Nvidia (NASDAQ:NVDA) shares shed nearly $183 billion in value during the last trading day alone, showing how vulnerable even the most dominant tech names are in times of market turmoil. As trade tensions between the world’s biggest economies escalate, the road ahead is looking increasingly uncertain.

With a large chunk of its production rooted in Taiwan and China, Nvidia now faces U.S.-imposed import duties of 32% and 34%, respectively. That’s a costly blow that could drive up GPU prices and potentially dampen consumer demand. Meanwhile, China isn’t standing still – it’s hitting back with its own 34% tariff on U.S. imports, putting additional pressure on Nvidia’s business in one of its most crucial markets.

Investor Vladimir Dimitrov warns that mounting tariffs may hit Nvidia hard, potentially triggering a shift in sentiment that could turn analysts against the once-untouchable Wall Street darling.

“The intensifying trade war could now act as a catalyst for the equity market and sell-side analysts are likely to use it as an excuse to downgrade the stock,” Dimitrov opined.

The investor also points to Nvidia’s recent inclusion in the Dow Jones Industrial Average as a potential warning sign. What many hailed as a milestone, he interpreted as a peak marked with “perfect precision.”

“On the day prior to NVDA’s inclusion into the index I outlined the possibility of this event having serious repercussions for shareholder returns and the risks that shareholders were taking by buying NVDA near the $150 handle. Not surprisingly perhaps, NVDA stock has lost roughly 30% of its value since then,” Dimitrov argued.

And he’s not calling the bottom yet. Dimitrov believes further downside is a real possibility. “I do not expect the stock to return to its $150 level anytime soon,” the investor noted. “More downward pressure is not something that I would rule out.”

Against this backdrop, Dimitrov rates NVDA shares a Hold (i.e. Neutral). (To watch Dimitrov’s track record, click here)

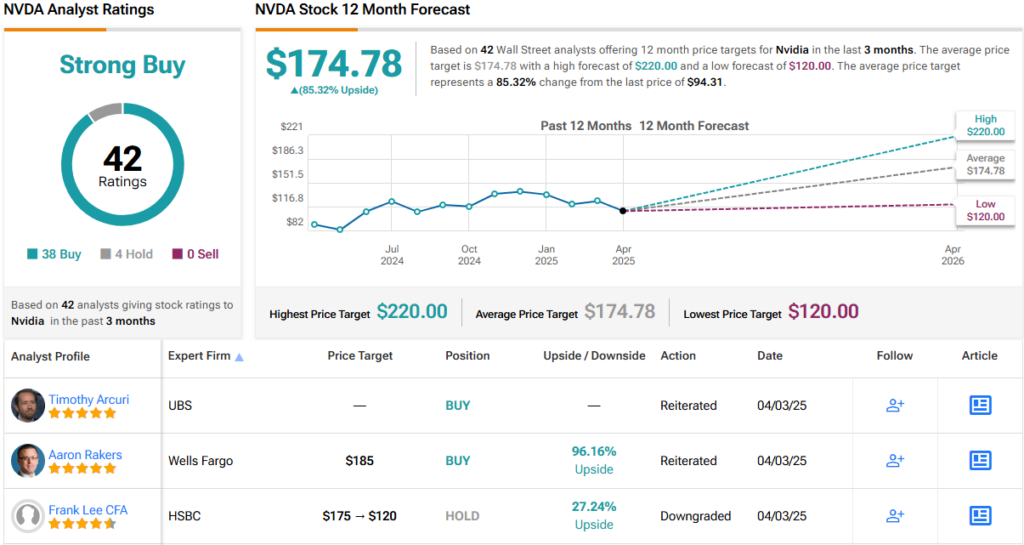

Wall Street analysts, however, remain firmly bullish. With 38 Buy and 4 Hold ratings, NVDA retains its Strong Buy consensus rating. Its 12-month average price target of $174.78 implies an upside of ~85% in the coming year. (See NVDA stock forecast)

To find good ideas for AI stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured investor. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.