Cloud stocks are increasingly looking like a smart play in today’s market, with demand for scalable digital infrastructure showing no signs of slowing down. The ongoing explosion in artificial intelligence, big data analytics, and remote work tools has made cloud services essential to how modern businesses operate and innovate.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

In response, leading cloud providers are doubling down on investments in next-gen technologies – from custom AI chips to ultra-efficient data centers – aiming to stay ahead in a fiercely competitive landscape. While these are hefty capital bets, they’re also setting the stage for long-term growth and continuous innovation.

Reinforcing this bullish outlook, Cantor analysts recently conducted three cloud check calls with partners representing more than $3 billion in combined IT cloud spend across major platforms like AWS, Azure, GCP, Oracle’s OCI, and others. The takeaway? A strong and healthy demand environment.

“Our cloud check calls left us constructive on C1Q25 being in line with expectations or potentially above, driven by strong momentum in AI,” Cantor reported.

Getting to specifics, the Cantor team recommends buying into Microsoft (NASDAQ:MSFT) and Amazon (NASDAQ:AMZN) for investors seeking cloud exposure. According to the latest data gathered on the TipRanks platform, even after the recent market declines, both stocks retain their Strong Buy ratings and trillion-dollar-plus market caps. Let’s give them a closer look.

Microsoft

First up is Microsoft, currently the second-highest valued company on Wall Street, with a market cap of ~$2.9 trillion. Since 2010, Microsoft’s Azure platform has picked up an ever-growing audience in the cloud computing field.

Azure’s popularity stems from its quality, and from the quantity of cloud-based tools it offers. The platform is versatile, and customers can choose from a wide range of packages, many with options to personalize the functionality. Azure is available as a subscription service, in Infrastructure-as-a-Service (IaaS), Platform-as-a-Service (PaaS), and Software-as-a-Service (SaaS) modes, and is one of the top-selling cloud subscriptions available.

From the customer’s perspective, Azure offers more than 200 tools and services. Microsoft supports this with a global network of data centers, more than 300, allowing for ease of access anywhere in the world. What’s more, Microsoft has in recent years been integrating AI technology into the tools on the Azure platform, providing users with an array of new features and capabilities. These include enhanced monitoring and improved online safety, among others, as well as tools to create new AI applications. The AI model catalog in Azure features more than 1,800 products, allowing for a wide range of choices and flexibility in setting up and building AI solutions.

Turning to financial results, we find that Microsoft generated total revenues in fiscal 2Q25, the last period reported, of $69.6 billion, up 12% year-over-year and beating the forecast by $790 million. The company’s quarterly EPS came to $3.23, up 10% from fiscal 2Q23 and 13 cents per share ahead of the forecast.

These results were driven by the company’s cloud and AI products. The Intelligent Cloud segment saw $25.5 billion in revenue, for 19% year-over-year growth; this included 21% growth in server products and cloud services revenue – and an impressive 31% growth in Azure revenue. In addition, Microsoft reported that its AI-linked revenues grew 175% year-over-year, to reach $13 billion. For its fiscal 2Q25, Microsoft reported cloud revenue as a whole of $40.9 billion. While up 21% from the prior year, this was slightly below (approximately a half-percent) the $41.1 billion forecast.

Cantor analyst Thomas Blakey covers Microsoft, and he remains optimistic about the company’s forward path, based in large part on the potential of its cloud and AI products.

“Azure commentary was relatively upbeat, with one partner describing Microsoft as the best-equipped vendor to weather the current macro environment. In particular, all checks continue to see consolidation trends in certain clouds and cited, overall, Microsoft as best positioned here given its other business lines (Productivity, Security). C1Q25 results were overall strong with partners meeting or exceeding C1Q25 targets with accelerating Azure growth rates this year and one partner seeing overall improvement for Microsoft q/q. Strong Azure results were mainly being driven by AI, which was reiterated by all checks,” Blakey noted.

Given all this, Blakey maintains an Overweight (i.e., Buy) rating on Microsoft shares. (To watch Blakey’s track record, click here)

