Despite trailing its Magnificent Seven peers over the past year, there’s reason to remain bullish on Microsoft (MSFT) stock, say analysts at Citigroup (C).

Confident Investing Starts Here:

- Quickly and easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks straight to you inbox with TipRanks' Smart Value Newsletter

The Wall Street bank has published a positive note about Microsoft, citing the Seattle-based tech giant’s continued strength in cloud computing, as well as the potential benefits of its artificial intelligence (AI) investments and recent job cut announcement.

Citigroup maintains a Buy rating on MSFT stock, but has raised its price target on the shares to $540 from $480, which is 20% above where they currently trade. The price target boost comes despite Microsoft underperforming its mega-cap technology peers over the last year.

Cost Controls

Microsoft’s 12-month price-to-earnings ratio has gained just 7% in the past 12 months compared with 29% for the Magnificent Seven tech stocks as a whole. MSFT stock slumped over concerns about the billions of dollars being spent on AI infrastructure, notably data centers.

Citigroup says signs that Microsoft is now taking steps to control costs should provide a tailwind to the company’s share price in coming months. Microsoft said on May 13 that it plans to reduce its global workforce by 3%. Citigroup sees the layoffs as positive, estimating they could save Microsoft $2.5 billion a year in operating expenses.

MSFT stock has increased 8% this year.

Is MSFT Stock a Buy?

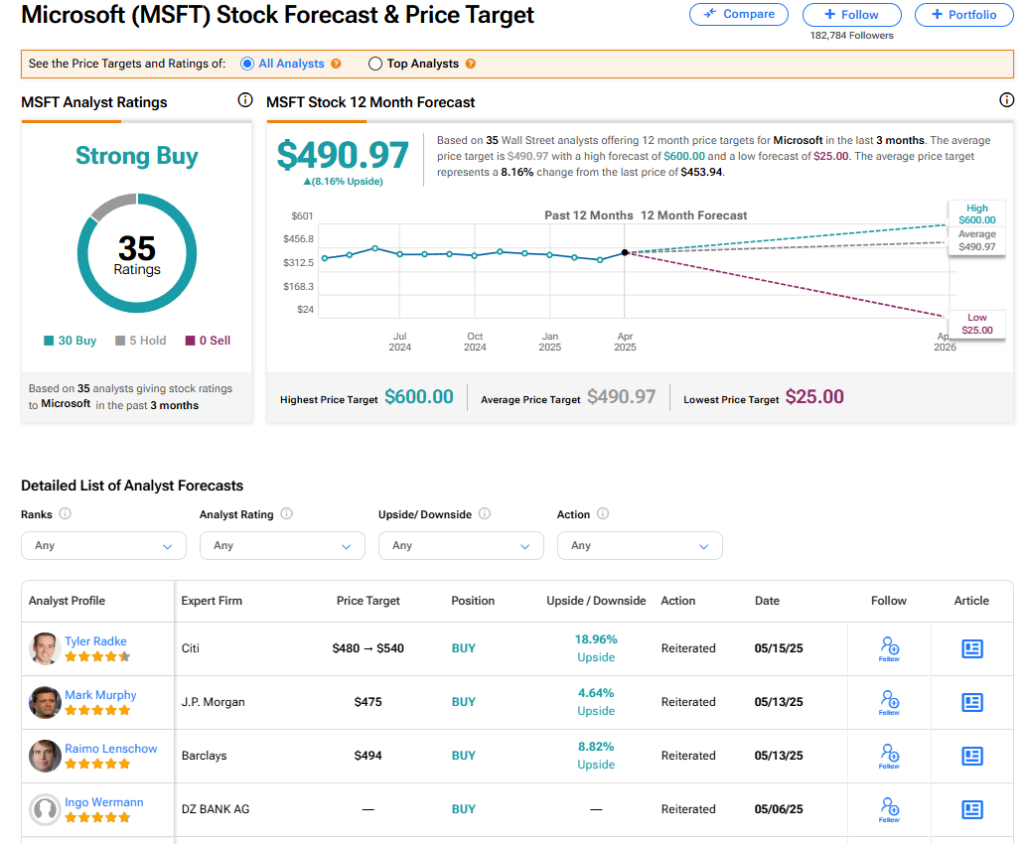

Microsoft’s stock has a consensus Strong Buy rating among 35 Wall Street analysts. That rating is based on 30 Buy and five Hold recommendations issued in the last three months. The average price target on MSFT stock of $490.97 implies 8.16% upside from current levels.