Microsoft (MSFT) has settled on Hyderabad, Telangana, as the home for its latest datacenter region in India. The tech giant has already established cloud infrastructure in Pune, Mumbai, and Chennai. The latest investment is expected to help clients in the country thrive in the cloud and artificial intelligence-enabled digital economy. MSFT shares fell 3.78% to close at $278.91 on March 7.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Microsoft is a technology company that offers software services and solutions. It also offers devices such as personal computers, tablets, and gaming consoles.

Investment In India

The new datacenter region in Hyderabad will offer an array of Microsoft products, including cloud, data solutions, artificial intelligence, and productivity tools. It will also offer advanced data security solutions. The investment comes as demand for the cloud as a platform for digital transformation is growing.

India has emerged as a key cloud market for the tech giant, with the datacenter regions having contributed $9.5 billion in revenue to the economy between 2016 and 2020. They have also had a significant impact on the labor market with the creation of about 1.5 million jobs.

In addition to job creation, the new datacenter in Hyderabad is expected to help Microsoft drive ongoing innovation in the country. The facilities should also provide a critical infrastructure foundation amid the ongoing transition to the cloud for enterprise, government, and education institutions.

Stock Rating

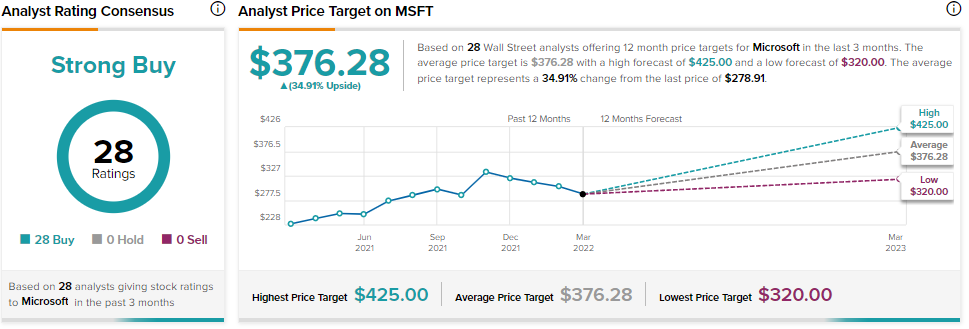

Last month, Morgan Stanley analyst Keith Weiss reiterated a Buy rating on Microsoft stock with a $372 price target, implying 33.38% upside potential to current levels. According to the analyst, Microsoft could generate $20 a share in earnings or more within the next five years. Therefore, the stock is an ideal play for investors looking for strong growth drivers and earnings growth.

Consensus among analysts is a Strong Buy based on 28 Buys. The average Microsoft price target of $376.28 implies 34.91% upside potential to current levels.

Download the TipRanks mobile app now.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure.

Related News:

RBC Launches Split with Friends Feature

Bionano Stock: 2022 an Inflection Year, Says Analyst

Biogen & Eisai Initiate PMDA’s Process for Lecanemab in Japan