The golf equipment and leisure company Topgolf Callaway Brands (MODG) reported mixed financial performance for the most recent quarter. On the one hand, the company reported a slight decrease in quarterly revenue, but on the other, it outperformed earnings per share expectations. Furthermore, an active partnership with PepsiCo (PEP) and an insider’s investment of $2 million suggest a positive outlook for the stock. However, earnings have declined over time, mounting debt has raised concerns about the company’s future growth and sustainability, and Topgolf’s traffic has deteriorated.

Stay Ahead of the Market:

- Discover outperforming stocks and invest smarter with Top Smart Score Stocks

- Filter, analyze, and streamline your search for investment opportunities using Tipranks' Stock Screener

This has led to a downward shift in guidance and the announcement of a strategic review to explore strategies for profitable sales growth and potential inorganic alternatives. Investors may want to stay on the sidelines until management can articulate a path forward and demonstrate meaningful steps in the right direction.

Topgolf Callaway Is Looking For Answers

Topgolf Callaway Brands operates in diverse segments, offering everything from golf equipment to lifestyle apparel and digital games. The company boasts various brands, including Callaway and Odyssey for golf equipment, TravisMathew for lifestyle, Jack Wolfskin for outdoor wear, and Topgolf venues that employ high-tech hitting bays and dining areas.

However, the company recently revealed disappointment in its stock performance and Topgolf’s same-venue sales performance. The company has launched a comprehensive strategic review of Topgolf, exploring organic and inorganic strategies for returning to profitable sales growth. This includes considering the potential spin-off of Topgolf. The analysis, assisted by external advisors, aims to enhance long-term shareholder value and is expected to be completed swiftly.

Topgolf Callaway’s Recent Financial Results & Outlook

The company recently reported financial results for Q2 2024. Revenue of $1.16 billion fell short of analysts’ expectations of $1.19 while declining 1.9% year-over-year due to a planned shift in golf equipment launch timing and lower sales in the active lifestyle segment. Net income also decreased by $55.3 million on a GAAP basis but increased to $7.5 million on a non-GAAP basis. The company reported earnings per share (EPS) of $0.42, surpassing the consensus projections of $0.28.

The company reported cash and short-term investments of $311.8 million at the quarter’s end.

Following second-quarter results, MODG’s management revised its guidance downward, estimating a consolidated Q3 net revenue of $970 to $990 million and a consolidated Adjusted EBITDA of $95 – $105 million, showing a decline from the Q3 2023 reported figures. The full-year outlook for 2024 projects consolidated net revenue in the range of $4,200 – $4,260 million, a decrease from the previous estimate.

Also, Topgolf’s revenue is projected to be approximately $1,790 million, reflecting a decrease compared to the previous estimate. The Topgolf same venue sales growth is predicted to decrease from low double-digits to high single-digits. Adjusted EBITDA for Topgolf is projected to be around $310 million. Non-GAAP diluted earnings per share are expected to be between $0.11 – $0.21, significantly lower than the previous year’s figure.

What Is the Price Target for MODG Stock?

The stock has been on a multi-year downward trend, shedding 63% over the past three years. It trades at the low end of its 52-week price range of $9.84 – $17.64 while demonstrating negative price momentum by trading below its 20-day (11.92) and 50-day (13.31) moving averages. With a P/S ratio of 0.5x, it trades at a discount to the Leisure industry’s average of 1.85x.

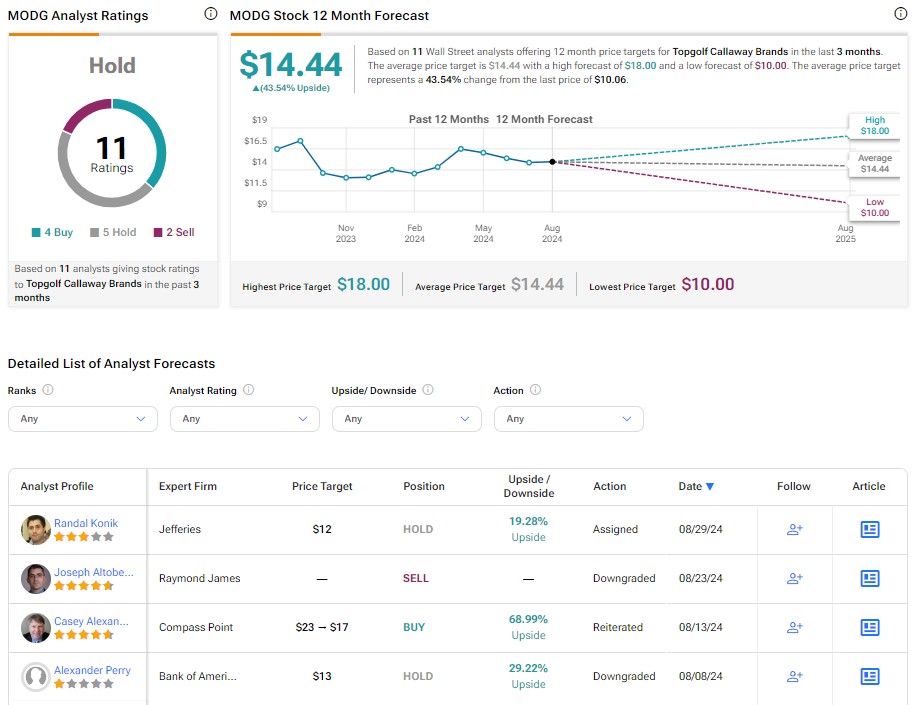

Analysts following the company have been cautiously optimistic about MODG stock. For instance, Jefferies analyst Randal Konik recently downgraded the shares to Hold from Buy with a price target change from $40 to $12, noting the company’s quality of earnings has declined. At the same time, the accumulation of debt raises concerns.

Topgolf Callaway Brands is rated a Hold based on the recent recommendations and price targets issued by 11 analysts. The average price target for MODG stock is $14.44, representing a potential 43.54% upside from current levels.

Seem more MODG analyst ratings

Final Thoughts on Topgolf Callaway

While Topgolf Callaway’s recent earnings per share surpassed expectations, declining revenues, a downward shift in guidance, and decreasing Topgolf traffic raise concerns about future growth and sustainability. These challenges have prompted a strategic review to identify pathways for profitable sales growth and potential alternatives. Yet, despite these hurdles, the company’s diverse product offering and global presence in retail channels continue to underscore its potential for a comeback.

With shares trading at a relative discount, this may be an appealing opportunity for the contrarian value investor. However, investors might want to hold off until management demonstrates more concrete measures towards growth.