Microsoft (NASDAQ:MSFT) has agreed to pay $14.4 million to settle claims that it discriminated against employees who took protected leaves, such as disability, pregnancy, and parental leave. The settlement was announced by the California Civil Rights Department.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

As part of the settlement, which is subject to court approval, Microsoft will provide monetary relief to affected employees in California who took protected leave between 2017 and 2024. The company will also implement measures to prevent future discrimination, including updated training for managers and human resource personnel.

Background of the Investigation

The California Civil Rights Department began the investigation in 2020. The investigation found that employees who took protected leave faced discrimination in pay and promotion opportunities. Specifically, these employees received lower bonuses and were less likely to receive merit increases, stock awards, or promotions.

The investigation also found that Microsoft did not take sufficient action to prevent this discrimination, negatively impacting the careers of women and other employees.

Microsoft Exposed to Legal and Regulatory Risks

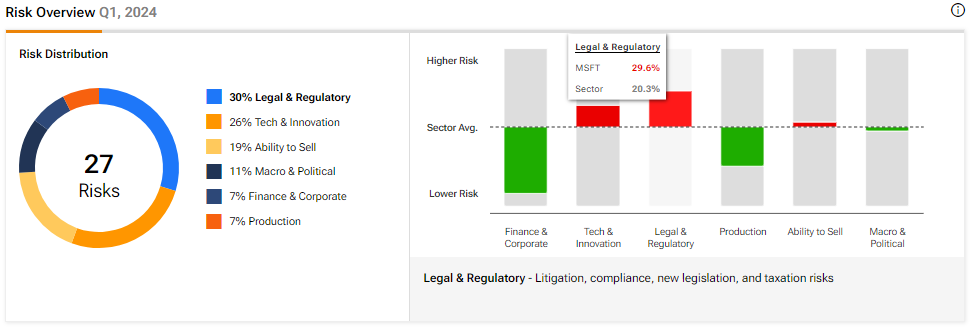

Microsoft has a history of dealing with various claims and legal disputes, and this settlement highlights its exposure to legal and regulatory risks. As it is subject to several litigations, TipRanks’ Risk Analysis tool shows that MSFT’s legal and regulatory risk exposure is significantly higher than the industry average.

Legal and regulatory risks comprise 29.6% of Microsoft’s total risks, compared to the industry average of 20.3%. In comparison, its rival Alphabet (NASDAQ:GOOGL) is managing its legal risks well. Per TipRanks’ Risk Analysis tool, GOOGL’s legal and regulatory risks account for 20.7% of its total risks, much lower than MSFT’s.

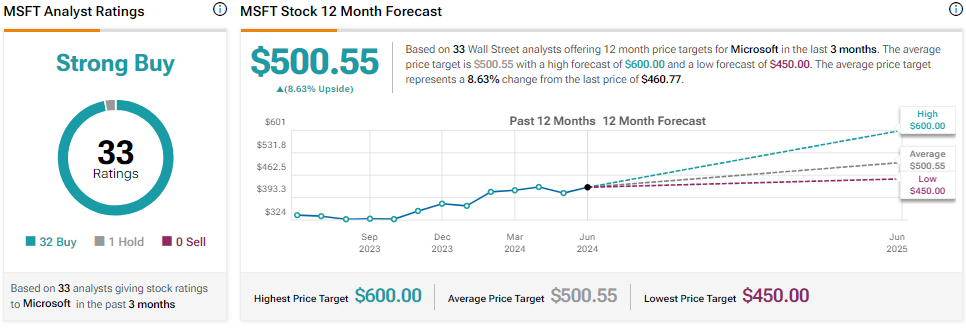

Is Microsoft a Buy, Sell, or Hold?

Wall Street is bullish about Microsoft’s prospects. With 32 Buys and one Hold recommendation, Microsoft stock has a Strong Buy consensus rating. Analysts’ average price target of $500.55 implies 8.63% upside potential from current levels.