U.S.-based memory chip maker Micron Technology (MU) is scrambling to domesticate manufacturing and diversify its products in light of recent U.S.-China trade tensions. The company’s memory modules and solid-state drives (SSDs) were not exempt from tariffs, forcing Micron to impose surcharges.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

Following a temporary exemption on semiconductors, President Donald Trump is reportedly inching closer to tariffs expected to impact Micron’s operations. In addition, Micron is facing a “double jeopardy” situation in that while its products remain banned from China’s critical infrastructure products, it is also dealing with increasing U.S. trade restrictions.

The battle between the two superpowers creates major headwinds for the company relative to South Korean competitors like Samsung (SSNLF) and SK Hynix. Micron’s pivot towards high-bandwidth memory (HBM) for AI applications, which will require significant capital expenditures, strikes me as bad timing in the current macroeconomic environment, making me bearish on the stock.

Memory Chips, the 21st Century Commodity

For those unaware, Micron specializes in two types of memory technologies: Dynamic Random Access Memory (DRAM) and NAND Flash Memory. These are critical components to many electronics. However, unlike processors (CPUs/GPUs) made by companies like Nvidia (NVDA) and Intel (INTC), memory chips are, essentially, commodities.

This basically means that these products are standardized and largely interchangeable. As a result, competition centers almost entirely on price. In this context, the competitive moat is scaling to mass produce the chips. Micron has done this, but so have others like Samsung and SK Hynix.

Caught Between Two Superpowers

Micron is no stranger to U.S.-China trade tensions. In 2023, it became a sacrificial lamb after China suddenly declared it posed significant security threats. The declaration came just months after the U.S. began restricting chip exports to China. Micron was an easy target because its products were easily replaceable by alternatives from South Korean companies.

Moving forward, Micron has several key vulnerabilities. While it is the only major U.S.-based memory manufacturer, only about 10% of its chips are made in the U.S. — most are made in Taiwan. However, the company is trying to expand its U.S. manufacturing footprint, with intentions to increase its share of U.S.-made chips to 60% in the coming years. Moreover, Micron sells nearly half of its products overseas, notably in China and Taiwan.

Current tariffs on SSDs and memory modules have increased prices and could push customers towards competing solutions. If tariffs affect the U.S.-based companies differently than their South Korean counterparts, Micron could face a significant disadvantage. This is really a key vulnerability for Micron. Korean competitors could navigate the middle ground and gain market share at Micron’s expense.

Notably, Micron’s products often cross borders several times, multiplying tariff impacts and forcing the company to consider costly supply chain reconfigurations. Lastly, Micron is between a rock and a hard place; as the U.S. strengthens its export controls, China retaliates and, as seen in the past, Micron is particularly vulnerable to being squeezed from both sides.

Revenue Challenges and the HBM Gamble

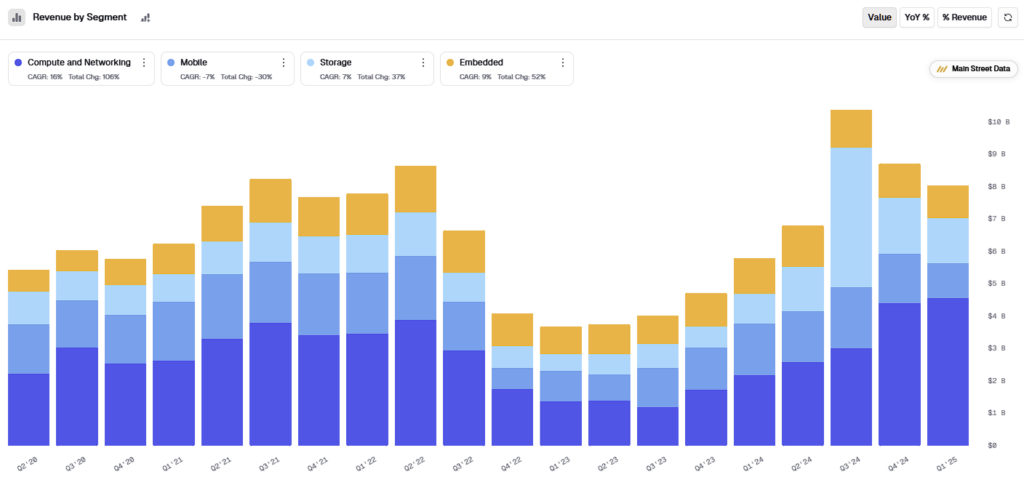

Micron is already seeing revenue declines from its NAND and DRAM products. FYQ2 2025 (ending February 27, 2025) NAND revenue dropped 17% quarter-over-quarter, while DRAM revenue decreased 4% quarter-over-quarter. DRAM and NAND comprise 76% and 23% of Micron’s total revenue (1% from 3D XPoint memory and NOR).

