After a powerful run fueled by early AI optimism over the past couple of years, Microsoft (MSFT) entered 2025 with high expectations but ultimately delivered returns that barely kept pace with the broader market.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

This outcome puzzled many investors, especially given that Microsoft continued to post best-in-class fundamentals, robust growth across its core segments, and one of the strongest balance sheets in global equities. Rather than signaling any form of structural deterioration, the stock’s modest performance appears to reflect a period of multiple compressions driven primarily by execution-related uncertainties and questions around the timing of AI monetization, particularly in the context of the most capital-intensive phase in the company’s history.

As the narrative shifts toward 2026, the key question is no longer whether Microsoft can grow, but whether the market is underestimating how quickly these heavy AI investments can translate into more meaningful economic returns. Viewed through this lens, the setup for 2026 appears less fragile than it may seem at first glance, creating an asymmetric risk-reward profile that supports a Buy rating at current levels.

A Year of Compression Without Deterioration

Even though it remains one of the leading names in the AI Revolution, Microsoft ended 2025 having barely matched the S&P 500’s returns. This is somewhat surprising, given that the company’s business fundamentals could be classified as best-in-class among global mega-caps, supported by triple-A-quality balance sheet ratings from S&P and Moody’s.

With no apparent signs of structural deterioration, a large part of this underwhelming performance appears to have been driven by a narrative of temporary uncertainty rather than by fundamentals.

Valuation data helps illustrate this disconnect. Today, Microsoft trades at roughly 29.8x forward earnings, slightly below its recent historical average of around 31x–32x. While this gap may seem modest at first glance, in practical terms it places the stock near the lower end of the multiple range observed over the past three years—and well below the roughly 37x multiple reached during the peak of early AI enthusiasm.

A similar pattern emerges in the forward revenue multiple, which currently sits at around 11x. This level is much closer to the bottom of Microsoft’s historical range (with troughs near 9.5x) than to the upper end, which exceeded 13x in the previous cycle. Importantly, this compression has occurred despite Microsoft continuing to deliver high-teens revenue growth and EPS growth north of 20% year over year.

In my view, what played out in 2025 was effectively a negative re-rating of valuation, without a corresponding deterioration in operating fundamentals. The share price pulled back from its peak, multiples compressed, but the core growth metrics remained resilient. The market’s focus, therefore, has been on perceived execution risk—not on a breakdown of the underlying investment thesis.

Microsoft’s Biggest Risk Is Also Its Catalyst

If Microsoft’s operational deterioration does not appear to be a problem—and most likely will not be anytime soon—then the discussion naturally shifts to identifying the factors that could mark the true inflection point for 2026.

If there is one issue that currently concentrates most of the market’s doubts around Microsoft, it is CapEx, or the company’s massive investments in AI infrastructure. In the most recent quarter, capital spending reached approximately $69 billion on a trailing twelve-month basis, up 40% year-over-year and representing nearly 24% of total revenue over the same period—well above Microsoft’s historical norm.

Not surprisingly, given how difficult it is to quantify the near-term ROI of this level of investment, the multiple compression observed in 2025 appears to be largely driven by concerns about capital returns rather than by any meaningful sign of weakening demand.

The key point, however, is that this CapEx is not being deployed into speculative bets, but rather anchored in demand that is already contracted. Commercial RPO (remaining performance obligation, or backlog) grew 51% YoY, reaching approximately $392 billion in the last quarter, with an average duration of close to two years, implying high visibility into future revenue. This suggests that much of the ongoing capacity expansion is being built to support recurring enterprise workloads, rather than short-lived training spikes or one-off projects. In my view, this reframes the debate from excessive investment to the timing of monetization—creating room for potential re-ratings.

More importantly, despite the intensity of spending, profitability metrics remain resilient. Gross margin continues to hover in the upper-60% range, while adjusted operating margins sit around mid-to-high 40s, still very high even after factoring in higher depreciation. As a result, the inflection point for 2026 does not appear to depend on cutting back investments, but rather on the gradual economic absorption of the installed base built during 2024 and 2025.

How Can 2026 Unlock a Re-Rating

Looking ahead to 2026, I believe Microsoft’s valuation framework—still at historically modest levels—combined with a less challenging set of conditions, could be enough for the company to deliver a materially stronger year, particularly relative to the broader market.

If Azure’s revenue growth, which has already progressed from roughly ~33% YoY in FY25 Q1 to ~40% in FY26 Q1, remains above consensus for another two to three quarters, while CapEx grows at a slower pace than revenue and operating margin expansion (as measured by TTM EBIT margin change) re-accelerates beyond the ~2.9% growth recorded over the last twelve months (versus 9.2% operating margin growth from 2023 to 2024), the setup naturally points to further upside.

