Buying shares of MicroStrategy (MSTR) can feel good when the price is rising rapidly, but this is one stock to avoid if you believe that value actually matters. I am neutral on MSTR stock as MicroStrategy is about to report its Q3 earnings results, but unfortunately, the company doesn’t have a great recent earnings track record. Also, it has a notably high valuation.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Microstrategy’s founder and chairman is the outspoken financier, Michael Saylor. The company is an enterprise analytics and mobility software provider, but many stock traders know MicroStrategy as an aggressive Bitcoin (BTC-USD) hoarder, and they know Saylor as a vocal advocate of Bitcoin and the blockchain.

MicroStrategy and Saylor are so aggressive about buying Bitcoin that the company is even willing to take on a large amount of debt in order to buy more Bitcoin. Previously, I expressed my opinion that Microstrategy’s constant Bitcoin purchases have reached an extreme level. Speaking of extreme levels, today I’ll use multiple metrics to indicate that MSTR stock is too high to buy right now, in my opinion.

Don’t Be Too Ambitious with MicroStrategy Stock

Price and valuation aren’t the same thing, but it’s still important to monitor a stock’s price action. MicroStrategy stock is up by more than 450% in the past 12 months, believe it or not. This doesn’t mean the stock won’t keep going up, but prudent-minded investors should ask themselves whether the risk-to-reward balance is favorable after a 450% share price run-up. Remember, you’ll never lose money by taking profits after a multi-bagger move.

Sure, cryptocurrency-related assets tend to make big moves, but it’s fine to take a breather now that Bitcoin is all the way up to $68,000. At these elevated levels, and with MicroStrategy stock making leveraged moves to the Bitcoin price, investors need to be cautious and selective. This stock doesn’t have the safety factor that you might get with a mega-cap blue-chip stock that just went down 20%, for example.

Besides for, careful investors might consider it a red flag that Saylor predicted Bitcoin is likely to reach $13 million by 2045. This implies an approximately 20,000% rally from the current Bitcoin price. Frankly, no one has a crystal ball, and 2045 is more than 20 years in the future. Plus, Bitcoin is especially unpredictable. Saylor is a great hype man and pitchman, but I don’t recommend making any financial decisions based on Saylor’s extremely ambitious predictions.

MicroStrategy’s Valuation Is a Major Concern

SchiffGold.com Chairman Peter Schiff recently wrote on the X social media platform that MSTR stock “has got to be the most overvalued stock in the MSCI World Index.” Schiff added, “When it finally crashes, that’s going to be the real bloodbath!”

Schiff’s “most overvalued stock” declaration might be an exaggeration, but his point is duly noted. MicroStrategy is unprofitable and therefore doesn’t have a price-to-earnings (P/E) ratio, but there are other commonly cited metrics we can use to assess MicroStrategy’s valuation.

On a trailing 12-month (TTM) basis, MicroStrategy’s price-to-sales (P/S) ratio is 81.31x, versus the sector median P/S ratio of 3x. Furthermore, MicroStrategy’s TTM price-to-book (P/B) ratio is 15.87x, compared to the sector median P/S ratio of 3.33x. Thus, while I won’t jump to the conclusion that MSTR is the “most overvalued stock,” I will encourage value-focused investors to take a neutral stance on Microstrategy.

MicroStrategy Earnings Event Is Coming Soon

Maybe you’re a huge cryptocurrency fan and you insist on buying MicroStrategy stock. If that’s the case, then I would encourage you to at least wait until the end of the month. That’s because Microstrategy is expected to release its third-quarter 2024 earnings results on October 30, which is very soon.

The analysts’ consensus estimate calls for MicroStrategy to have lost $0.12 per share in Q3 of 2024. Personally, I’m not very optimistic. Bear in mind that out of the past four quarterly earnings reports, Microstrategy posted wide misses three times.

TipRanks subscribers know that information is key to success. After October 30, you’ll have more information about MicroStrategy’s recent financial performance. Will the company continue to be unprofitable, or will MicroStrategy manage to turn a profit in the third quarter? There’s no need to play a guessing game when fresh data is right around the corner.

Is MicroStrategy Stock a Buy?

On TipRanks, MSTR comes in as a Strong Buy based on five unanimous Buy ratings assigned by analysts in the past three months. The average MicroStrategy stock price target is $229.60, implying 2.02% downside potential.

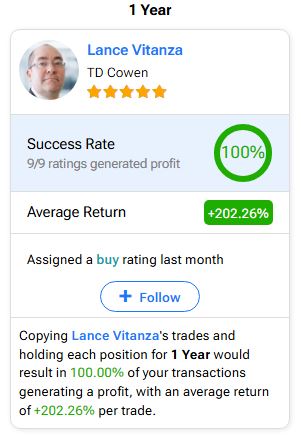

If you’re wondering which analyst you should follow if you want to buy and sell MSTR stock, the most accurate analyst covering the stock (on a one-year timeframe) is Lance Vitanza of TD Cowen, with an average return of 202.26% per rating and a 100% success rate. Click on the image below to learn more.

Conclusion: Should You Consider MicroStrategy Stock?

Will Saylor’s audacious prediction about the Bitcoin price come true? Will MicroStrategy manage to beat Wall Street’s earnings expectations for the third quarter? It’s difficult to place a trade with confidence when there are unanswered questions.

Moreover, MicroStrategy’s valuation is a serious concern that prudent investors shouldn’t disregard. Consequently, even though I appreciate the pro-Bitcoin argument in general, I am staying on the sidelines today when it comes to MSTR stock.