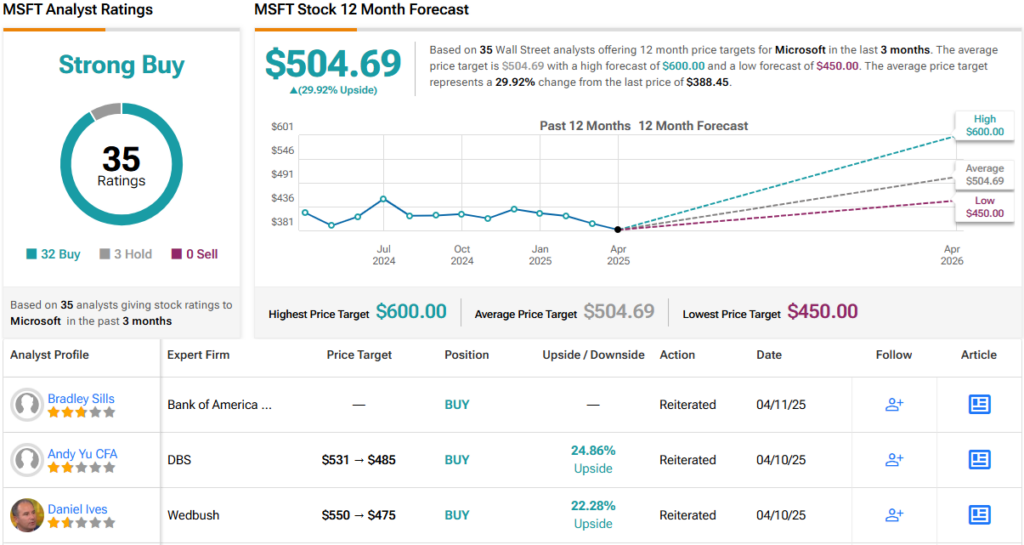

If we step back and look at the bigger picture, we can see that overall MSFT has a ‘Strong Buy’ analyst consensus rating. In the last three months, the stock has received 32 Buy ratings and just 3 Holds. With an average analyst price target of $504.69, analysts are projecting upside potential of ~30% from the current share price. (See MSFT stock forecast)

Amazon

Next on our list is Amazon, the world’s largest online retailer, and the dominant force in e-commerce. But online retail isn’t Amazon’s only game. The company has built a strong set of online services, including its market-leading AWS cloud platform.

AWS, which was first launched in 2006, has over the years become an important source of revenue for Amazon, and offers users a cost-effective cloud computing platform capable of scaling to any level of business or personal needs. The service is designed to meet high-sensitivity security needs, and is flexible enough to function with operating systems, programming languages, and databases. Like Microsoft, Amazon is enhancing AWS with AI tools and functions, adding automation capabilities, generative AI, and an array of AI-powered app building tools. Prominent among the AI tools on AWS is Bedrock, a fully-managed service that allows users to access foundation models from a wide range of leading AI companies.

Amazon is also using AI to enhance its core business of online retail. In a recently launched example, the company is in the process of rolling out a new feature, ‘Buy for Me,’ which uses an AI shopping bot to find items on the sites of competing online retailers. The feature, which is now in beta testing, is designed to allow Amazon shoppers to locate hard-to-find items off-site, and make the purchase through Amazon’s platform.

Amazon’s last financial release covered 4Q24, and the company brought in $187.8 billion in total revenues. This figure was up 10.5% from the prior-year quarter and beat the estimates by $560 million. At the bottom line, Amazon realized an EPS of $1.86, representing an 86% year-over-year gain and beating the forecast by 38 cents per share.

The drill-downs show the contribution of AWS to Amazon’s whole. The cloud platform generated $28.8 billion in revenue in Q4, or 15.3% of the total, and saw 19% year-over-year growth. The AWS segment realized an operating income of $10.6 billion, which was up from the $7.2 billion reported in 4Q23.

In his comments on Amazon for Cantor, 5-star analyst Deepak Mathivanan – who is rated by TipRanks among the top 1% of Wall Street’s analysts – points out AWS and AI as key revenue drivers for Amazon going forward.

“In 2024, one panelist noted that AWS’ business grew ~25% y/y (above +20% y/y target) and 3-5 pts of growth came from GenAI activities (which is expected to increase to 10 pts in 2025). More recently, 1Q trends for another panelist saw AWS growth in the low-20% y/y range (slightly below mid-20% y/y in 4Q). While there could be further uncertainties from tariffs, each panelist called out expectations for AWS to demonstrate consistent growth for FY25 largely from confidence on demand and Gen AI contribution (with two calling out acceleration to low/mid-20% y/y growth). Within AWS AI workloads, customers have mostly been adopting Bedrock, while Sagemaker is also getting a lot better with Bedrock integration,” Mathivanan opined.

To this end, Mathivanan rates Amazon shares an Overweight (i.e., Buy) with a $270 price target, implying 46% upside from current levels. (To watch Mathivanan’s track record, click here)

AMZN is that rare beast – a stock with plenty of coverage where almost everyone is in agreement. It has garnered 46 analyst reviews over the past 3 months, including 45 Buys and just 1 Hold – naturally making the consensus view here a Strong Buy. The average price target currently stands at $261.72, implying the shares will deliver returns of ~42% over the one-year timeframe. (See AMZN stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

Looking for a trading platform? Check out TipRanks' Best Online Brokers , and find the ideal broker for your trades.

Report an Issue