Meta Platforms (META) stock was up on Thursday alongside reports that the Facebook and Instagram owner is in talks to license content from publishers to use with its artificial intelligence (AI) services. According to The Wall Street Journal, the company has reached out to Fox Corp (FOX), News Corp (NWS), and other publishers for such deals.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Meta’s desire for more content from publishers makes sense, as this would allow it to offer more through its AI services. The AI industry has experienced a boom that’s increased demand for such services, including the chatbots Meta offers to its users. These chatbots can provide more real-time news updates and deeper insight into world affairs with the help of licensing deals with publishers, making them more valuable to users.

Meta’s rivals are already working to add publishers’ content to their AI. For example, Alphabet’s (GOOGL) Google now has an AI feature added to its search function. This feature highlights sources that it pulls information from, allowing it to collect resources for users while still giving credit to publishers. It’s unclear if Meta’s deal will offer similar links back to the content its AI will pull from.

Meta Stock Movement Today

Meta stock was up 0.53% on Thursday, following a 0.42% fall yesterday. The shares have rallied 32.71% year-to-date and 38.74% over the past 12 months. While Meta’s AI efforts have fallen behind industry leaders, the company has sought to alleviate this by poaching top talent in the field.

Is Meta Stock a Buy, Sell, or Hold?

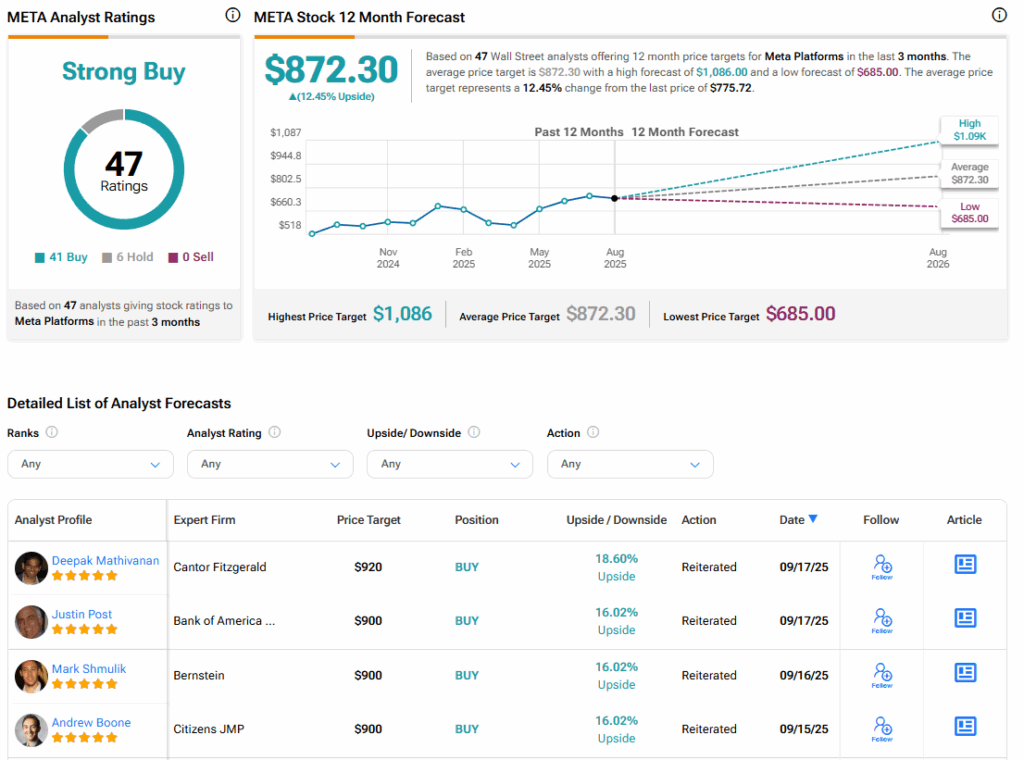

Turning to Wall Street, the analysts’ consensus rating for Meta Platforms is Strong Buy, based on 41 Buy and six Hold ratings over the past three months. With that comes an average META stock price target of $872.30, representing a potential 12.45% upside for the shares.