Social media giant Meta Platforms (META) is set to release its third-quarter results after the market closes on October 30. Wall Street analysts anticipate strong growth in both earnings and revenue, supported by AI-driven ad optimization and effective cost-control measures. Earnings per share are expected to reach $5.21, marking an 18.7% increase from last year’s third quarter. Meanwhile, revenues are expected to hit $40.19 billion, reflecting a 17.7% year-over-year rise, as per TipRanks Forecast data.

Claim 50% Off TipRanks Premium and Invest with Confidence

- Unlock hedge-fund level data and powerful investing tools designed to help you make smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis so your portfolio is always positioned for maximum potential

Over the past year, META stock has surged more than 91%. As Q3 results draw near, it’s noteworthy that Meta has consistently surpassed consensus EPS estimates for six consecutive quarters. Investors should watch closely to see if Meta can sustain this strong performance through the remainder of the year.

Website Traffic Shows Q3 Dip for Meta’s Facebook Platform

While analysts anticipate growth in Meta’s Q3 revenue and earnings, the website traffic data tells a different story. Using TipRanks’ Website Traffic Tool, investors can gain early insights into a company’s performance, as the tool tracks traffic patterns on specific domains over selected time frames.

For Meta, the tool indicates a decline in traffic for Q3, both sequentially and year-over-year. Specifically, visits to facebook.com dropped by 8.66% from the same quarter last year and 5.52% compared to the previous quarter.

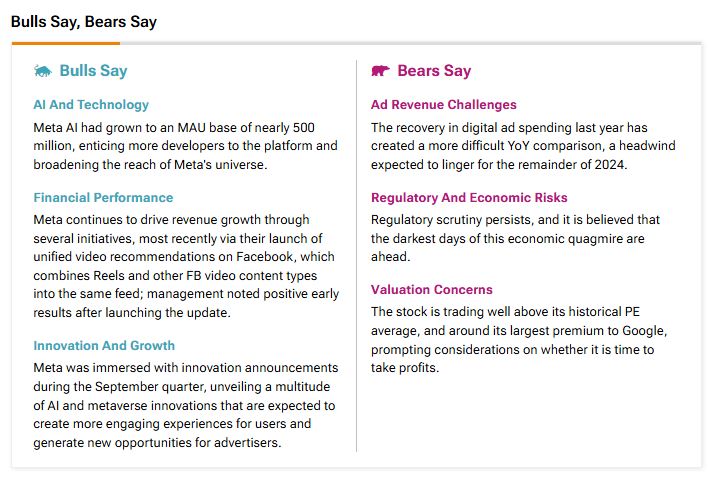

Key Takeaways from TipRanks’ Bulls & Bears Tool

TipRanks’ Bulls Say, Bears Say tool gives insight into analysts’ views on Meta as it approaches its Q3 earnings. Bulls are confident in Meta’s AI ecosystem, which now reaches nearly 500 million active users monthly, attracting developers and broadening its digital influence. Further, they contend that Meta’s revenue growth is gaining momentum, driven by unified video recommendations on Facebook that combine Reels and other video formats. Furthermore, analysts believe that Meta’s recent AI and metaverse advancements are expected to boost user engagement and open new opportunities for advertisers.

On the flipside, bears pointed out that Meta’s ad revenues remain under pressure. They also remain concerned about Meta’s ongoing regulatory challenges and high valuation.

Options Traders Anticipate a Large Move

TipRanks’ Options tool offers a quick way to gauge what options traders anticipate from the stock following its earnings report. The expected earnings move is calculated using the at-the-money straddle of the options set to expire closest to the announcement. While this may sound complex, the tool handles the calculations for you.

Currently, it indicates that options traders are predicting an 8.09% swing in either direction.

Is META Stock a Buy?

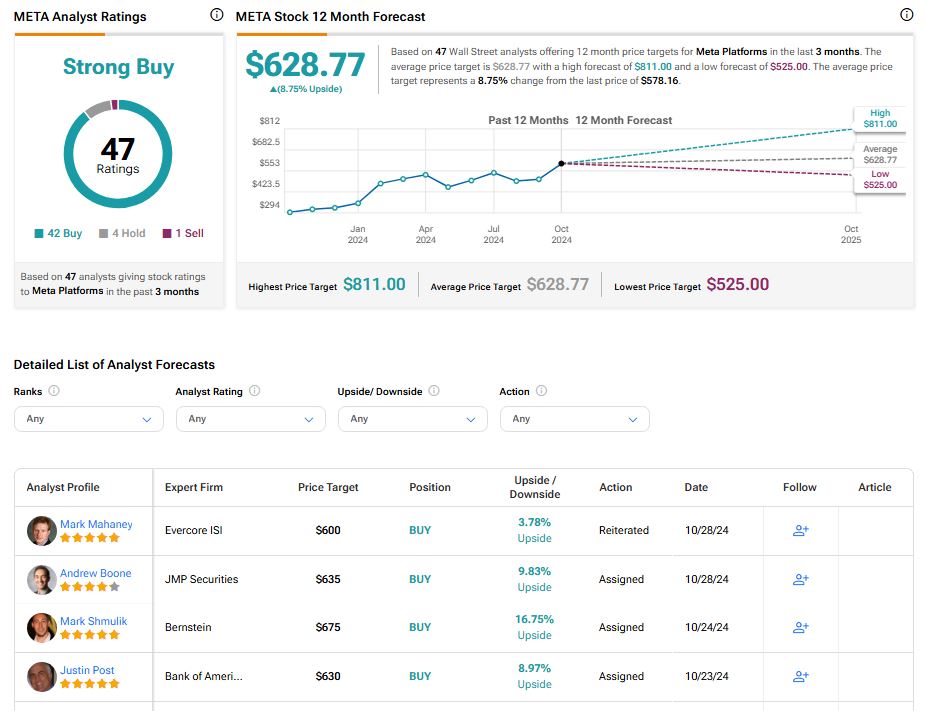

Turning to Wall Street, analysts have a Strong Buy consensus rating on META stock based on 42 Buys, four Holds, and one sell assigned in the past three months, as indicated by the graphic below. At $628.77, the average META price target implies 8.75% upside potential.