Microsoft (MSFT) stock should be a clear cut investment for more novice investors to consider. This is a company of long-term success, but this blue chip stock deserves recognition for its AI potential too. From my perspective, it might just be the best long term and safest AI stock to invest in.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Microsoft is a well-run legacy business that’s known for its software products, particularly office productivity tools and the Windows operating system. The company is now gaining recognition for its Azure cloud platform which is used by organizations around the world to build, deploy, and manage applications across multiple cloud environments, on-premises, and even at the edge.

I am bullish on Microsoft because of its leadership status and the progress it’s making on its AI investments.

Microsoft’s Status in Artificial Intelligence

Microsoft’s leadership status in the emergence of AI is the main reason behind my bullish view on the stock. The company is one of the longtime backers of OpenAI, the organization that took the world by storm when it released ChatGPT in late 2022 and brought AI mainstream. Microsoft has invested tens of billions of dollars in OpenAI over the past 2 years. It just participated in another one of OpenAI’s funding rounds that was sized at $6.6 billion. There are plenty of reasons for investor excitement.

However, some Wall Street analysts have raised concern about the hefty investments the tech giant is making in AI. D.A. Davidson’s senior software analyst Gil Luria was quoted as saying, “If revenue acceleration doesn’t materialize and increases in capex continue, investors may be disappointed”. I believe the Street is missing the bigger picture and is too focused on the near term. Microsoft is poised to continue benefiting from its first-mover advantage in AI. It’s worth remembering that the company’s size and strong cash generation allow it to make these huge investments.

Additionally, I consider Microsoft an extremely well-run company that will avoid taking bets without appropriate conviction. I believe management has a long-term view regarding these investments that I’m confident will result in great reward. Management said the company is taking, “customer demand signals and time-to-value” into account as it makes these investments to, “generate durable long-term operating leverage”. I like this story and I’m on board with it. The company is conscientious of customer feedback, and not making decisions without it.

Microsoft is Making Good Progress on the AI Front

I am optimistic about Microsoft is the progress it’s been making on additional AI investments. The company has announced investments for building data centers in many countries around the world including Kenya, France, Indonesia, Thailand, and Malaysia. CEO Sateya Nadela commented during the FQ4 2024 earnings call that the company expanded its data center footprint across four continents and expects these assets to drive growth over the next decade.

Microsoft is playing the long game and there’s a high probability that patient investors will be rewarded. The company’s AI investments are certainly paying off already because Azure AI customers grew by about 60% year-over-year to 60,000 and the average spend per customer is also accelerating. Moreover, the number of Azure AI customers using the company’s Intelligent Data Platform, which provides tools for analytics and business intelligence, also grew 50% year over year.

Additionally, the company introduced new real-time intelligence capabilities to its AI-powered next-generation data platform, Microsoft Fabric. Just like the rest of its AI products, Fabric’s customers also rose impressively year-over-year, by 20% to 14,000 paid users. Keeping these facts in view, I am not too worried about the billions of dollars Microsoft is spending on AI development because it’s just trying to meet the demand of its customers which are growing incrementally, quarter after quarter.

Is Microsoft Stock Affordable?

Although MSFT stock couldn’t considered cheap right now, that doesn’t mean I am any less bullish on its prospects. The stock is currently trading at 31.5x forward earnings, which is roughly on par with its 5-year average, and a slight premium to its sector average of 24x. You can’t always buy high-quality businesses at a discount, and Microsoft is one of the highest quality compounders out there.

I do not think it’s reasonable to attempt to put a long-term growth rate on Microsoft given that many of its AI investments are yet to bear fruit. Wall Street analysts are forecasting 11% growth in earnings in its current fiscal year and 16.4% growth next year. Microsoft has increased its earnings at a compounded 16% rate over the past 10 years and didn’t have any AI-related growth for the better part of that period. It’s hard to see growth decelerating.

Moreover, at a forward P/E of 31.5x, investors are currently expecting Microsoft to earn about $98 billion in annual profits for fiscal 2025, while its net income for fiscal 2024 (ended June) was $88 billion. Yes, MSFT stock is slightly expensive relative to earnings, however, that doesn’t mean investors should ignore a high-quality blue chip. It could be useful to wait for some share price weakness and capitalize on any overreactions to the company’s “AI-related cash burn”. The company reports its next quarterly earnings on October 22.

Analysts’ Take on Microsoft Stock

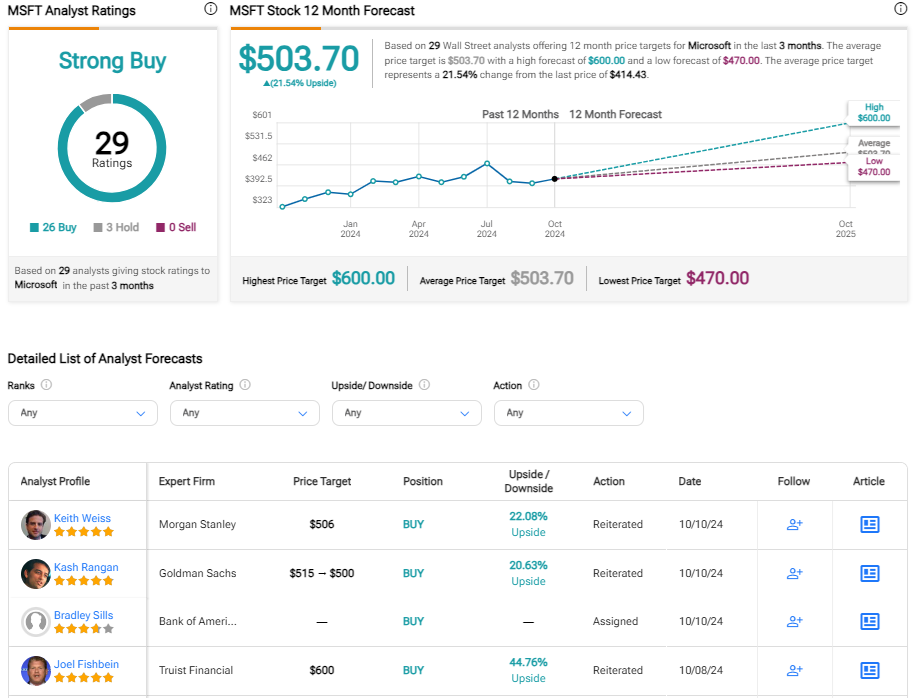

On TipRanks, Microsoft stock has a consensus Strong Buy rating based on 26 Buy and 3 Hold ratings. The average MSFT price target of about $503.70 represents an upside of about 21% from current levels.

The Bottom Line

Microsoft has long been one of the most reliable large-cap companies and should be considered a cornerstone holding for many portfolios. The company has a legacy in software but it’s not too old to compete against new technology leaders. Its early investment in OpenAI shows how the company is committed to innovation and staying ahead of the curve. Microsoft’s sizable AI-related investments have worried some investors but I believe the company knows what it’s doing. I like the strategic capital allocation.

Given how well Microsoft is executing in winning AI-related market share, I do not believe investors should be scared off by its slight premium valuation. While I’m bullish MSFT stock, I personally prefer to monitor the stock closely for any opportunity to buy on weakness.