Tech giant Microsoft (MSFT) is scheduled to announce its results for the first quarter of Fiscal 2025 on October 30. Investors will mainly focus on Azure’s growth and the extent to which the company is gaining from artificial intelligence (AI)-related tailwinds, given its significant capital investments. Wall Street expects MSFT’s Q1 FY25 EPS to rise about 4% year-over-year to $3.11 and revenue to increase by more than 14% to $64.57 billion.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

Gauging Analysts’ Sentiment Ahead of MSFT’s Q1 Earnings

Recently, Citi analyst Tyler Radke reduced the price target for Microsoft stock to $497 from $500 and maintained a Buy rating on the shares. The analyst noted MSFT stock’s sluggish movement over the last quarter, with investors concerned about the company’s significant capital expenditure amid “underwhelming” Azure growth and decelerating earnings increase.

Radke sees a mixed scenario ahead of the Q1 results. However, he highlighted that Citi’s reseller and CIO survey indicated stability, and there is a possibility of Microsoft delivering a modest surprise in Q2. Overall, Radke is bullish on MSFT and believes that the stock is a buy on a pullback, as investor sentiment is expected to turn more positive ahead of the expected reacceleration in Azure growth and earnings growth in the second half of the Fiscal Year.

Like Radke, Evercore analyst Kirk Materne also reaffirmed a Buy rating on Microsoft stock with a price target of $500. Commenting on the worries around the underperformance of MSFT stock compared to the S&P 500 Index (SPX) over the past few months, the analyst contended that the company’s fundamentals remain strong. He highlighted that the demand for Microsoft’s Cloud business continues to be solid, Copilot is steadily gaining traction, and the company continues to win market share in areas like security.

Materne acknowledged that near-term concerns, especially those related to Azure’s growth and return on AI investments, could weigh on the stock. That said, he thinks that acceleration in Azure growth in the second half of Fiscal 2025 could be a key catalyst for the shares. Overall, the analyst is bullish on MSFT’s long-term generative AI opportunity.

Options Traders Anticipate a More Than 4% Move

TipRanks’ Options tool offers a quick way to gauge what options traders anticipate from the stock following its earnings report. The expected earnings move is calculated using the at-the-money straddle of the options set to expire closest to the announcement. While this may sound complex, the tool handles the calculations for you.

Currently, it indicates that options traders are predicting about a 4.7% swing in either direction in MSFT stock.

Is MSFT Stock a Buy, Sell, or Hold?

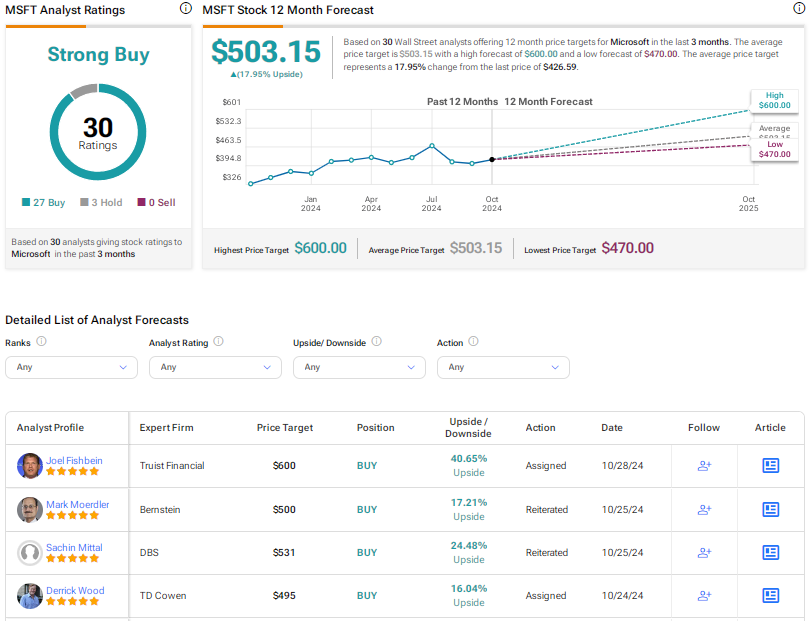

With 27 Buys and three Holds, Microsoft earns a Strong Buy consensus rating on TipRanks. The average MSFT stock price target of $503.15 implies 18% upside potential. Shares have risen over 13% year-to-date.