With AI demand outpacing supply and its own silicon production delayed, Microsoft (MSFT) is buying time for its cloud by leasing billions of dollars’ worth of third-party GPUs from Nvidia (NVDA). This week’s news that Nebius (NBIS) will provide MSFT with GPU capacity helped lift NBIS stock over 40% in Tuesday’s volatile trade. MSFT, meanwhile, has remained range-bound all week, barely shifting from its $500 per share anchor.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The five-year, $17.4 billion Nebius deal accomplishes three key objectives for the tech giant: it front-loads capacity, de-risks supply, and diversifies beyond CoreWeave. However, in doing so, Microsoft is sacrificing its short-term margins to keep the AI revenue engine running.

If one thing is for certain, it is that the demand for Azure is unrelenting, which makes for a compelling Bullish stance on MSFT despite the near-term margin trade-off.

Supply is the Bottleneck Rather Than Demand

Microsoft’s Azure and broader cloud services are expanding at a staggering pace, with Microsoft Cloud revenue surging 27% year-over-year to $46.7 billion in the fiscal fourth quarter.

The challenge for Microsoft isn’t demand—it’s supply. While the company is developing its own silicon (Maia and Cobalt) and rapidly expanding data centers, these efforts still trail the surging appetite for its AI products. Given the sudden explosion in computing needs for AI, the shortfall is understandable. In the meantime, Microsoft has little choice but to “rent” GPUs. Put simply, the growth equation is straightforward: more GPUs fuel more Azure AI consumption, which in turn drives sustained expansion.

Near-Term Cloud GM Pressure from Outsourced Capacity

As with most things, there’s a trade-off. Microsoft’s cloud business is already showing the strain, with gross margins slipping to 68% in FQ4 as the company scales its AI infrastructure.

Of course, so long as Microsoft is outsourcing, via Nebius and CoreWeave, it will pressure gross margins relative to owned assets. Although as utilization rises and contract pricing normalizes, gross margins are expected to stabilize.

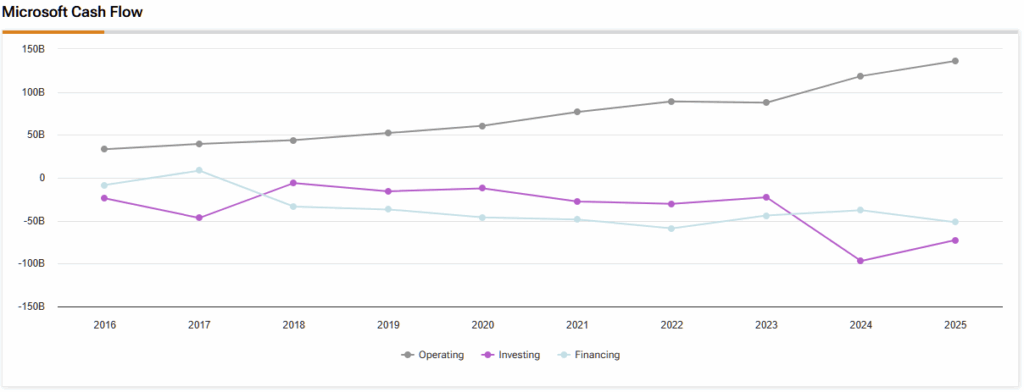

Microsoft Pours Billions Into AI with Cash to Spare

Beyond cloud margin pressures, Microsoft is ramping up capital expenditures—pouring money into chip development and new data centers. Capex reached $24.2 billion in FQ4 (including finance leases) and is expected to top $30 billion in FQ1. The good news: Microsoft throws off massive cash, generating $25.6 billion in free cash flow last quarter alone, with $94.6 billion in cash and short-term investments on hand.

Microsoft’s AI Ambitions Face Capacity and Chip Delay

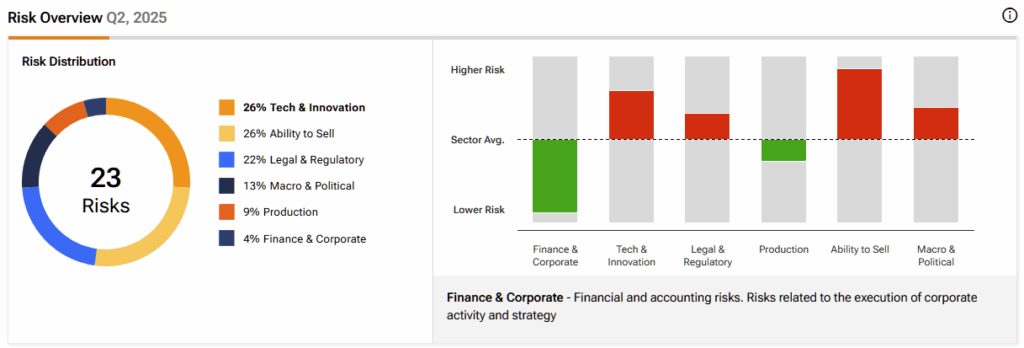

Beyond cloud margin pressure from outsourced GPU capacity, Microsoft faces several risks. Meeting surging demand may prove challenging, as Nebius NJ capacity is not yet fully secured and the broader industry remains heavily reliant on Nvidia. Earlier this year, Microsoft pushed back production of its Maia chips to 2026, and any further delays could limit its ability to capture cost efficiencies—particularly against rivals rolling out alternatives like Nvidia’s Blackwell and Amazon’s (AMZN) Trainium.

