Meta Platforms (META) seeks to manage the massive electricity demands of its data centers by entering the wholesale power-trading business, Bloomberg reported. The company has submitted an application to the Federal Energy Regulatory Commission (FERC) through its subsidiary Atem Energy LLC, for permission to sell energy, capacity, and ancillary services.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

This move reflects a broader trend among major tech companies, including Google (GOOGL) and Microsoft (MSFT), which are dealing with the escalating power needs of building and running advanced AI systems.

Meta has requested that its application be approved by November 16, 2025.

Rising Energy Demand

Meta’s energy push is part of its big investment in infrastructure, mostly to support AI. Training large AI models takes huge computing power, with thousands of GPUs running continuously and using a lot of electricity.

According to BloombergNEF, energy demand from data centers is expected to quadruple over the next decade.

By entering the power-trading space, Meta can better manage its energy costs, hedge against price spikes, and even sell excess electricity back to the grid when demand is high. It is a strategic move that gives the company more control over its energy footprint, especially as it works toward powering operations with clean energy.

In this regard, Louisiana’s state regulators approved Entergy Corp.’s (ETR) plan to build three natural gas plants to power Meta’s largest data center. This decision highlights that while clean energy is the goal, fossil fuels are still needed to meet the current growing AI energy demand.

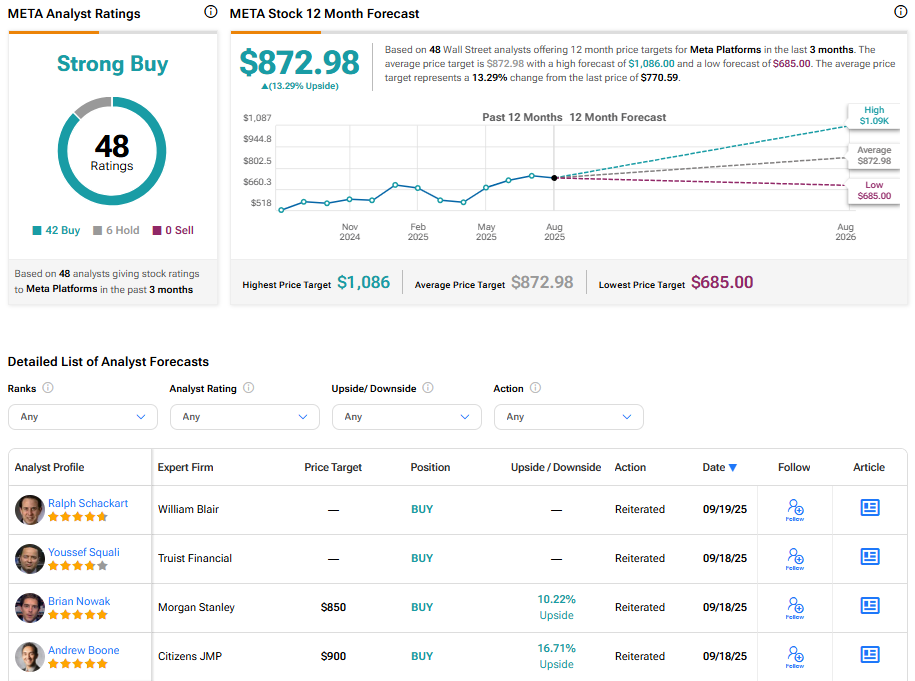

Is Meta a Buy, Hold, or Sell?

Turning to Wall Street, META stock has a Strong Buy consensus rating based on 42 Buys and six Holds assigned in the last three months. The average Meta share price target is $872.98, which implies an upside of 13.2% from current levels.