Shares in Mind Medicine (MNMD) are surging, following a shift in market sentiment regarding possible growth and the potential of a significant appointment. Robert F. Kennedy Jr., known for challenging the FDA’s stance on psychedelics, has moved a step closer to leading the Department of Health and Human Services in the Trump administration after the finance panel voted along party lines to recommend approval and forwarded his nomination to the full Senate. Concurrently, MindMed has announced the dosing of the first patient in its second Phase 3 study. This study will test the efficacy and safety of a proprietary form of LSD as a potential treatment for generalized anxiety disorder.

Maximize Your Portfolio with Data Driven Insights:

- Leverage the power of TipRanks' Smart Score, a data-driven tool to help you uncover top performing stocks and make informed investment decisions.

- Monitor your stock picks and compare them to top Wall Street Analysts' recommendations with Your Smart Portfolio

There is still a long path ahead, and many potential risks could derail the company’s progress, yet its robust recent earnings and a healthy financial runway are positive signs. Investors may want to watch this one for further evidence of progress before establishing a position.

Treatment Pipeline Progress

MindMed is a biopharmaceutical company currently in the late stages of developing new product candidates to treat brain health disorders. Its primary focus is the development and delivery of treatments that have the potential to notably enhance patient outcomes by focusing on creating a pipeline of innovative product candidates, some of these having acute perceptual effects, specifically targeting neurotransmitter pathways critical to brain health.

The company has recently begun its second phase 3 study, Panorama, which will assess the efficacy and safety of MM120 ODT, MindMed’s pharmaceutically optimized form of LSD. The treatment is designed for patients with Generalized Anxiety Disorder (GAD), aiming to fulfill a significant unmet need in the field of psychiatry.

Better-Than-Anticipated Earnings

Mind Medicine most recently reported financial results for Q3 of 2024. Research and development expenses grew to $17.2 million, compared to $13.2 million in 2023. This $4 million increase partly stems from a $2.1 million hike in costs for MM120 ODT’s progression in clinical studies, with additional expenses attributed to the MM402 program, internal personnel costs, and preclinical activities. Mind Medicine anticipates further growth in R&D expenses in 2025, aligning with the commencement of more Phase 3 studies.

The company reported a net loss of $13.7 million for the quarter, a $4.2 million decrease compared to the same period in 2023. This was primarily due to changes in the fair value of the warrants issued in the company’s underwritten offering in 2022 despite increased R&D expenses. GAAP earnings per share (EPS) came in at -$0.27, surpassing expectations by $0.03.

As of quarter’s end, cash and cash equivalents had significantly increased to $295.3 million from $99.7 million at the end of 2023. Management expects this to adequately fund operations until 2027, comfortably covering 12 months following the first Phase 3 study of MM120 ODT.

Analysts Are Bullish

The stock has been on an upward trajectory, climbing over 131% in the past year. It trades in the upper half of its 52-week price range of $3.67 – $12.22 and shows ongoing positive price momentum as it trades above major moving averages.

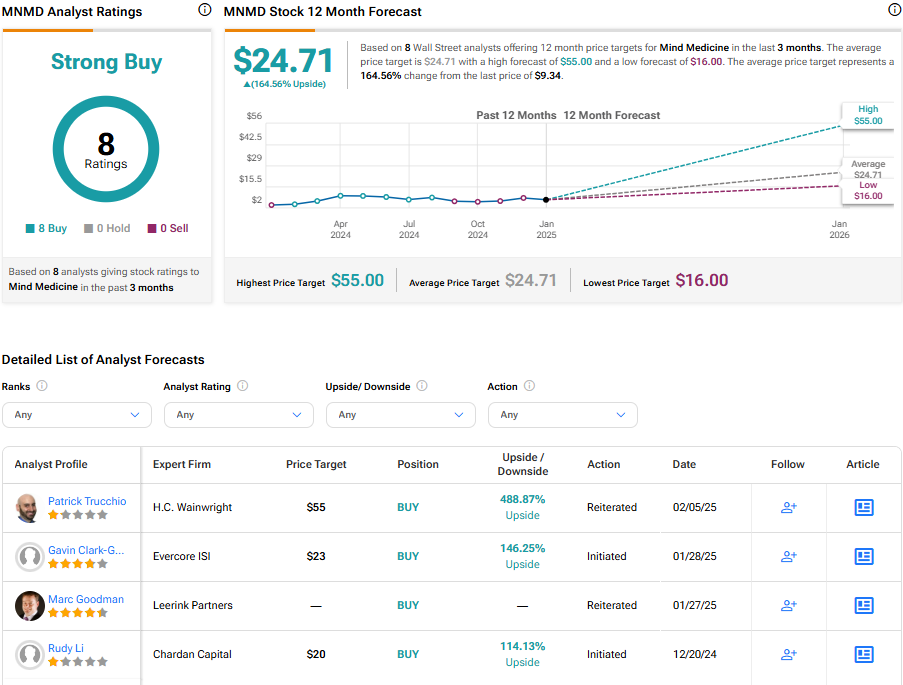

Analysts following the company have been bullish on MNMD stock. For instance, Evercore ISI recently initiated coverage with an Outperform rating and $23 price target on the shares, noting the large expansion opportunities for psychedelics in future treatments.

Mind Medicine is rated a Strong Buy overall, based on the recent recommendations of eight analysts. The average price target for MNMD stock is $24.71, which represents a potential upside of 164.56% from current levels.

MNMD Stock in Review

Mind Medicine is making substantial strides in pursuing groundbreaking treatments for mental health disorders. The company’s shares are seeing a positive response due to a shift in market sentiment and the progress of a leading treatment to a Phase 3 study. Its better-than-forecasted earnings, robust R&D investment, and healthy financial runway underscore its promising prospects. The journey ahead is formidable, with potential hurdles to overcome, yet the company’s potential upside warrants investors’ attention. However, waiting for additional evidence of progress might be prudent before taking a position.