With Micron Technology (MU) stock trading flat over the past five months and still down 36% from its 52-week high of $157.54, the semiconductor memory giant’s investment case is becoming increasingly compelling. While a number of factors have built a negative sentiment, including cyclical weakness in semiconductor demand, inventory buildup, and pricing pressure, Micron appears poised for a major rebound in revenues and earnings. In my view, this indicates that the stock is undervalued at current levels. For this reason, I am bullish on the stock and believe this is a must-see opportunity.

Claim 50% Off TipRanks Premium and Invest with Confidence

- Unlock hedge-fund level data and powerful investing tools designed to help you make smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis so your portfolio is always positioned for maximum potential

What Has Caused MU Stock to Underperform Recently?

Firstly, let’s take a look at what has driven the negative sentiment and caused shares to underperform lately. To my understanding, the challenges can be broadly attributed to three key reasons: declining semiconductor demand due to cyclical trends, inventory buildup and pricing pressure, and geopolitical concerns.

Regarding current cyclical trends, a decline in demand in important markets, such as personal computers and smartphones, has been a significant headwind for Micron. The slowdown in consumer demand for these products has directly impacted Micron’s DRAM and NAND memory product sales. Thus, despite the rising demand for memory in AI systems, the overall market weakness in PCs and smartphones continues to weigh on Micron’s sentiment. Notably, the slowdown in these sectors has overshadowed gains in specialized memory used in data centers and AI servers.

Another pressing issue is the buildup of inventory. Essentially, softer demand across key markets has led to an accumulation of unsold memory products. This inventory buildup has suppressed prices, especially in DRAM products, which are crucial to Micron’s revenue mix. These ongoing concerns about declining DRAM prices have further negatively impacted investor sentiment, contributing to the rather muted stock price.

Last but not least, I would point out that Micron is currently affected by the broader challenges facing the semiconductor industry, particularly the impacts of ongoing geopolitical tensions. If you are unaware, U.S. export restrictions on advanced technologies to China have created uncertainty for Micron and the wider semiconductor sector. Sure, these measures were not as severe as initially feared. Yet, they have added a layer of caution in the market, causing many investors to remain on the sidelines.

Micron’s Results Tell a Different Story

Despite the aforementioned factors that appear to have weighed on Micron’s stock price, the company’s underlying results tell a different story, supporting my bullish outlook on the stock. In particular, Micron ended Fiscal 2024 with remarkable momentum, which paints a notably more positive picture of its actual prospects. The company’s Q4 revenue skyrocketed by 93.3% year-over-year, reaching $7.75 billion, while its adjusted earnings per share (EPS) climbed 90.3% to $1.18. This indicates a notably stronger demand for Micron’s products compared to the sluggish numbers seen in earlier quarters.

The most important driver powering Micron’s performance appears to be the surging demand for data center products, mainly fueled by rising AI workloads. As Micron’s management highlighted in the Fiscal Q4 earnings call, the company’s high-bandwidth memory (HBM) and data center DRAM segments saw a significant boost, mainly due to the increasing adoption of AI solutions and the associated need for high-speed memory modules. Evidently, Micron set a record for NAND revenue, powered by data center SSD sales that exceeded $1 billion for the first time.

Micron’s Momentum Is Expected to Continue into Fiscal 2025

Beyond Micron’s recent performance, the more meaningful part bolstering my bullish view on MU stock is the expectation that this momentum will continue into Fiscal 2025, fueled by several key factors. Specifically, according to Micron’s management, the ramp-up in AI-driven server demand is expected to persist, providing strong support for Micron’s data center memory products. Further, traditional server demand is likely to improve as companies refresh their IT infrastructure, further boosting the outlook for Micron’s DRAM business.

Consensus estimates support this view, projecting a significant increase in Micron’s top and bottom lines for Fiscal 2025. Revenue is expected to surge by 52%, reaching $38.2 billion, while EPS is forecast to grow by an impressive 587%, reaching $8.93. With such a strong rebound in earnings, Micron shares are now trading at just 11 times forward earnings, which I find a relatively attractive multiple.

One could argue that Micron operates within a highly cyclical industry, meaning its earnings multiple should be viewed within that extra careful context. However, Wall Street analysts expect continued growth in both revenue and earnings in Fiscal 2026, as memory demand from AI and data centers remains robust. For this reason, I find Micron’s investment case particularly compelling at its current levels.

Is Micron a Good Stock to Buy Today?

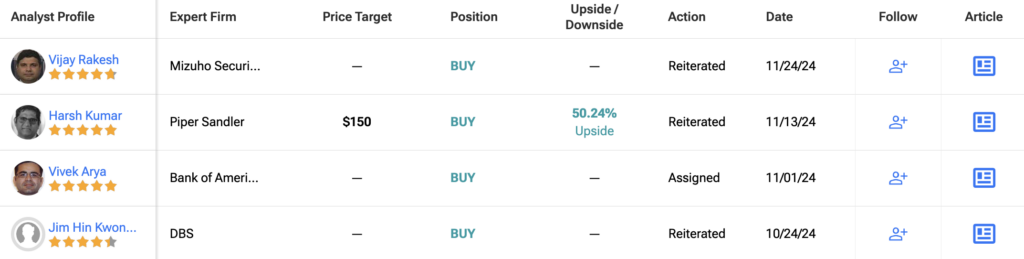

Wall Street analysts appear quite upbeat about Micron’s future prospects. Specifically, MU stock features a Strong Buy, with recent analyst ratings of 23 Buys, 23 Holds, and one Sell over the past three months. At $149.81, the average MU price target implies a 50% upside potential.

For the best guidance on buying and selling MU stock, look to Timothy Arcuri. He is the most accurate and profitable analyst covering the stock (on a one-year timeframe), boasting an average return of 38.6% per rating and an impressive success rate of 72%.

Summing Up

Micron Technology has struggled to gain momentum recently, but its recent performance and outlook tell a totally different story. With surging demand for AI-related memory products and cheerful expectations for revenue and earnings growth in Fiscal 2025 and beyond, the stock appears set for a rebound. My view is also reinforced by the stock’s current valuations, which implies a heavy discount even when treating MU stock as a highly cyclical semiconductor stock. Hence, despite the sentiment issues lately, I am bullish on the stock.