Investors who want to invest in semiconductor stocks but are concerned about the elevated valuations of some of the leading names should look no further than memory chip giant Micron (MU).

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Despite reporting blowout earnings and laying out strong guidance for the year ahead, shares of Micron are 30% lower than their 52-week high. While this has been painful for Micron shareholders, it creates a compelling entry point for new investors.

I’m bullish on Micron based on its deceptively cheap valuation, strong forward guidance, and its overwhelmingly favorable analyst outlook. The average analyst price target for Micron implies a potential upside of over 35% over the next 12 months.

Deceptively Cheap Valuation

If you’re looking at Micron’s earnings on a trailing 12-month basis, you might be wondering how someone can say the stock is cheap. Over the past 12 months, Micron has earned a mere $0.67 per share, giving it a sky-high price-to-earnings multiple of ~161x based on today’s share price.

However, the market is forward-looking, and looking ahead, Micron is projected to grow earnings dramatically. Micron typically only guides a quarter out, but after its last earnings call, it guided to adjusted earnings of $1.74 per share, already more than double what it earned for the entirety of fiscal 2024. For fiscal 2025 (which ends in August 2025), consensus analyst estimates call for earnings to accelerate to $8.93 per share. Based on these estimates, Micron trades at 11.8x forward earnings.

Trading at just 11.8x forward earnings estimates, Micron is the rare chip stock with the type of valuation that even a deep-value investor can fall in love with. This low valuation means that shares of Micron look remarkably cheap. Case in point, the S&P 500 (SPX) has an average forward price-to-earnings multiple of 24.7x, more than double that of Micron’s.

Micron looks even cheaper when moving the calendar further ahead; the stock trades at just 8.2x consensus 2026 earnings estimates. This surprisingly cheap valuation gives Micron ample room for upside potential going forward, and possibly some degree of downside protection. Even if the market sours on chip stocks for a period of time, Micron’s P/E multiple simply has less room to compress than stocks trading at much higher multiples.

Micron Is Significantly Cheaper than Other Chip Stocks

There’s even more of a disparity when comparing Micron to its fellow semiconductor stocks. For example, Nvidia (NVDA) trades for 46.3x January 2025 earnings estimates, and Advanced Micro Devices (AMD) trades for an identical 46.3x December 2024 earnings estimates. That’s a good reason to feel optimistic about Micron stock.

One can certainly make the case that leaders like Nvidia and AMD deserve higher multiples than Micron. They produce the cutting-edge GPU chips used for generative AI, while Micron’s chips are used for memory. Whether for on-demand use or for long-term storage, the memory segment of the chip market is viewed as more commoditized. Case in point: Nvidia and AMD boast gross margins of 76.0% and 40.6%, respectively, while Micron’s gross margins are a respectable, but comparatively low, 22.4%.

Micron Is a Major AI Beneficiary

Nonetheless, there appears to be a massive valuation gap here. Micron’s chips may be more commoditized, but many are still incredibly technologically advanced. For example, only three companies in the world (Micron, Samsung and SK Hynix) make the types of high bandwidth memory chips (HBMs) Micron makes.

High bandwidth memory chips are an important part of the AI stack as they help GPUs to process large amounts of data. While it may not be as glamorous as Nvidia or AMD, Micron is still a major beneficiary of AI tailwinds. For example, Micron’s high bandwidth memory chips are used in Nvidia’s GPUs. Sell-side analysts like KeyBanc’s John Vinh expect that Micron’s HBMs will earn significant share of the memory chips used in Nvidia’s next generation Blackwell GPUs.

Furthermore, while the PC and smartphone market has been a drag on Micron in recent times, the next generation of AI computers and laptops will require substantially more memory than the current generation of PCs. In sum, there will be plenty of need for additional memory as AI advances further, which bodes well for Micron.

Semiconductors are a cyclical industry to begin with, and the memory portion of the market is even more cyclical (as evidenced by the drastic uptick in Micron’s earnings analysts are projecting for the year ahead). While perhaps Micron’s business does deserve a discounted multiple, at under half the market multiple MU stock looks way too cheap.

Is MU Stock a Buy, According to Analysts?

Turning to Wall Street, MU earns a Strong Buy consensus based on 22 Buy ratings, one Hold rating, and one Sell rating assigned by analysts in the past three months. The average MU stock price target of $148.68 implies about 35% upside potential from current levels.

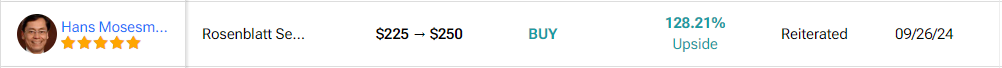

It’s worth noting that some analysts are considerably more bullish on Micron than others. Rosenblatt’s Hans Mosesmann, who has a five-star rating from TipRanks, recently increased his price target on MU stock from $225 to a street high of $250, which is more than double today’s share price.

A Bullish Outlook Going Forward

While MU is a cyclical stock in a cyclical industry, the explosive earnings growth projected for the year ahead means that the stock looks way too cheap, especially compared to other semiconductor companies and the broader market.

Additionally, while Micron’s chips may be less specialized and more commoditized than those of AI darlings like Nvidia and AMD, the company will still benefit from AI tailwinds. In many cases its high bandwidth memory chips will work in concert with Nvidia’s GPUs. The company should benefit from surging data center demand, and while the PC and smartphone end markets are facing a challenging period, the next generation of AI-enabled PCs will use much more memory than the current ones.

Wall Street analysts are also extremely bullish on the stock, rating it a Strong Buy and ascribing potential upside of over 35% during the next 12 months. I’m bullish on Micron stock.