Michael Burry, who is known for his successful bet against the 2008 U.S. housing crash, made notable investments in Chinese tech stocks in late 2022. However, it seems like his strategy is now changing. Indeed, in the first quarter, his firm, Scion Asset Management, cut its portfolio significantly, reducing the number of stocks held from 13 to just seven, according to a regulatory filing. The filing also revealed that Burry bought bearish put options on major Chinese tech companies, including Alibaba (BABA), Baidu (BIDU), JD.com (JD), and PDD Holdings (PDD), as well as Trip.com and AI chip giant Nvidia (NVDA).

Don’t Miss TipRanks’ Half-Year Sale

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

- Make smarter investment decisions with TipRanks' Smart Investor Picks, delivered to your inbox every week.

This indicates that Burry expects these stocks to decline in value. In addition to the bearish positions on Chinese tech stocks, Scion Asset Management increased its investment in Estée Lauder (EL) by doubling its shares to 200,000. It is worth noting that Estée Lauder’s stock has faced challenges as it is down over 50% in the past year. However, Burry’s increased stake suggests that he still sees potential in the company despite its struggles.

Furthermore, by the end of March, Scion Asset Management was managing around $155 million. While his earlier Chinese tech investments rallied, Burry’s recent moves suggest that he believes these stocks have achieved their upside potential. Meanwhile, Estée Lauder’s stock rose slightly after Burry’s investment was disclosed, but it remains to be seen if the stock will recover to its previous highs.

Which Michael Burry Stock Is the Better Buy?

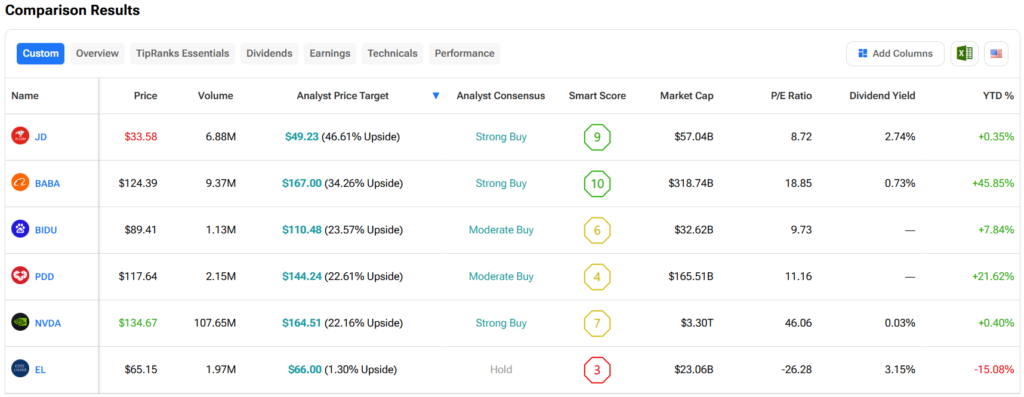

Turning to Wall Street, out of the six stocks mentioned above, analysts think that JD stock has the most room to run. In fact, JD’s average price target of $49.23 per share implies more than 46% upside potential. On the other hand, analysts expect the least from EL stock, as its average price target of $66 equates to a gain of 1.3%.