Social media giant Meta Platforms (META) is planning to cut about 600 jobs from its Superintelligence Labs division, which includes teams like Facebook AI Research, AI product, and AI infrastructure, according to a memo reported by Axios. However, the newly created TBD Lab will not be affected. Meta’s Chief AI Officer, Alexandr Wang, explained that having fewer team members will help speed up decision-making and give each role more responsibility and impact. As a result, the company is encouraging affected employees to apply for other positions within Meta and expects many will find new roles internally.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The news follows Meta’s $27 billion financing deal with Blue Owl Capital (OWL), the biggest private funding agreement in the company’s history, which will be used to build Meta’s largest data center project yet. Interestingly, some analysts believe that the deal gives Meta the ability to pursue its large-scale AI goals while shifting much of the upfront cost and risk to outside investors. In return, Meta will maintain a smaller ownership stake in the project while reducing its financial burden.

It is also worth noting that Meta CEO Mark Zuckerberg has been investing heavily in AI this year, especially when it comes to attracting talent. Indeed, the firm has been offering compensation packages as high as $100 million in order to poach key employees from competitors after receiving poor feedback on its open-source Llama 4 model.

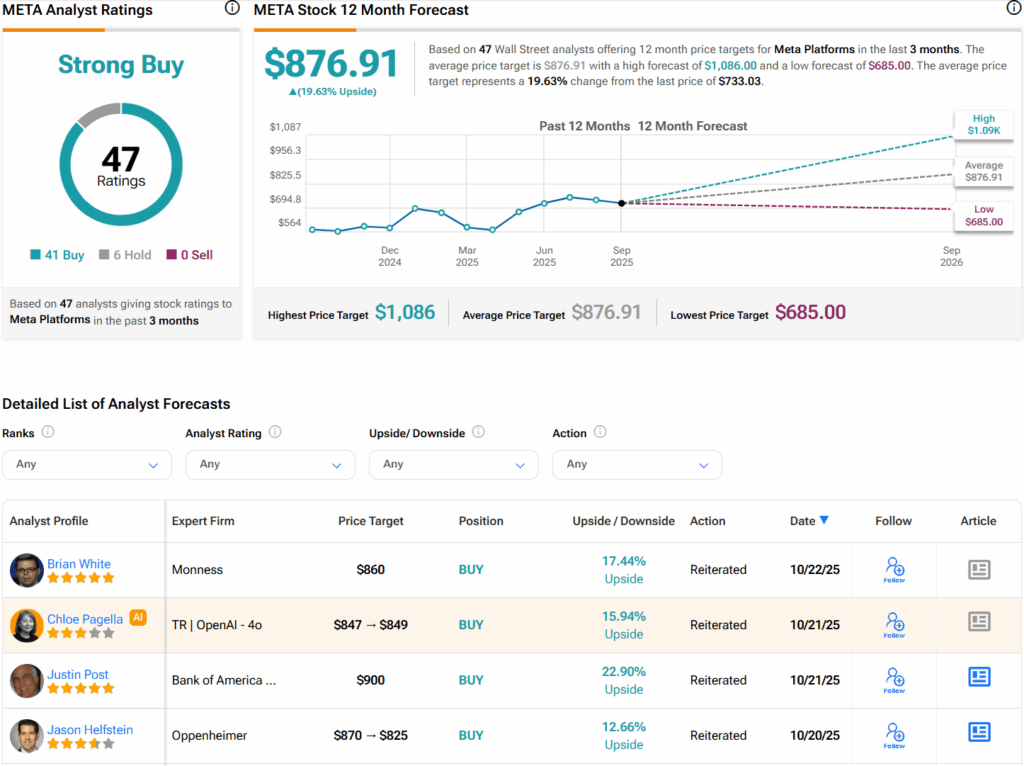

Is Meta a Buy, Sell, or Hold?

Turning to Wall Street, analysts have a Strong Buy consensus rating on META stock based on 41 Buys, six Holds, and zero Sells assigned in the past three months, as indicated by the graphic below. Furthermore, the average META price target of $876.91 per share implies 19.6% upside potential.