Microsoft (MSFT) and Google (GOOGL) are under growing pressure to show returns on their massive AI investments. According to Barron’s, the tech giants have made a combined $99 billion investment in AI infrastructure over the past year. Amid these expectations, both companies recently overhauled pricing for their productivity suites and AI features.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

GOOGL and MSFT Revamp Pricing for Productivity Suites

Last week, Google integrated its Gemini Business AI tools into its Google Workspace suite at no additional cost. However, this move was accompanied by a 17% increase in the subscription price, from $144 to $168 annually. Notably, users cannot opt out of this price hike. According to a Wall Street Journal report citing Earnest Analytics data, only 60% of Gemini Advanced users retained their subscriptions after six months, suggesting challenges in retaining AI users.

This news was followed by Microsoft bundling its Copilot Pro AI features into consumer Microsoft 365 plans. MSFT had previously priced its Copilot Pro AI at $240 annually as an add-on. Now these features will be part of the standard suite, but the individual plan price will increase from $70 to $100 annually—a steep 43% hike. Customers who wish to choose to forgo AI features can avoid the price hike, while unlimited AI access remains priced at $240 annually.

Why Are Tech Giants Changing Their Pricing Strategies?

These pricing shifts suggest the original AI strategies may have struggled to attract enough customers. By embedding AI features at a higher price, both companies are effectively asking all customers, even non-users, to subsidize AI services. Traditionally, software companies were able to scale up quickly as every new customer came at a low marginal cost. However, there are higher costs involved in scaling AI, where adding a new customer for AI services is expensive.

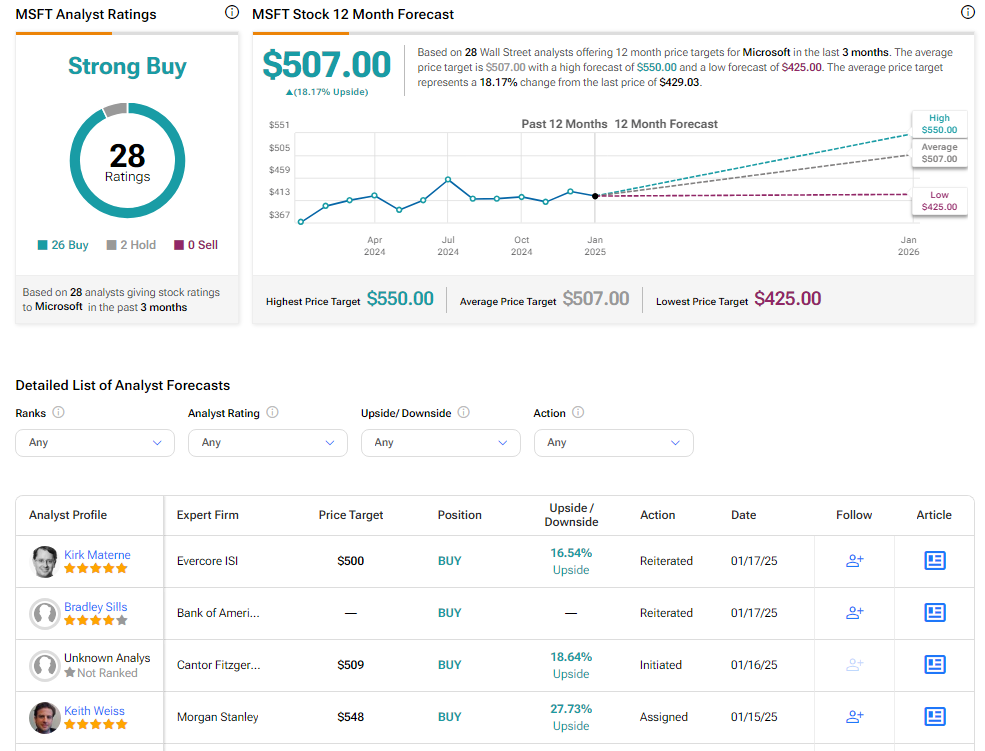

Is Microsoft a Buy, Hold or Sell?

Analysts remain bullish about MSFT stock, with a Strong Buy consensus rating based on 26 Buys and two Holds. Over the past year, MSFT has increased by more than 6%, and the average MSFT price target of $507 implies an upside potential of 18.2% from current levels.