Meanwhile, Micron is making major capital expenditures (approximately $14 billion in FY2025) to support its HBM venture. This is Micron’s attempt to escape the commodity trap that traditional memory products face. However, it’s a little late to the game, and while HBMs are essential for artificial intelligence, they are significantly more difficult to manufacture than traditional memory chips.

Although Micron trails Samsung and SK Hynix in market share, the HBM market is experiencing a severe supply-demand imbalance. All Micron’s HBM capacity for 2025 is already sold out, and the company is already taking orders for 2026. However, this segment, too, is quite vulnerable to tariffs and trade restrictions. HBM is a natural evolution for Micron, but it’s coming at a time when its core business (NAND and DRAM) faces significant macroeconomic headwinds that could dent revenue and margins.

Is Micron Technology a Buy, Hold, or Sell?

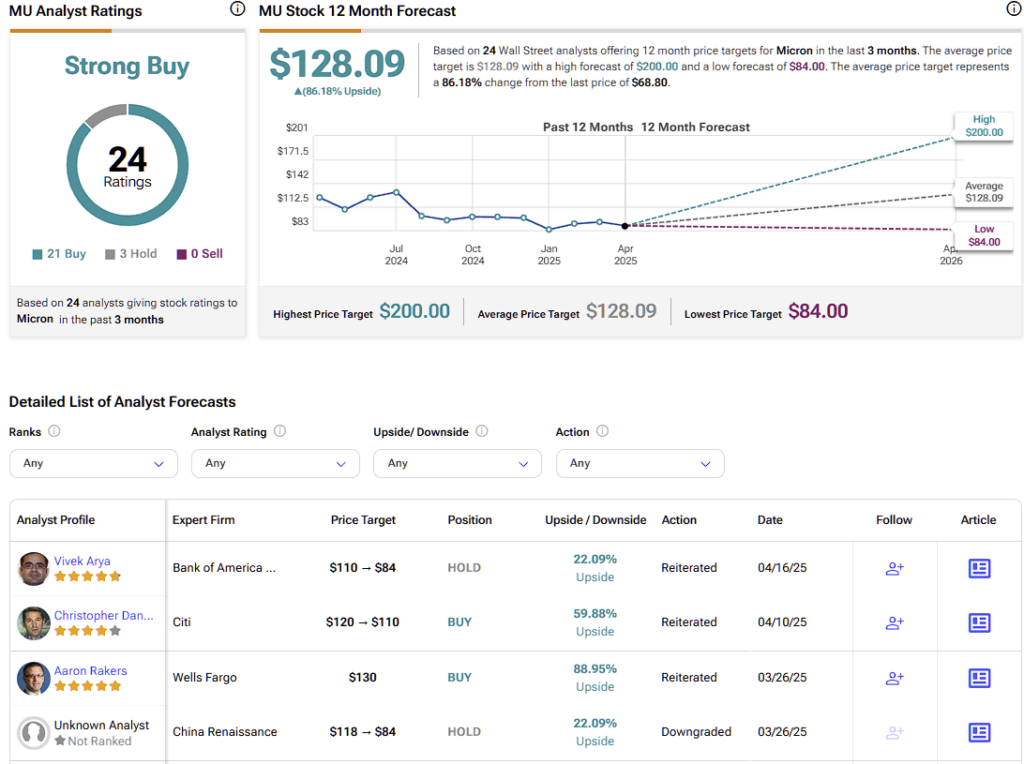

On Wall Street, MU has a Strong Buy consensus rating based on 21 Buy, three Hold, and zero Sell recommendations. MU’s average price target of $128.09 implies an 86% upside potential over the next twelve months.

Last week, Citi analyst Christopher Danely maintained a Buy rating on MU with a price target of $110.00. Judging by MU’s average price target, Wall Street is pretty confident that Micron will emerge unscathed from macroeconomic and competitive troubles. While I acknowledge that this is certainly possible, I find it unlikely.

Trade War Necessitates Bearish Outlook

Micron is facing challenges from several directions. Unlike its competitors, Micron remains caught between two dueling superpowers. Meanwhile, Korean companies may be in a prime position to undercut Micron on price. As discussed above, pricing is everything for traditional memory products.

Moreover, the company’s decision to deploy considerable capital on HBM memory amid problems with its traditional memory products is lousy timing. Granted, HBM is a critical and necessary pivot for the company. However, this does not guarantee return-on-investment, and its upfront costs will be significant. Despite Wall Street optimism on MU, I am feeling bearish in light of trade wars, tariffs, supply chain problems, and heavy capital expenditures amid margin compression.