Micron Technology (MU) is closing out 2025 on a strong note after hitting a new all-time high of $294.37 on December 29. The move pushed the stock past its previous record of $290.87, set just days earlier on December 26, as investors continued to favor memory chip makers tied to artificial intelligence. The key question now is whether the stock’s sharp rally can extend into 2026.

Claim 70% Off TipRanks This Holiday Season

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Notably, Micron’s gains came even as the broader market moved lower on Monday. The S&P 500 (SPX) fell 0.35% to 6,905.74, while the Dow Jones Industrial Average (DJIA) dropped 0.51% to 48,461.93 during the same session.

Why Micron Is Flying High

Micron’s rally in 2025 has been striking. The stock is up more than 250% year-to-date, far outpacing most chip and tech peers, driven by strong demand for memory and storage used in AI data centers.

Recent earnings also topped expectations, with revenue of $13.64 billion and adjusted EPS of $4.78. The results highlight Micron’s strength in high-bandwidth memory (HBM), the ultra-fast memory used in the latest AI chips from Nvidia (NVDA) and AMD (AMD).

Looking ahead, management expects the HBM market to grow from $35 billion in 2025 to $100 billion by 2028, implying a compound annual growth rate of about 40%. That outlook has pushed several analysts to raise price targets, with Rosenblatt Securities setting a new street-high of $500 per share.

Can MU’s Run Continue in 2026?

Looking ahead to 2026, Micron’s outlook will depend on how long current demand trends last. Demand for AI-related memory remains strong, as data centers continue to expand and capacity for high-bandwidth memory stays tight. If this trend holds, it could support growth into next year.

At the same time, pricing will matter. Memory prices have climbed because supply has not kept up with demand. If that gap remains, Micron should be able to protect margins. Analysts also remain positive, pointing to solid results and better guidance as signs the rally may continue.

That said, competition remains a major risk. Chipmakers such as Samsung (SSNLF) and SK Hynix are rapidly expanding their own HBM production, which could pressure pricing over time.

Is MU Stock a Buy Right Now?

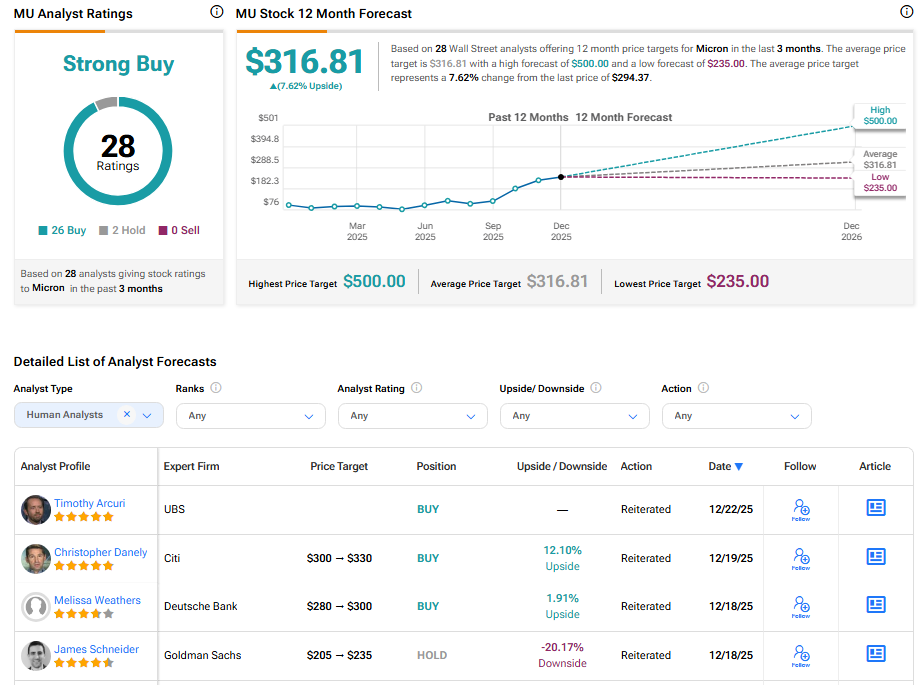

Turning to Wall Street, analysts have a Strong Buy consensus rating on MU stock based on 26 Buys and two Holds assigned in the past three months, as indicated by the graphic below. Further, the average Micron price target of $316.81 per share implies 7.62% upside potential.