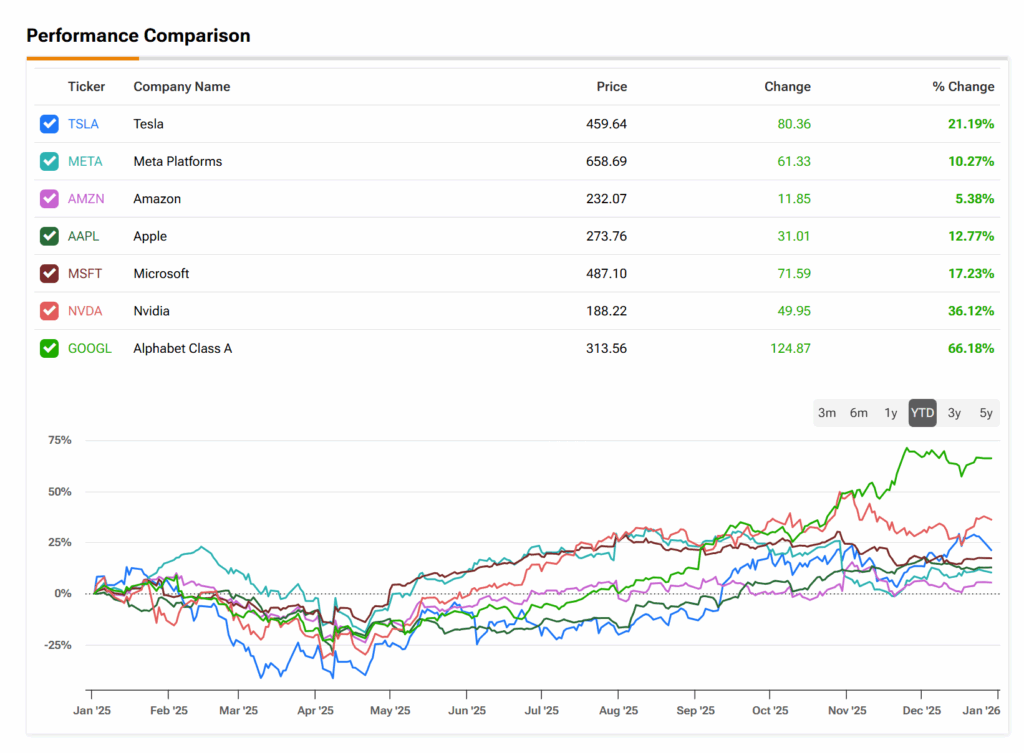

Since the start of the year, shares in Microsoft (MSFT) have climbed over 17%, ahead of its Magnificent Seven peers Meta (META), Amazon (AMZN), and Apple (AAPL). Analysts across Wall Street believe the U.S. tech giant is poised for an even bigger 30% gain in 2026, riding on its AI momentum.

Claim 70% Off TipRanks This Holiday Season

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

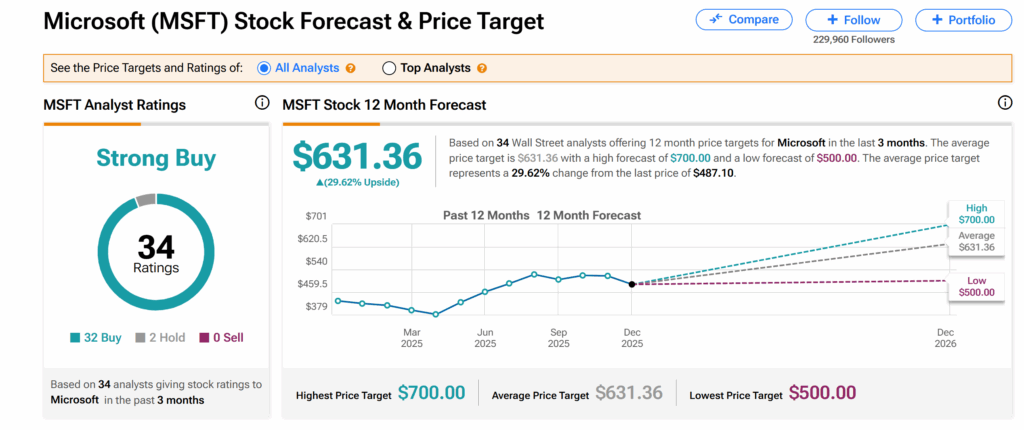

On Wall Street, Microsoft’s shares currently command a Strong Buy consensus rating from 34 analysts. This breaks down to 32 Buys and two Holds issued over the past three months.