According to TipRanks’ Risk Analysis tool, MSFT is currently focusing on four key risk areas, namely innovation, legal, market access, and negative macroeconomic developments.

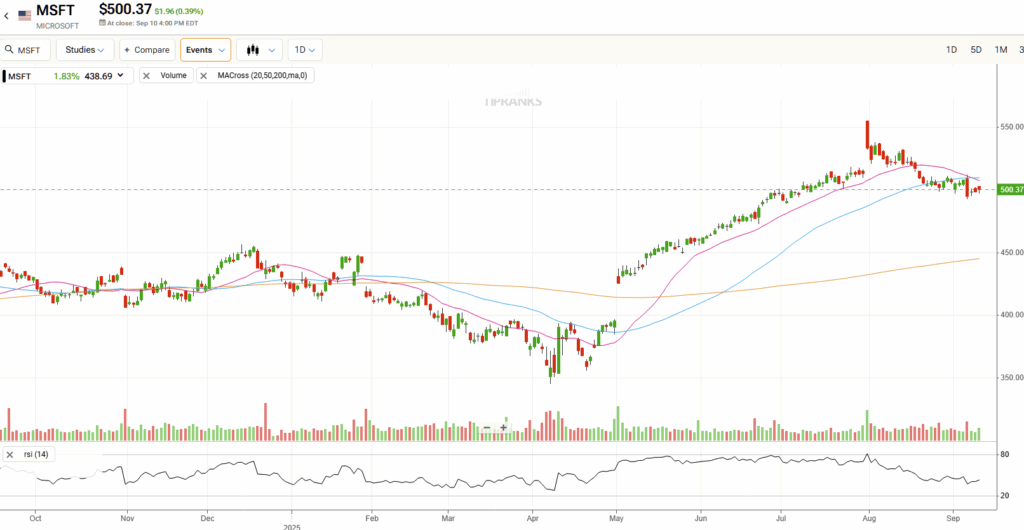

MSFT’s Pullback Doesn’t Undercut Its Long-Term Strength

After a strong rally, Microsoft (MSFT) has cooled off, recently dipping below its 50-day moving average. Still, with a market cap north of $3 trillion, it’s hard to argue the stock is overextended.

Admittedly, Microsoft’s P/E ratio of 36.3 sits about 25% above the Information Technology sector average—but the premium looks justified. Microsoft’s forward revenue growth of 14.65% is nearly double the sector median of 7.53%. And despite near-term margin pressures, profitability remains exceptional: its trailing twelve-month EBITDA margin of 55.56% is almost five times that of its peers.

Is Microsoft a Buy or Sell?

On Wall Street, MSFT sports a consensus Strong Buy rating based on 33 Buy, one Hold, and zero Sell ratings in the past three months. MSFT’s average stock price target of $626.88 implies an upside potential of more than 25% over the next 12 months.

Wall Street remains exceptionally bullish on MSFT, with a focus on Azure acceleration, durability of AI demand, and the capex-to-margins trade-off. William Blair analyst Jason Ader is particularly bullish on MSFT, citing the company’s “optimistic guidance for upcoming fiscal year, anticipating double-digit growth in both revenue and operating income.”

Meanwhile, Barclays analyst Raimo Lenschow placed a price target of $625 on the stock, representing ~25% upside.

Near-Term Pressure and Long-Term Power

Microsoft’s partnership with Nebius represents a clear trade-off: accept short-term cloud margin pressure in exchange for accelerating Azure AI revenue without waiting on internal supply. To me, the deal underscores two critical points. First, demand for Microsoft’s products is unprecedented. Second, over time, growth will outweigh dilution, and margins should recover as utilization improves, custom silicon comes online, and pricing power strengthens heading into 2026 and beyond.

Looking ahead, investors should closely watch delivery milestones. The Nebius pact includes termination rights, suggesting Microsoft has safeguarded its position. Azure’s gross margins could begin to stabilize in FY26 as capacity scales and utilization rises. Most importantly, if Microsoft successfully brings its Maia chips into production next year, unit economics would improve dramatically while reducing reliance on costly third-party GPUs.

Overall, this latest development validates the depth of demand for Azure and reinforces a stoutly Bullish outlook on MSFT.