Social media giant Meta Platforms (META) is once again attracting positive attention from Wall Street despite ongoing regulatory and execution risks. In fact, analysts at several firms argue that the stock still offers attractive upside.

Claim 70% Off TipRanks This Holiday Season

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Meta Is an ‘Opportunistic Buy’

For example, Robert W. Baird’s five-star analyst, Colin Sebastian, calls Meta an “opportunistic buy.” Therefore, he has a Buy rating while only slightly lowering his price target to $815 from $820. Interestingly, his valuation uses a 30x multiple on 2026 earnings and a 15x multiple on 2026 EV/EBITDA, which he believes are reasonable given Meta’s scale, margins, and diversified revenue base.

At the same time, five-star Citi (C) analyst Ronald Josey reiterated a Buy rating with a higher $850 price target, while Bank of America (BAC) also reaffirmed its Buy rating with a target of $810. Together, these calls show that Wall Street is confident that Meta’s long-term fundamentals can outweigh near-term concerns. Even with regulatory scrutiny and heavy investment spending, analysts see Meta’s financial strength and market position as key supports for the stock.

Several Potential Catalysts Could Drive Meta Shares

Looking ahead, several potential catalysts could drive Meta shares into 2026. Investors are closely watching upcoming Q1 guidance and margin comments, particularly for clarity on spending tied to AI and the metaverse. In addition, improvements in ad ranking, the growing monetization on WhatsApp and Threads, and the wider adoption of automated ad tools like Advantage+ continue to support the core advertising business.

What Is the Price Target for Meta

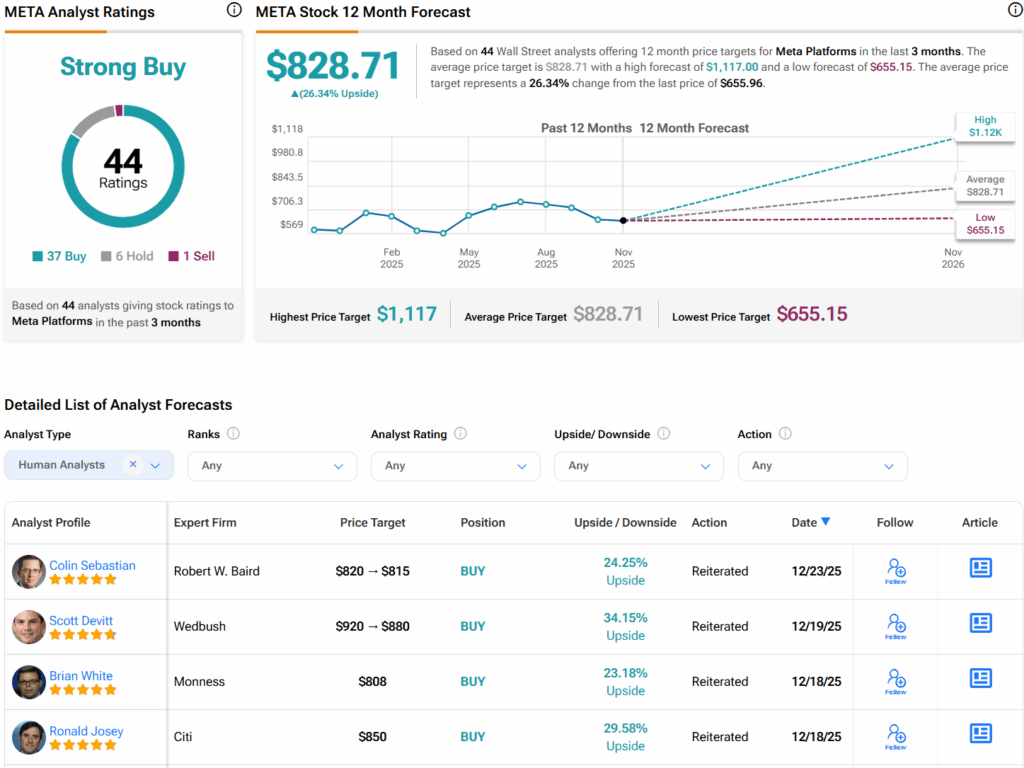

Overall, analysts have a Strong Buy consensus rating on META stock based on 37 Buys, six Holds, and one Sell assigned in the past three months, as indicated by the graphic below. Furthermore, the average META price target of $828.71 per share implies 26.3% upside potential.