Shares in Mobileye Global (MBLY), the Israeli company focused on self-driving car technology and backed by chipmaker Intel (INTC), jumped about 8% on Monday. This came after it secured a “second top-10 automaker” for its Surround advanced driver assistance systems (ADAS).

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

According to the company, the major U.S.-based carmaker — “one of the world’s great automakers” — could deploy ADAS systems running on EyeQ6H, its high-performance car computer or chip platform, in as many as nine million vehicles. This shows “accelerating demand” globally for the system, Mobileye noted.

Mobileye Expands Footprint

Furthermore, Mobileye estimated that future delivery of the systems based on the EyeQ6H system-on-chip will reach reach 19 million systems. “The new customer will offer Surround ADAS as standard equipment across many mainstream and premium models in software-defined vehicle architectures,” the firm said.

In October last year, Mobileye similarly teamed up with manufacturing services firm VVDN Technologies to offer its ADAS technologies to India-based automakers. The car tech firm’s move comes as the race to make robotaxis commercial continues to heat up.

Automakers Race to Make AVs Commercial

According to ResearchAndMarkets, many companies see 2026 as the starting point for large-scale robotaxi rollout, with major automakers targeting 2025-2027 as “the critical phase” for mass production of level-three autonomous vehicles (AVs). This level describes hands-free, eyes-off-the-road driving in certain conditions (e.g., on highways) but which requires a human driver to be ready to take over should the system requests that they do so.

The momentum is already on the ground as Alphabet’s (GOOGL) Waymo self-driving unit delivered 14 million rides between January and early December 2020. This puts the brand ahead of rivals such as Uber (UBER), Lyft (LYFT), Tesla (TSLA) and Amazon’s Zoox (AMZN).

Mobileye notes that its system “significantly lowers costs” and provides vertical software integration by offering multiple driving functions on one chip and electronic control unit. It expects its systems “to become standard equipment on many European and U.S. models in the near future.”

The car technology company has reportedly shed about 5% of its workforce. Mobileye has said its goal is to meet its changing needs.

Is Mobileye a Good Stock to Buy?

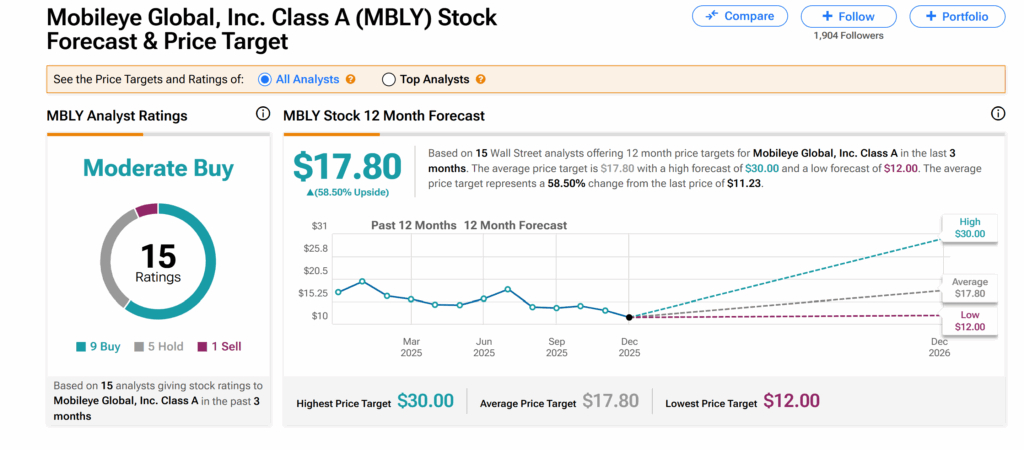

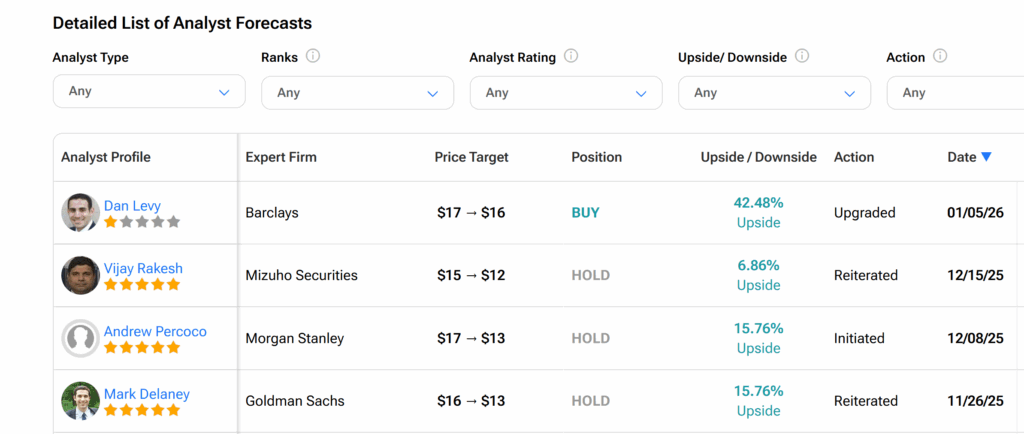

On Wall Street, Mobileye’s shares hold a Moderate Buy consensus rating based on nine Buys, five Holds, and one Sell issued by 15 analysts over the past three months.

Moreover, the average MBLY price target of $17.80 implies about 59% upside.

See more MBLY analyst ratings here.