Social media giant Meta (META) recently warned the European Union that it will seek help from President Trump if it continues to impose harsh penalties on the company. This threat was made by Joel Kaplan, Meta’s global policy chief, at the Munich Security Conference. Kaplan stated that if Meta feels unfairly treated by Brussels, it won’t hesitate to involve the White House.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Meta has already faced significant fines from the EU, which have totaled over $3 billion, for violating data privacy and antitrust rules. Unsurprisingly, the company is pushing back against these regulations, with Mark Zuckerberg saying that Europe’s laws are slowing down innovation. As a result, Zuckerberg has pledged to work with President Trump in order to counter governments that are targeting American companies.

Meta’s warning is seen as a strategic move to use Trump’s opposition to Europe as support and push back against EU regulations. The EU Commission has not commented on Meta’s warning, but the situation highlights the complex relationship between tech giants and governments.

Is META Stock a Good Buy?

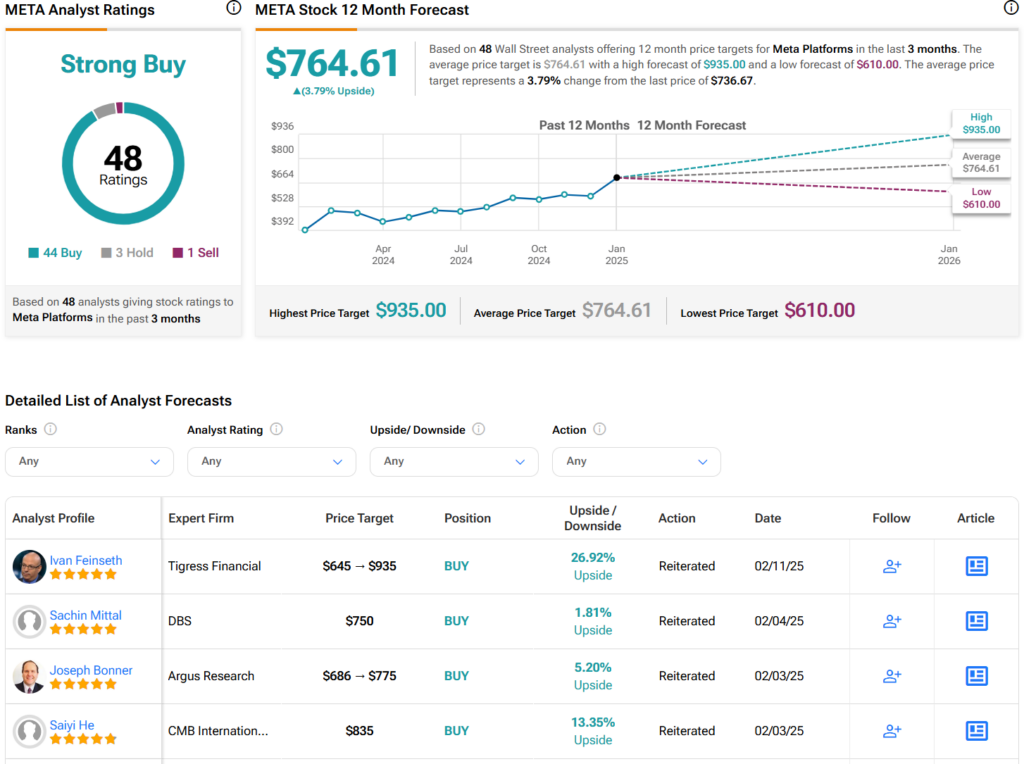

Turning to Wall Street, analysts have a Strong Buy consensus rating on META stock based on 44 Buys, three Holds, and one Sell assigned in the past three months, as indicated by the graphic below. After a 57% rally in its share price over the past year, the average META price target of $764.61 per share implies 3.8% upside potential.