value (GMV) and sales have the highest exposure to home appliances and electronics. That said, Wang contended that the impact of the trade-in policy is fading and will make comparisons tough from Q3 2025.

Consequently, Wang expects JD’s year-over-year revenue growth to decelerate to 5.6% in Q4 2025 due to lower sales in the home appliances and electronics categories. The analyst expects further deceleration in 2026, with revenue growth of 4.4%.

Furthermore, Wang expects the diminishing benefits of the trade-in policy and slower top-line growth to result in less operating leverage over the next 12 months. He also expects JD’s continued investments in new businesses to weigh on long-term margins and ROE (return on equity). Notably, Wang expects JD’s non-GAAP net margin to decline to about 2.3%-2.5% in 2025-2030. Moreover, he expects “structural deterioration” in JD’s ROE from 20.3% in 2024 to 12.6% in 2030.

Is JD Stock a Buy, Sell, or Hold?

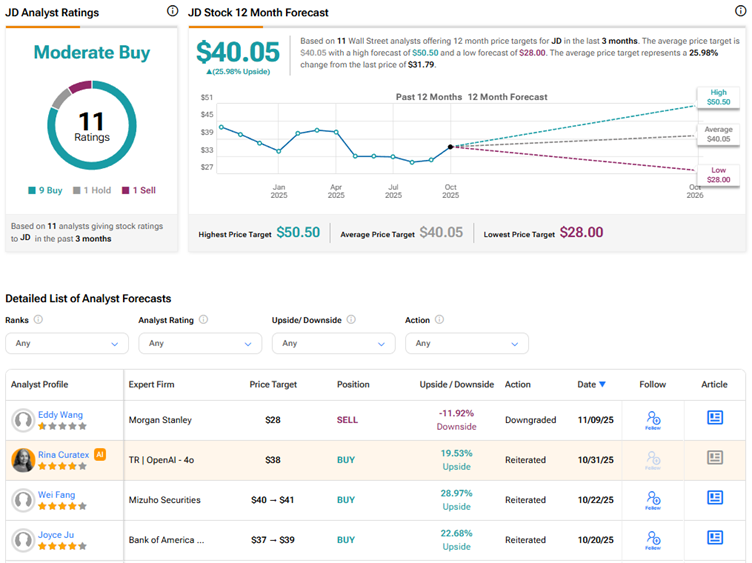

Currently, Wall Street has a Moderate Buy consensus rating on JD.com stock based on nine Buys, one Hold, and one Sell recommendation. The average JD stock price target of $40.05 indicates 26% upside potential from current levels.