In that scenario, a re-rating would not require a “home run,” but rather consistency—and some patience from the market. With Azure sustaining high-30% YoY growth and CapEx remaining elevated but increasingly better absorbed, the market would likely begin to reduce the discount currently applied to execution risk. Even a modest multiple expansion of 1x to 2x earnings, combined with a partial recovery in margin expansion—from roughly ~3% to a range of 5%–7%—would be enough to drive earnings growth well ahead of the pace of revenue.

Is MSFT A Buy?

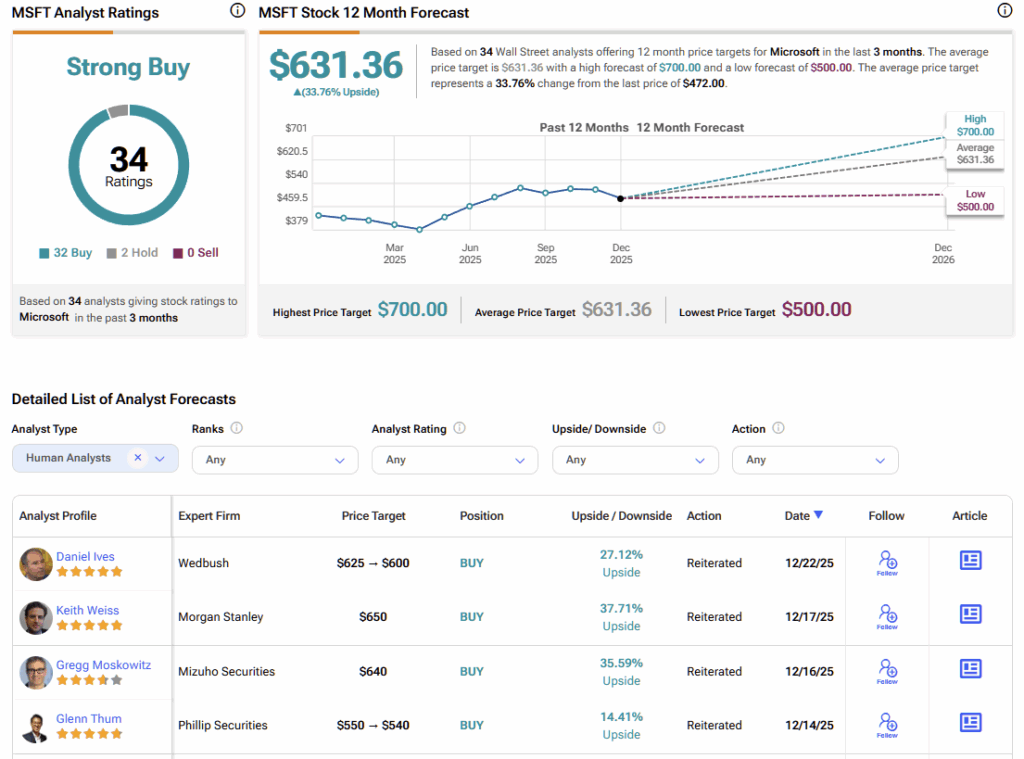

If it weren’t for just two analysts out of 34 over the past three months holding a Hold rating on Microsoft, the consensus would be entirely bullish, with the remaining 32 analysts rating the stock a Buy. The average price target currently stands at $631.36, implying a meaningful upside of roughly 33% from the latest share price.

The Upside Case Is Simpler Than It Looks

I believe Microsoft is ripe to be priced as a compounder entering the “harvest phase” in 2026, which, by itself, tends to support performance above the broader market—regardless of the market’s overall direction.

In quantitative terms, I see Microsoft’s case as being supported by a relatively conservative set of assumptions. Starting from a valuation close to ~30x forward earnings, the thesis only requires a partial multiple re-expansion of 1x to 2x—still below the company’s historical averages over the past few years—combined with EPS growth in the mid-to-high teens.

This would be driven by Azure growing at similar or slightly better rates than today, alongside a slowdown in relative CapEx growth, which should allow margins to re-accelerate from the recent ~3% pace to a more normalized level over the next couple of years.

On this basis, no heroic assumptions are needed. Even modest margin expansion and incremental multiple normalization would be enough to support attractive upside. In this scenario, I believe the MSFT thesis remains constructive, and a Buy rating is warranted.