MGM Resorts International (MGM) shares jumped over 3% in after-hours trading after the casino giant posted stronger-than-expected Q1 earnings and unveiled a massive $2 billion share buyback program. Notably, MGM reported quarterly adjusted earnings of $0.69 per share, significantly beating Wall Street expectations of $0.46. The upbeat results and shareholder-friendly move signal confidence in the company’s growth outlook and balance sheet strength.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

- Make smarter investment decisions with TipRanks' Smart Investor Picks, delivered to your inbox every week.

BetMGM Profits on Record Q1 Bets

MGM’s strong results were largely driven by a surge in online gambling, especially in sports betting. Recently, MGM’s rival company Caesars Entertainment (CZR) also reported strong performance in digital operations, particularly in sports betting and iGaming.

Earlier this week, BetMGM, MGM’s joint venture with UK-listed gambling firm Entain PLC (GB:ENT), reported strong performance, reinforcing its position as a key growth driver.

In Q1, BetMGM recorded $657 million in revenue, up 34% from last year. This growth came from a 68% jump in online sports betting and a 27% rise in iGaming revenue. The company added that BetMGM turned a profit on an EBITDA basis in Q1 and said strong trends support its confidence in posting full-year EBITDA profits in 2025. Additionally, BetMGM reaffirmed its full-year revenue forecast, expecting to bring in between $2.4 billion and $2.5 billion.

On the downside, MGM’s total revenue fell 2.4% year-over-year to $4.28 billion for the quarter, due to weaker performance at its Las Vegas Strip Resorts and MGM China. Specifically, revenue from MGM China dropped 2.7% to $1.03 billion.

Is MGM Stock a Good Buy Now?

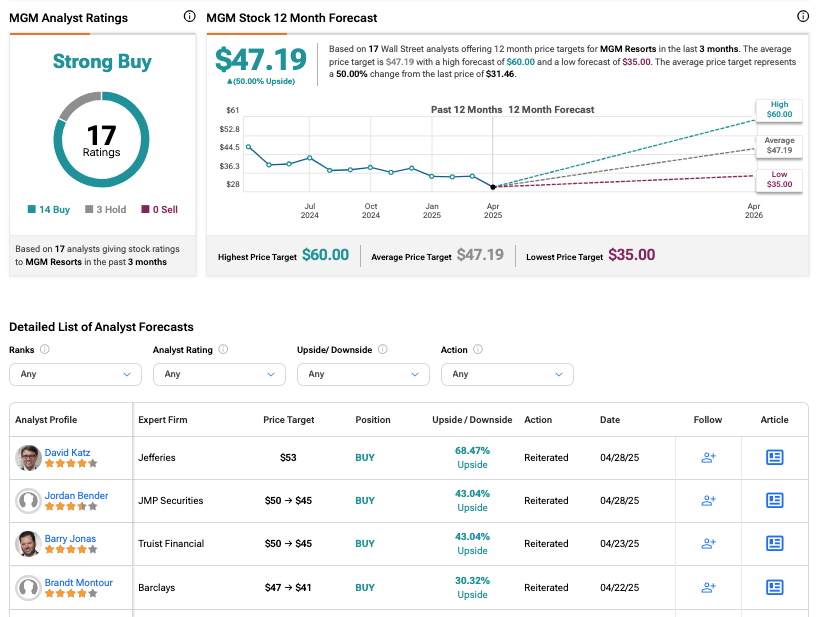

According to TipRanks, Wall Street has a Strong Buy consensus rating on MGM stock, based on 14 Buys and three Holds assigned in the last three months. The average MGM Resorts stock price forecast of $47.19 implies 50% upside potential from current levels.