Microsoft’s (MSFT) stock rallied into the close of trading on March 21, narrowly avoiding an eight-week losing streak in the process.

MSFT stock had been on pace to post its first eight-week losing streak since 2008 when the global financial crisis hit. Fortunately, the shares rose just before the end of the Friday trading session, pushing the stock up 0.7% for the week.

Still, Microsoft’s stock remains in a funk. The company’s share price is down 7% this year and has declined 8% over the last 12 months . The current pullback is being blamed on concerns over the $80 billion Microsoft plans to spend on artificial intelligence (AI) infrastructure and technologies this year, as well as on weakness in the company’s Azure cloud computing unit.

MSFT Stock Rebound?

The last time MSFT stock experienced a multi-week drawdown like the current one was in January and February 2008 when the share price fell for nine consecutive weeks. Microsoft’s stock is also being pulled lower currently by a downturn in the mega-cap tech stocks collectively known as the “Magnificent 7,” which also includes Apple (AAPL), Amazon (AMZN), and Nvidia (NVDA).

MSFT stock is now down 17% from its 52-week high of $468.35 and approaching a bear market defined as a decline of 20% or more from recent highs. However, many analysts remain bullish on MSFT stock and say it’s only a matter of time before the share price rebounds.

Is MSFT Stock a Buy?

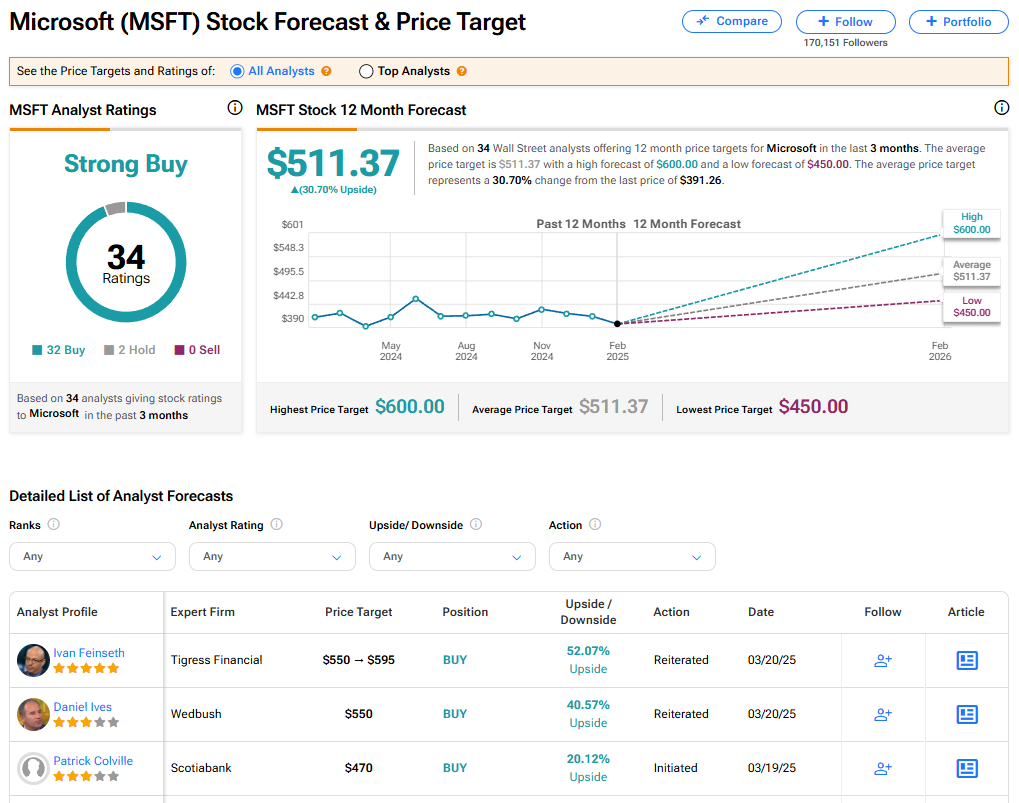

Microsoft’s stock has a consensus Strong Buy rating among 34 Wall Street analysts. That rating is based on 32 Buy and two Hold recommendations issued in the last three months. The average price target on MSFT stock of $511.37 implies 30.70% upside from current levels.

Read more analyst ratings on MSFT stock

Questions or Comments about the article? Write to editor@tipranks.com