Analysts and investors cheered news that Dollar Tree (DLTR) plans to offload its troubled Family Dollar business, sending shares rocketing up 10% on Thursday. The decision to sell the Family Dollar business for $1 billion ends a decade-long effort to find a fit for the discount chain, which DLTR bought for $9 billion in 2015.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Sale of Family Dollar is “Game Changer“

Loop Capital said the announcement of an agreement to sell long-time albatross Family Dollar is a “game changer” for the stock. The sale, analysts at the firm said, not only rids Dollar Tree of a money-losing distraction but places it back squarely as pureplay, single-price-point retailer with limited direct competition.

Loop kept a Hold rating and $75 price target on Dollar Tree, noting that management has had a rocky record of meeting consensus expectations of late.

Other analysts were more upbeat and prepared to raise forecasts. Truist raised the firm’s price target on Dollar Tree to $84 from $76 and kept a Buy rating on the shares after its Q4 earnings beat. The company’s Family Dollar sale is a “win,” and its sales momentum is “solid”. Big picture-wise, Truist is upbeat and notes that expectations for 3%-5% comparable sales growth is a “better rate than most.”

Evercore ISI meanwhile raised DLTR to $85 from $79 and kept an In Line rating on the shares after the company announced the “much-anticipated” sale of its Family Dollar business. Evercore hailed its “solid efforts to mitigate at least the first round of tariff announcements.” However, it notes that the $1 billio price tag for Family Dollar was at the low end of the $1-$3 billion anticipated.

Not everyone was impressed though as JPMorgan lowered its price target on Dollar Tree to $78 from $88 and kept a Neutral rating on the shares following the Q4 report.

Is DLTR a Good Stock to Buy?

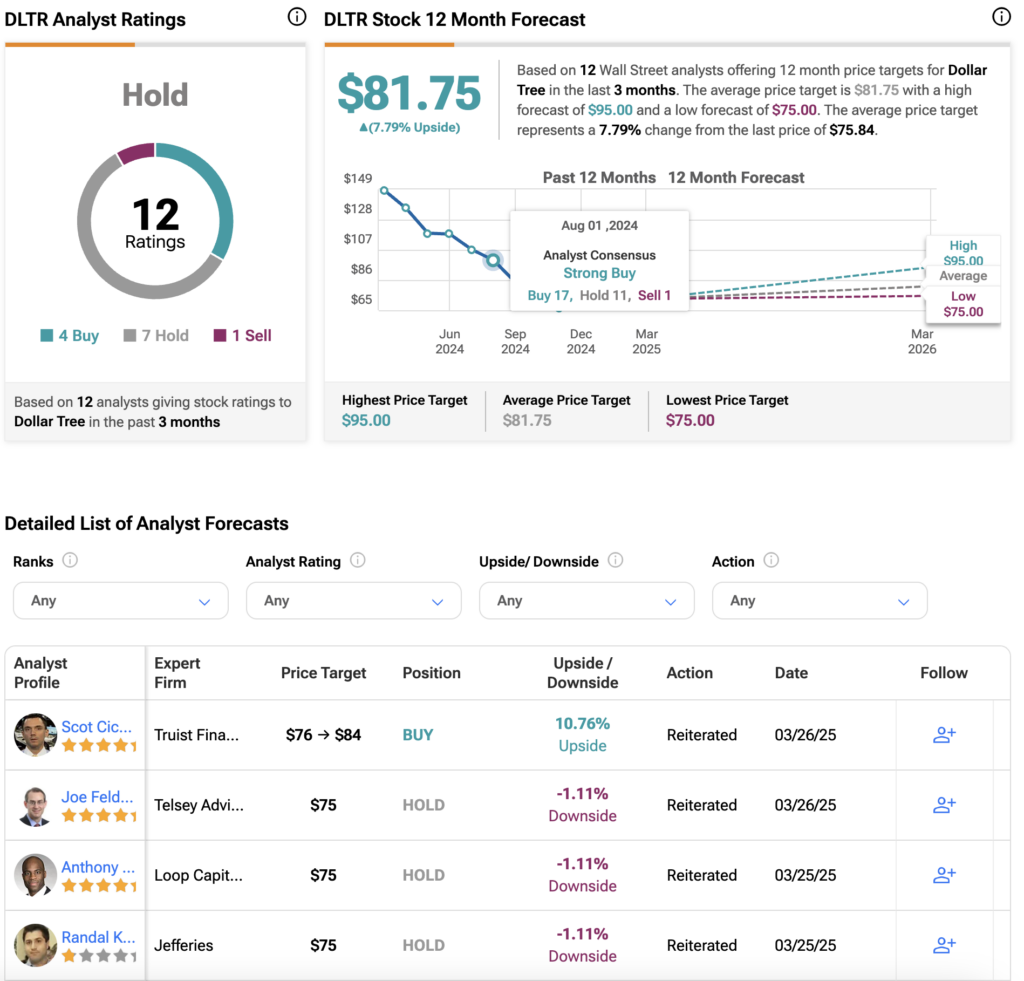

Following the earnings report, Wall Street has a Hold consensus rating on the stock, based on four Buys, seven Holds and one Sell. The average DLTR price target of $81.75 implies about 7% upside.