Molson Coors (NYSE:TAP) shares are tracking lower today despite the alcoholic beverage major delivering a better-than-expected performance for the fourth quarter. Revenue increased by 6.1% year-over-year to $2.79 billion. The figure surpassed expectations by a thin margin of $10 million. Similarly, EPS of $1.19 outpaced estimates by $0.07.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Amid shifting purchasing patterns in the present macroeconomic environment, the company experienced robust U.S. brand volume gains in its Coors Light, Miller Lite, and Coors Banquet offerings. Notably, TAP’s volume, market share, and net sales increased in three of its largest global markets during the year.

Looking ahead to Fiscal Year 2024, Molson Coors is aiming for net sales growth in the low single digits. EPS growth for the year is anticipated in the mid-single digits. The company has also declared a quarterly dividend of $0.44 per share. The Molson Coors dividend is payable on March 15 to investors of record on March 1.

Will Tap Stock Go Up?

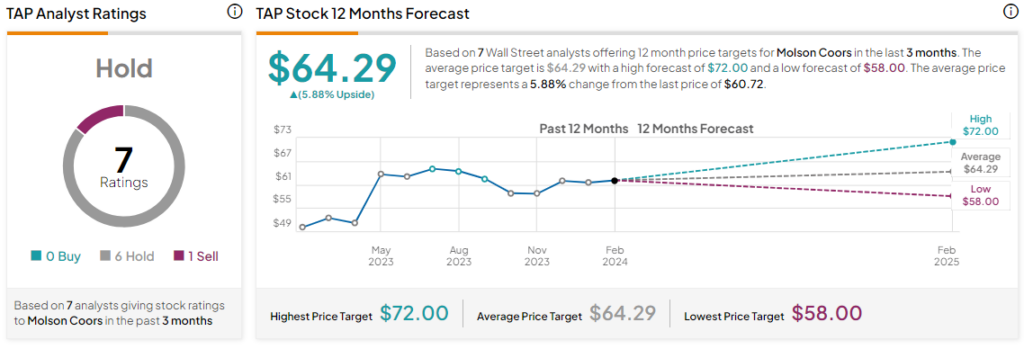

Overall, the Street has a Hold consensus rating on Molson Coors, and the average TAP price target of $64.29 implies a modest 5.9% potential upside in the stock. That’s after a nearly 15% rise in the company’s share price over the past year.

Read full Disclosure