Technology giant Microsoft (MSFT) says it is open to deploying natural gas with carbon capture technology to power its artificial intelligence (AI) data centers.

In a television interview, Bobby Hollis, Microsoft’s vice-president of energy, said when asked about powering AI data centers with natural gas, “That absolutely would not be off the table.” However, he quickly added that using natural gas with carbon capture would only happen if it was deemed “commercially viable and cost competitive.”

Oil and gas companies have been developing carbon capture technology for years. Essentially, it captures carbon dioxide emissions from industrial sites and stores them deep underground. However, carbon capture at a commercial scale hasn’t taken off due to the high costs associated with such projects.

Ambitious Goals

Microsoft has big AI ambitions and big climate goals. The company has said it plans to spend about $80 billion this year building out its AI infrastructure, including on data centers. However, the company also has ambitious goals to address climate change, aiming to match all of its electricity consumption with carbon-free energy by 2030.

Last year, Microsoft made headlines worldwide with its proposal to use nuclear energy to power its AI data centers, going so far as to sign a deal to support the restart of the Three Mile Island nuclear reactor. Data center developers view natural gas as a near-term power solution despite its carbon-dioxide emissions.

Energy giants Exxon Mobil (XOM) and Chevron (CVX) announced last December that they are entering the data center space with plans to develop natural gas plants and accompanying carbon capture technology. MSFT stock has declined 8% over the last year.

Is MSFT Stock a Buy?

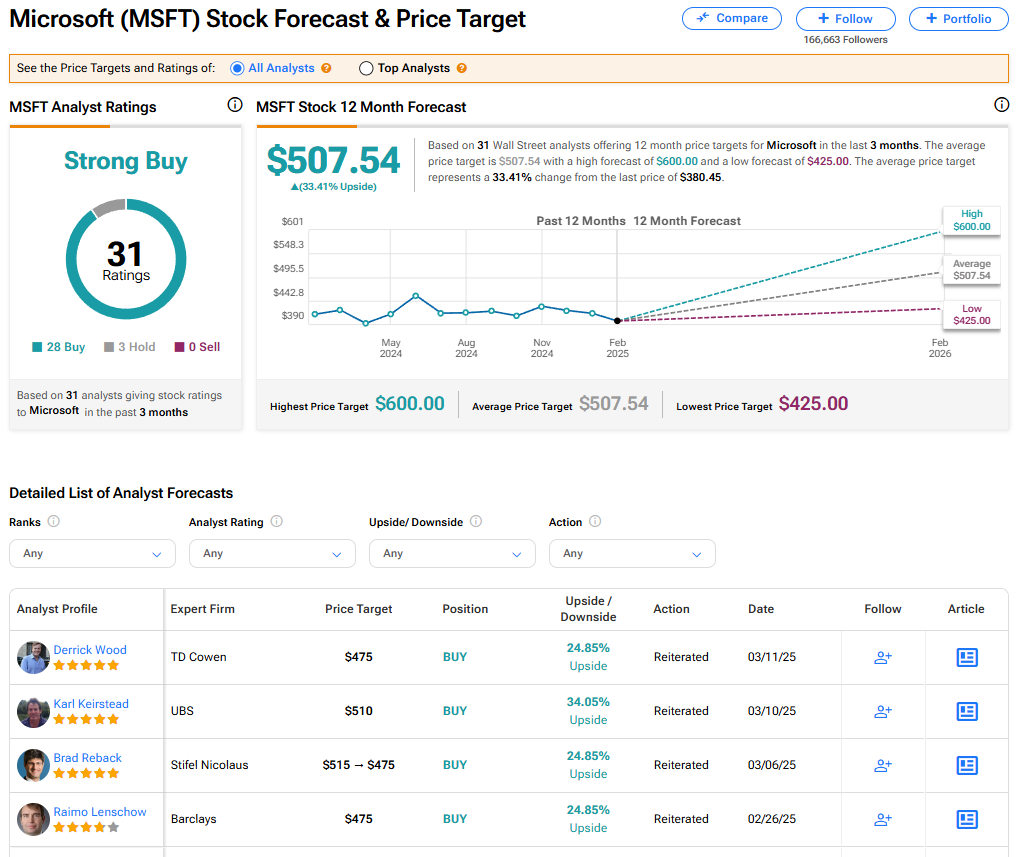

Microsoft’s stock has a consensus Strong Buy rating among 31 Wall Street analysts. That rating is based on 28 Buy and three Hold recommendations issued in the last three months. The average price target on MSFT stock of $507.54 implies 33.41% upside from current levels.

Read more analyst ratings on MSFT stock

Questions or Comments about the article? Write to editor@tipranks.com