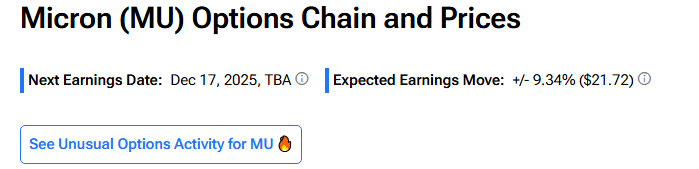

Memory chipmaker Micron (MU) is scheduled to announce its results for the first quarter of Fiscal 2026 after the market closes on December 17. MU stock has rallied more than 187% year-to-date, driven by optimism about the demand for the company’s high-bandwidth memory (HBM) chips amid the ongoing artificial intelligence (AI) boom. According to TipRanks’ Options Tool, options traders expect about a 9.34% move in either direction in MU stock in reaction to Q1 FY26 results.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

This implied move is higher than MU stock’s average post-earnings move (in absolute terms) of 7% over the past four quarters.

Wall Street expects Micron’s Q1 FY26 earnings per share (EPS) to increase 120% year-over-year to $3.94. Meanwhile, revenue is expected to rise 48% to $12.87 billion.

Analysts’ Views Ahead of Micron’s Q1 Earnings

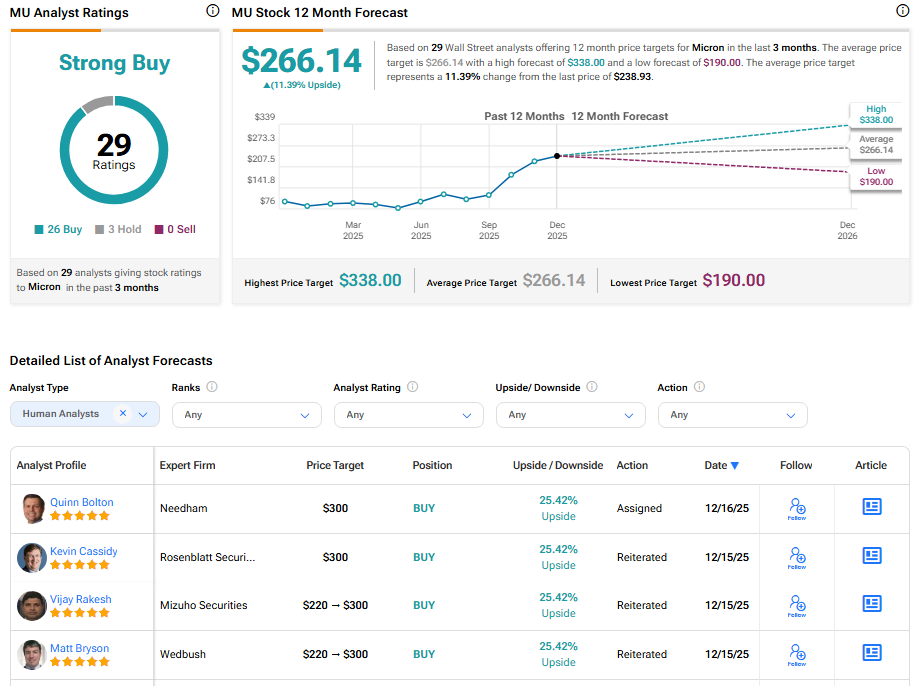

Ahead of the Q1 print, several analysts have raised their price targets on MU stock, signaling growing confidence in the company’s near-term outlook. The analysts cited improving memory pricing trends, stronger demand for HBM, and signs that the industry downturn is bottoming out.

One such analyst is Joseph Moore of Morgan Stanley, who raised his price target on Micron to a Street-high $338 from $325 while maintaining a Buy rating. Moore believes Micron is well positioned to benefit from strong demand for AI-related memory chips as pricing continues to improve. He also lifted his 2026 earnings forecast by 15%, noting that tight supply and rising AI demand could continue to support earnings growth.

Meanwhile, analyst Ricky Seo at HSBC initiated a Buy rating on MU stock with a price target of $330. Seo said concerns around Micron’s financial risks from new competitors and the Stargate Project are overdone. He added that the stock still offers upside, even after its strong run this year, and said there is “plenty of room for further growth.”

Is Micron a Good Stock to Buy?

Micron stock has a consensus Strong Buy rating among 29 Wall Street analysts. That rating is based on 26 Buy and three Hold recommendations assigned in the last three months. The average MU price target of $266.14 implies 11.39% upside from current levels.