MongoDB’s (MDB) shares climbed 23% early Tuesday as analysts greeted the cloud-based database provider’s Wall Street-beating Q3 2026 results with price target boosts and Buy ratings.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

During the quarter, MongoDB’s earnings per share (EPS) rose 14% from a year ago to $1.32, while revenue climbed by 19% to $628.31 million. Reacting to the results, BMO Capital analyst Keith Bachman said the New York-based company achieved the results “without the benefit of AI contribution.”

Chipping in, RBC Capital’s Rishi Jaluria pointed out that “execution remains strong” under new CEO Chirantan ‘CJ’ Desai. Desai, a former executive at cybersecurity firm Cloudflare (NET), took over the leadership of MongoDB from Dev Ittycheria on November 10.

Analyst Expects More Future Income from AI

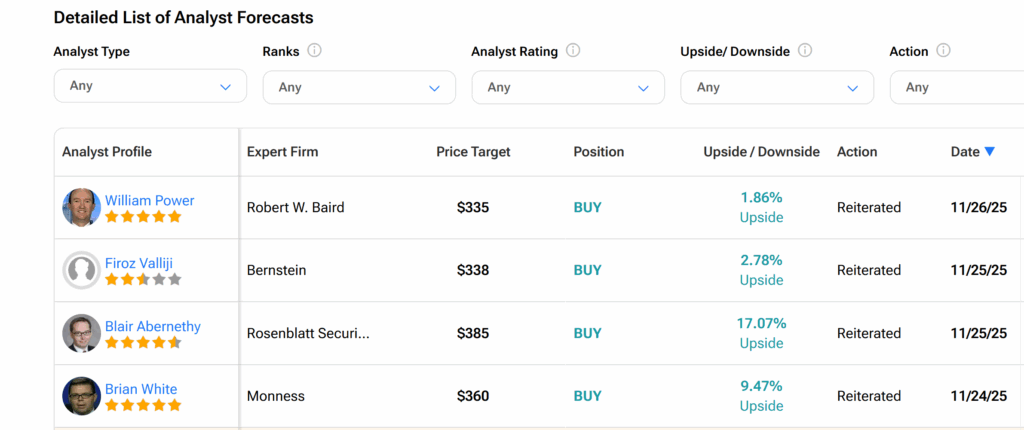

Bachman and Jaluria both reaffirmed their Outperform (Buy) ratings on MDB stock and elevated their price targets by 10% and 11% to $455 and $450 per share, respectively. Both targets represent close to 40% upside from MDB’s closing price of $328.87 on Monday.

Commenting further, Bachman noted that BMO Capital expects MongoDB’s AI-specific features to be a strong contributor to its earnings at the end of Fiscal Year 2026. The four-star analyst further emphasized that the opportunity for growth in MDB stock remains.

Bachman believes that this growth will be fueled by higher sales from Atlas, MongoDB’s fully managed cloud database service. He also sees Atlas “generating a greater percentage of consolidated mix” — that is, accounting for a larger portion of total revenue across all of MongoDB’s business categories.

On his part, Jaluria pointed out that MongoDB’s expectations of higher numbers for both its sales and profit show continued momentum in the ongoing quarter. In its earlier Q2 2026 results, MongoDB also beat Wall Street’s sales and earnings per share projections.

Is MDB a Strong Buy?

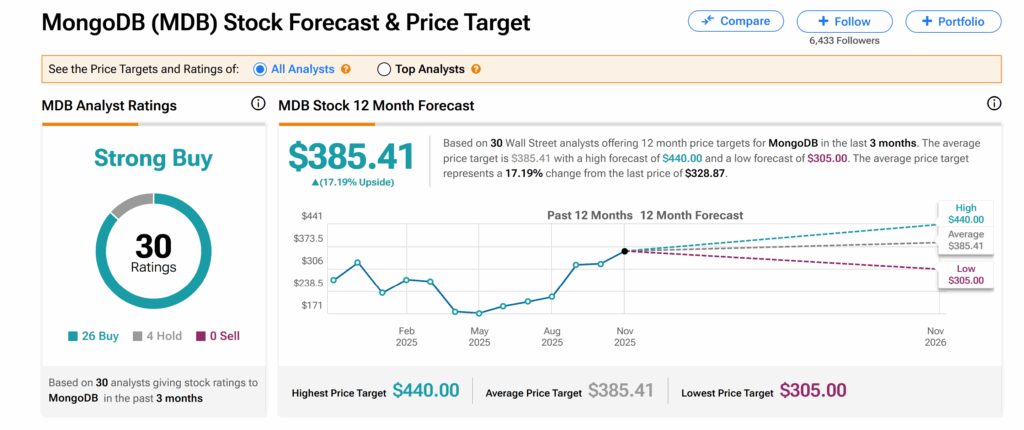

Across Wall Street, sentiment on MongoDB’s shares remains highly upbeat, with the stock carrying a Strong Buy consensus rating. This is based on 26 Buys and four Holds from 30 analysts over the past three months.

Moreover, at $385.41, the average MDB price target implies over 17% upside from current levels. However, this might change as more analysts reassess the stock following the earnings results.