Meta’s antitrust headache just turned into a full-blown legal migraine. The Federal Trade Commission has officially kicked off its trial against the tech giant, pushing for a breakup that could force Meta to spin off Instagram and WhatsApp. It’s the biggest monopoly fight in tech since Microsoft (MSFT) in the ’90s—and it’s not just legal drama. Meta’s stock (META) is sitting in the middle of it.

FTC Accuses Meta of Buying Off Rivals

The FTC’s argument is clear: Meta didn’t outcompete—it outspent. The agency says Mark Zuckerberg followed a “buy not compete” playbook, citing internal emails like one from 2008 where he wrote, “It is better to buy than compete.” That’s the smoking gun now front and center in the case.

At issue are Meta’s acquisitions of Instagram in 2012 and WhatsApp in 2014. The FTC says both deals were meant to neutralize threats and cement Meta’s social media dominance. Meta, for its part, says the purchases were lawful and made the platforms better.

Analysts Back Meta Despite Legal Clampdown

Tech analysts are calling this a watershed moment for regulation. If the FTC wins, expect tougher scrutiny on mergers, especially those that target rising competitors. Some industry watchers are already comparing the moment to Microsoft’s antitrust saga in the early 2000s. But the stakes now? Arguably bigger. Meta doesn’t just make tools—it runs the digital town square.

“This could set a precedent for every future tech acquisition,” one analyst told AP News. “It’s a shot across the bow for Silicon Valley.”

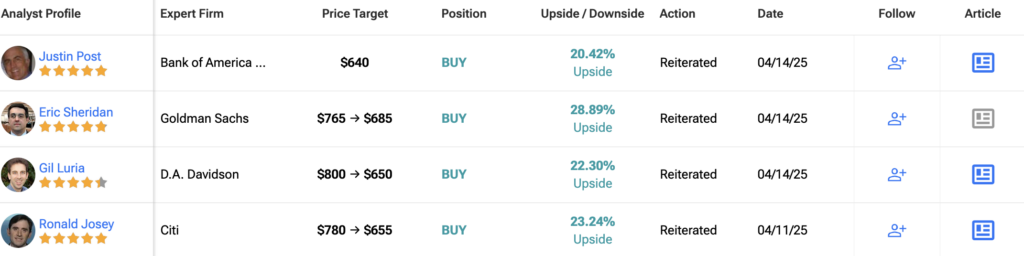

Still, the stock is holding up. And some analysts aren’t fazed. Bank of America’s Justin Post maintained a Buy rating on Meta and stuck with a $640 price target. In his view, the FTC case poses some tail risk—but not enough to derail Meta’s long-term playbook.

Post wrote that “while the FTC’s case presents some tail risk, the likelihood of a final resolution is distant, with potential appeals extending the timeline until 2027.” He added that Meta’s multi-app empire—Instagram, WhatsApp, and Facebook—will likely stay intact, and that the market hasn’t priced in any major penalties. In short: Post sees room to run.

Meta Stock Still Climbs as Bulls Bet on Growth

Meta shares are still trading strong, holding near all-time highs despite the legal overhang. Investors seem to believe that even if the case drags out, Meta’s ad juggernaut—plus growth in Threads, AI, and WhatsApp Business—will power through.

But make no mistake: if Meta loses this trial, it’s not just about a few apps. It could change how Big Tech does business.

What Is the Target Price for META?

Analysts remain bullish about META stock, with a Strong Buy consensus rating based on 42 Buys, three Holds, and one Sell. Over the past year, META has increased by more than 5%, and the average META price target of $733.67 implies an upside potential of 38% from current levels