Micron (MU) stock surged about 6.6% on Thursday as of writing, as top analysts at UBS and Citi raised their price targets and reaffirmed their Buy ratings on the memory and storage chips provider. Notably, UBS analyst Timothy Arcuri raised his price target for Micron stock to $245 from $225 and reiterated a Buy rating. Likewise, Citi analyst Christopher Danely raised his price target for MU stock to $240 from $200 while maintaining a Buy rating. Both analysts expect the company to benefit from the shortage in the supply of DRAM (dynamic random access memory) chips.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Top UBS Analyst Sees Strong Upside in Micron Stock

UBS’s Arcuri views the intensifying shortage in DRAM supply, revealed by his industry checks, as a tailwind for Micron stock. He expects the tight supply conditions to drive further profitability in core DRAM.

Furthermore, the 5-star analyst highlighted the rise in demand from both U.S. hyperscalers and smartphone customers. That said, Arcuri noted that this increased demand has not been met, as most new DRAM bits are still allocated to high bandwidth memory (HBM) applications.

Overall, Arcuri continues to believe that the cycle will likely be more durable this time, as HBM “crowds out” the traditional memory market, allowing memory suppliers to allocate bits to the highest-value markets.

Here’s Why Citi Analyst Raised MU Stock Price Target

Citi’s Danely increased his estimates for Micron further above the Street’s consensus forecast to reflect “higher and sustainable” DRAM pricing. Danely expects MU’s gross margin to rebound to 60% in Q3 FY26. Moreover, he expects 2026 earnings per share (EPS) to increase above $23, almost double the company’s previous peak earnings of $12.26 in 2018.

The top-rated analyst’s optimism is backed by expectations of higher DRAM pricing and longer-term contracts. “We believe DRAM will be the next chip to get long-term contracts with the AI food chain given its importance and undersupply, similar to what happened with NVDA (NVDA), AMD (AMD), and AVGO (AVGO),” said Danely.

Danely now expects Micron to generate revenue of $62.5 billion and EPS of $21.05 in Fiscal 2026, up from his previous outlook of revenue of $56 billion and EPS of $16.93. The analyst also raised his estimates for Fiscal 2027 and 2028.

Is MU a Good Stock to Buy?

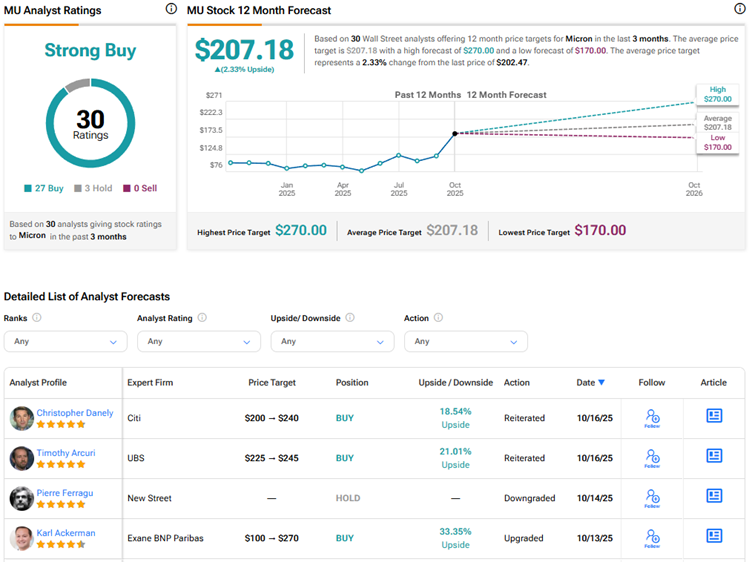

Currently, Micron stock scores a Strong Buy consensus rating based on 27 Buys and three Holds. The average MU stock price target of $207.18 indicates 2.3% upside potential. MU stock has risen about 134% year-to-date.