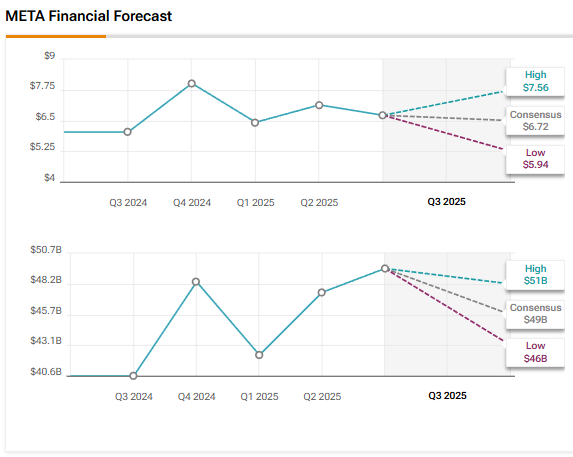

Social media giant Meta Platforms (META) is scheduled to announce its third-quarter results after the market closes on Wednesday, October 29. META stock has risen more than 28% year to date, as the company has been delivering solid ad revenue growth in recent quarters by leveraging artificial intelligence (AI). Wall Street expects Meta Platforms to report 11.4% growth in its Q3 2025 earnings per share (EPS) to $6.72. Revenue is estimated to increase by about 22% year-over-year to $49.49 billion.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Investors will pay attention to management’s commentary on the momentum in Meta’s business and the outlook for margins amid massive investments in AI.

Analysts’ Views Ahead of Meta Platforms’ Q3 Earnings

Ahead of the Q3 results, Truist analyst Youssef Squali raised his price target for Meta Platforms stock to $900 from $880 and reaffirmed a Buy rating. The analyst remains “constructive” on META stock and expects Q3 results to be in line or slightly ahead of his 22% year-over-year revenue growth estimate (high-end of guidance). Squali expects Meta’s Q3 results to reflect solid user engagement and improved monetization due to better ranking and recommendations, driven by AI-led improvements.

For Q4 2025, Squali expects management’s outlook to bracket the consensus revenue growth estimate of 18% (or revenue of $55 billion to $58 billion) due to tough year-over-year comparisons. Further, he expects Meta Platforms to maintain its operating expenses outlook ($142 billion to $146 billion) and capital expenditure guidance (about $100 billion) to support AI investments and drive above-industry growth. Squali adjusted his Fiscal 2026 top-line estimate to reflect better traction with wearables.

Meanwhile, Stifel analyst Mark Kelley reiterated a Buy rating on META stock with a price target of $900. The 5-star analyst continues to view META as a top pick in the long term. Kelley believes that Q3 estimates seem reasonable, with his checks highlighting continued strength in Instagram. He expects Meta Platforms’ 2026 capex (and related expenses) to take “center stage” this quarter, though he believes that investors have grown slightly more comfortable with elevated levels of capex over the near term. Kelley also thinks that downside risk from greater-than-expected capex guidance is reasonably limited.

AI Analyst Is Bullish on META Stock Ahead of Q3 Print

Interestingly, TipRanks’ AI Analyst has assigned an Outperform rating to Meta Platforms stock with a price target of $849, indicating 13% upside potential. TipRanks’ AI analyst’s rating is based on robust financial performance and strong earnings call insights, driven by AI advancements and user engagement growth.

However, technical indicators suggest caution, and valuation metrics reflect moderate attractiveness. Regulatory challenges and high expenses are potential risks.

Options Traders Anticipate a Major Move on META’s Q3 Earnings

Using TipRanks’ Options tool, we can see what options traders are expecting from the stock immediately after its earnings report. The expected earnings move is determined by calculating the at-the-money straddle of the options closest to expiration after the earnings announcement. If this sounds complicated, don’t worry, the Options tool does this for you.

Indeed, it currently says that options traders are expecting a 6.76% move in either direction in META stock in reaction to Q3 2025 results.

What Is the Price Target for Meta Platforms Stock?

Overall, Wall Street has a Strong Buy consensus rating on Meta Platforms stock based on 40 Buys and six Holds. The average META stock price target of $878.09 indicates a 17% upside potential from current levels.