Meta Platforms’ (META) massive AI investment spree is starting to weigh on Wall Street’s patience. The company’s stock tumbled more than 11% Thursday morning after reporting mixed third-quarter results that showed strong revenue growth but rising expenses and shrinking profit margins.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Earnings per share came in at $1.05, far below analyst expectations due to a one-time charge, while revenue hit $51.2 billion, up 26% from last year and ahead of estimates. But investors focused on what’s next, and the numbers show a company spending faster than it’s growing.

AI Expansion Drives Expenses Higher

Meta’s operating margin fell to 40%, down from 43% last year, as costs tied to its AI push surged. Research and development expenses jumped 28%, largely due to aggressive hiring across Meta’s artificial intelligence unit.

The company also raised its 2025 capital expenditure forecast once again, now expecting around $71 billion, up from $69 billion, with an even steeper increase expected in 2026. This figure cements Meta’s position as one of the largest corporate spenders in the world, fueled by a race to expand its AI data centers and in-house compute infrastructure.

CEO Mark Zuckerberg said on the earnings call that the spending is already showing results. “It’s pretty early, but I think we’re seeing the returns in the core business,” he said. “That’s giving us a lot of confidence that we should be investing a lot more.”

Still, investors appear skeptical. Unlike Amazon (AMZN), Microsoft (MSFT), or Google (GOOGL), which rent out their AI infrastructure through cloud platforms, Meta’s massive data centers are built for its own internal use. This is a strategy that could take longer to pay off.

Balance Sheet Pressure Mounts

Meta’s aggressive capital plan is reshaping its financial profile. For the second straight quarter, the company reported more debt, tax, and lease liabilities than cash and short-term investments, deepening its shift toward a more asset-heavy model.

Even though operational cash flow rose 21% year over year, free cash flow fell by 35% once capital spending was deducted. To offset some of that strain, Meta recently announced a $27 billion joint venture with Blue Owl Capital, moving its Hyperion data center off the balance sheet.

Essentially, Meta wants AI woven through all its platforms, from ad targeting to its Meta AI assistant. But for now, investors seem to be asking how much longer the company can keep spending at this pace before returns catch up.

Is Meta a Good Stock to Buy?

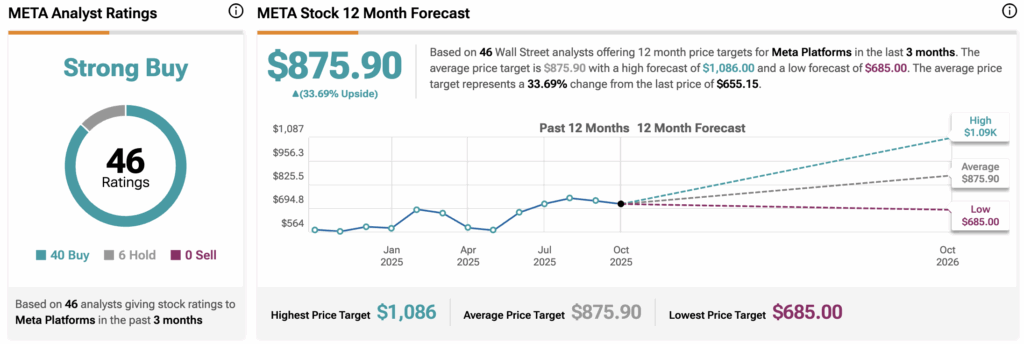

Despite its post-earnings pullback, analysts remain broadly bullish on Meta Platforms (META). Out of 46 Wall Street analysts, 40 rate the stock a Buy and six a Hold, giving it a consensus rating of “Strong Buy.”

The average 12-month META price target is $875.90, implying an upside of about 33.7% from the current price.