Microsoft (NASDAQ:MSFT) plans to launch GPT technology, powerful language-producing models from OpenAI, for the U.S. federal agencies using its Azure cloud service. It marks a pioneering effort by a major tech company to make chatbot technology available to government clients, including federal, state, and local government customers.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

OpenAI models are already being offered to Azure commercial cloud users through Azure OpenAI Service, which boosts 4,500 customers as of May 2023 compared to 2,500 in the prior quarter.

Product Launch Details

Microsoft, which is the largest investor in OpenAI, has added support for large language models (LLMs) powering GPT-4 and GPT-3 to Azure Government cloud computing service. These are the latest and most sophisticated LLMs from OpenAI that can now be leveraged by government clients.

Government customers can accommodate these language models for specific tasks, including content generation, language-to-code translation, and summarizing reports. Among the existing federal government customers of Azure Government are the Defense Department, the Energy Department, and the National Aeronautics and Space Administration (NASA).

A Defense Technical Information Center (DTIC) official confirmed to Bloomberg that the organization, which is a part of the Defense Department focusing on gathering and sharing military research, will be trying the OpenAI models through Microsoft’s new offering.

Bill Chappell, Microsoft’s Chief Technology Officer, Strategic Missions and Technologies, confirmed that Azure Government users won’t have access to ChatGPT specifically. Also, data from Azure Government customers won’t be used to train the AI models.

Is Microsoft a Good Stock to Buy?

Earlier this week, Bernstein analyst Mark Moerdler maintained a Buy rating on MSFT and raised the price target to $380 from $342. The analyst expects AI to become a large driver of Azure’s revenue growth over the long term.

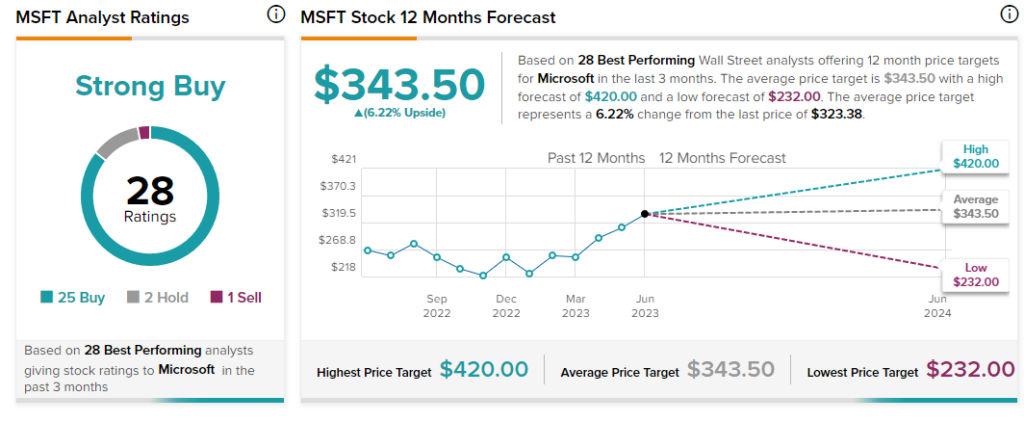

Most top Wall Street analysts covering MSFT are bullish on the stock. Of the 28 best-performing analysts covering the stock, 25 have a Buy rating, two suggest a Hold, and one has a Sell rating. Overall, the stock scores a Strong Buy consensus rating. The average price target stands at $343.50, implying an upside potential of 6.2%.