The rating comes with an average MSFT price target of $631.36, implying that the stock could jump 29.62% over the next few months.

How Does Microsoft Stock Performance Compare to Rivals?

While Microsoft’s year-to-date (YTD) gain of a little more than 17% falls behind Alphabet’s (GOOGL) leading 64% gain and Nvidia’s (NVDA) 36.12% price appreciation, it is closer to the Magnificent Seven average of 25% and tallies with the S&P 500’s (SPX) 17.41% YTD gain so far. Kindly refer to the graphics below.

Microsoft Is a ‘Core Winner’ in AI Stocks Group

In its recent Q1 2026 earnings results released in late October, Microsoft saw its revenue jump by 18% from a year ago to about $78 billion. The tech giant’s Azure and other cloud services climbed much higher, by about 40%.

However, Microsoft’s higher-than-expected capital expenditure of $34.9 billion and aggressive spending on AI infrastructure by its Big Tech rivals have sparked investor concerns. Adding to this, Microsoft in October deepened its ties with OpenAI, taking a 27% stake valued at $135 billion in the startup.

However, Wedbush analyst Dan Ives believes there should be no cause for alarm. The five-star analyst recently called Microsoft a “core winner” in its AI stocks grouping and listed Microsoft as one of his top five AI stocks for 2026, alongside Palantir (PLTR), Apple (AAPL), Tesla (TSLA), and CrowdStrike (CRWD).

Where’s the Azure Growth Story Headed?

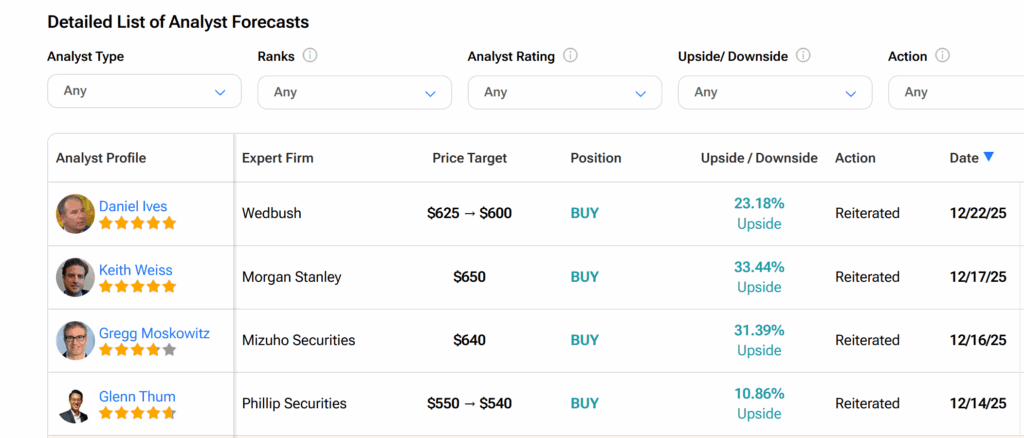

Ives argued that the Azure growth story is underestimated on Wall Street and believes that Fiscal Year 2026 will be a real turning point as businesses move from early testing to full-scale AI adoption. However, the analyst recently lowered his MSFT price target from $625 to $600, implying over 23% upside.

Similarly, Evercore ISI analyst Julian Emanuel dismissed fears of a bubble in AI stocks, noting that “systemic risks are still largely absent” in the market. The analyst argued that AI hyperscalers’ balance sheets look healthy and cross-holdings — situations where companies own shares in each other — “remain muted on aggregate.”

Is There a Reason to Take Caution?

Meanwhile, while Emmanuel reaffirmed his Overweight (Buy) rating on AI-focused businesses, including those in information technology, Phillip Securities analyst Glenn Thum believes that there is a reason to take caution. Thum lowered his price target on MSFT to $540, implying about 11% upside.

He pointed to Microsoft’s aggressive expansion of its cloud and AI infrastructure business for the lower rating. Despite this, however, the analyst also stuck to this Buy rating on the stock.

Should You Buy Microsoft before 2026?

According to analysts on Wall Street, Microsoft stock is poised for a significant jump of 29.62% in 2026, with several forecasting more than 30% upside.