Cholula and Frank’s hot sauces maker McCormick & Company (MKC) guided lower-than-expected sales growth as it battled weaker demand for spices and condiments, particularly in China.

The company reported sales fell almost 7% in Asia Pacific in its Fiscal fourth quarter as demand in China fell and weighed on the outlook for future growth.

Performance was tempered by China, “slightly more than we had originally expected,” said President and CEO Brendan Foley on the earnings call.

“As we look ahead to the Q4, we expect the environment in China to remain challenged and this is reflected within our guidance,” he added.

The firm now expects China consumer sales to be down slightly compared to 2023 for the full year. Across the company sales rose just 1% in the Fiscal 2024 year, however, comparable sales were down 0.2%.

Its Fiscal 2024 adjusted earnings per share projection of $2.85 to $2.90 reflects a 5% to 7% increase compared to 2023. For its Fiscal fourth quarter of 2024, sales rose 2.6% to $1.8 billion, ahead of analyst expectations.

For Fiscal 2025, it anticipates earnings of $2.99 to $3.04 a share, but said revenues could be flat, with sales growth seen between 0 and 2%.

MKC Sees Consumers Tighten Belts

McCormick, which also owns the EL Guapo Mexican food brand and French’s mustard, is seeing consumers tighten their belts, a pattern repeated at other packaged food companies like General Mills (GIS) and Conagra Brands (CAG).

Overall, consumers are resilient but remain challenged, said Foley.

“They are exhibiting value seeking behavior, making more frequent trips to the grocery store with smaller baskets and shopping just for what they need,” he said, adding that they are also focused on cutting waste and making budgets stretch further.

Is MKC a Good Stock to Buy?

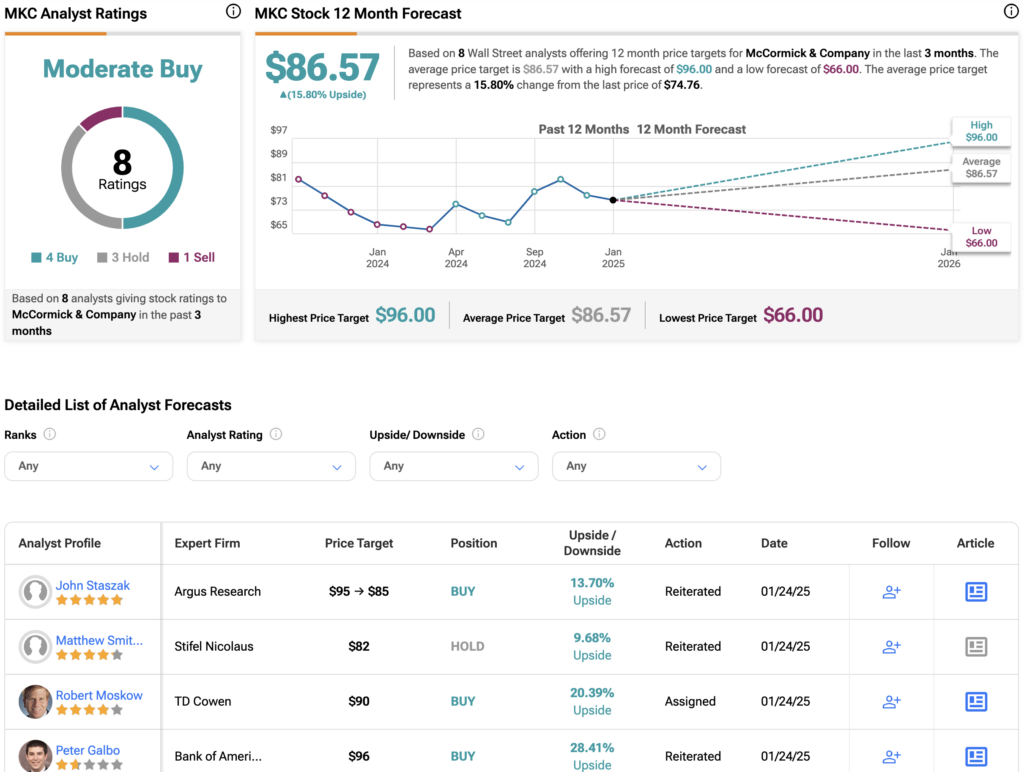

Overall, Wall Street has a Moderate Buy consensus rating on MKC, based on four Buys, three Holds and one Sell. The average MKC price target is $86.57, implying over 15% upside after shares rose 16% in the last 12 months.