Nvidia (NVDA) is within striking distance of its all-time high, and the next move might not even come from inside its own walls. All eyes are now on Micron Technology (MU), a behind-the-scenes player whose upcoming earnings could be the silent catalyst that pushes Nvidia into uncharted territory.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

Nvidia shares rose 2.6% on Tuesday, and premarket action shows the stock hovering just a hair below its record of $149.43 set in January. But today’s big trigger isn’t a product launch or earnings call from Nvidia—it’s Micron’s results after the bell. Why? Because Micron supplies a crucial ingredient in Nvidia’s AI dominance: high-bandwidth memory (HBM).

Why HBM Chips Matter in the AI Arms Race

If Nvidia’s AI chips are the engines of modern machine learning, then Micron’s high-bandwidth memory is the fuel. These advanced memory modules are what allow Nvidia’s GPUs to handle enormous volumes of data in real time. Without enough supply of these components, Nvidia’s AI accelerators—used by cloud giants, researchers, and enterprises—can’t run at full throttle.

Micron is one of only a handful of companies capable of making this tech. The others? South Korean giants SK Hynix and Samsung. So when Micron reports earnings, the street isn’t just looking at revenue and profit—it’s looking for clues about whether demand for AI infrastructure is still surging, and whether Micron can keep up.

If Micron delivers a strong beat and guides higher, it suggests Nvidia’s supply chain is healthy and end demand is still booming. That’s exactly the kind of macro signal that could tip Nvidia into a breakout.

The Price Action Tells a Quiet Story

Over the last 12 months, Nvidia stock is up 17%, while Micron is down 9%. But those numbers don’t tell the full story. The two stocks often move in tandem because their fates are tied—Nvidia’s AI dominance depends on memory suppliers like Micron scaling efficiently.

Tuesday’s price jump already hints that traders are positioning for a bullish Micron print. If those expectations are confirmed, it could reignite the broader AI trade, just as summer tech earnings season kicks off.

Micron’s Numbers Could Shift Sentiment on Nvidia and AI Stocks

This is a textbook case of downstream dependency. Nvidia is the public face of the AI revolution, its chips power everything from ChatGPT to Tesla’s Autopilot. But it relies on a stack of lesser-known players like Micron to keep its pipeline moving.

That makes Micron’s earnings tonight more than just another chipmaker update. It’s a temperature check on AI infrastructure. If orders are strong, inventories are tight, and pricing is healthy, it validates the entire AI thesis. If not, it raises questions about just how long the current cycle can last.

A blowout Micron report could do more than boost MU shares, it could push Nvidia through its record high and reset expectations for Q3 across the board. If you’re investing in AI, Micron’s call tonight is must-watch.

Is Nvidia a Buy, Sell, or Hold?

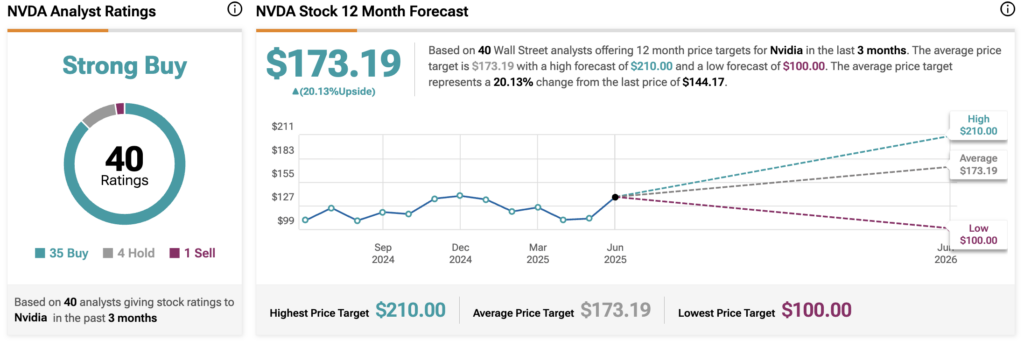

According to TipRanks data, Wall Street is still firmly in Nvidia’s corner. Of 40 analysts covering the stock, 35 rate it a Buy, four say Hold, and just one sees a Sell. The average 12-month NVDA price target is $173.19, about 20% above current levels, while the highest target sits at $210. That implies Nvidia still has plenty of room to run, at least on paper.

But make sure you consider this: Nvidia’s stock is already just 1% off its record high, and a lot of this optimism may already be baked in. Analysts have been pricing in aggressive AI-driven revenue growth for several quarters now.