Social media company Meta Platforms (META) said on Monday that it removed about 10 million fake profiles in the first half of 2025. These accounts were pretending to be well-known content creators and were creating spammy content. Understandably, Meta is working to make its Facebook Feed more useful and trustworthy by cutting down on spam, especially when it comes to posts made using AI tools. As part of this plan, the company is also rolling out new rules that give more visibility to original posts created by real users.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

- Make smarter investment decisions with TipRanks' Smart Investor Picks, delivered to your inbox every week.

In addition to removing fake profiles, Meta also targeted around 500,000 accounts that were spreading spam or behaving in dishonest ways by limiting how many people could see their posts and hiding their comments. Meta explained that unoriginal content, such as reusing videos or images without giving credit, is one of the problems it is targeting. As a result, the company is now using new technology to find and reduce the spread of these duplicate videos. What is interesting about Meta’s move to clean up content is that it comes as Meta increases its spending on AI.

In fact, CEO Mark Zuckerberg recently shared that the company is planning to spend hundreds of billions of dollars on AI infrastructure, which includes building a powerful AI system called a supercluster. Other platforms are also making similar changes. For example, YouTube announced that videos that are spammy, repetitive, or mass-produced won’t be able to earn ad revenue. At first, some users thought that YouTube was banning all AI content, but the company later clarified that it still supports creators who use AI in creative ways.

Is Meta a Buy, Sell, or Hold?

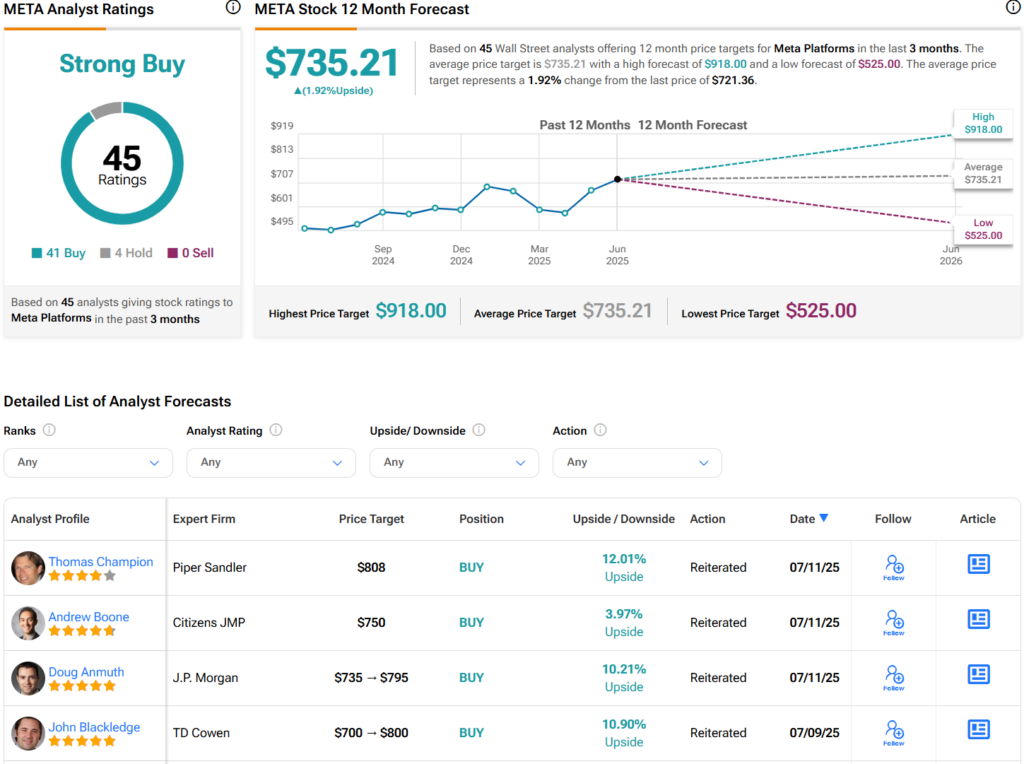

Turning to Wall Street, analysts have a Strong Buy consensus rating on META stock based on 41 Buys, four Holds, and zero Sells assigned in the past three months, as indicated by the graphic below. Furthermore, the average META price target of $735.21 per share implies that shares are near fair value.