Meta Platforms (META) shares are up about 7% over the past year. Recently, the company announced new nuclear power agreements covering 6.6 gigawatts of capacity with Vistra Energy (VST), Bill Gates–backed TerraPower, and Oklo (OKLO). This adds to the 1.1 gigawatts already secured with Constellation Energy (CEG).

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

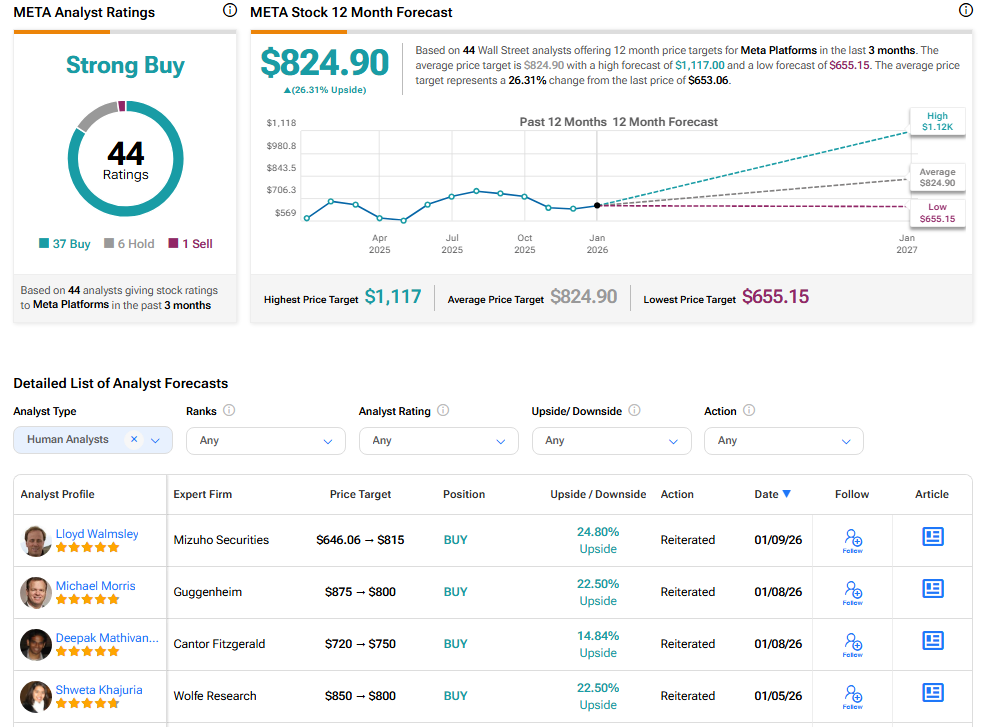

Following the announcement, top Rosenblatt analyst Barton Crockett reiterated a Buy rating on Meta stock with a $1,117 price target, citing improved visibility around the company’s AI data center plans. With sentiment improving, it’s worth taking a closer look at who owns the largest stakes in Meta stock.

Now, according to TipRanks’ ownership page, public companies and individual investors own 32.20% of META. They are followed by mutual funds, ETFs, other institutional investors, and insiders, at 28.30%, 21.05%, 18.37%, and 0.07%, respectively.

Digging Deeper into META’s Ownership Structure

Looking closely at top shareholders, Vanguard owns the highest stake in META at 7.53%. Next up is Vanguard Index Funds, which holds a 6.61% stake in the company.

Among the top ETF holders, the Vanguard Total Stock Market ETF (VTI) owns a 3.13% stake in Meta stock, followed by the Vanguard S&P 500 ETF (VOO) with a 2.48% stake.

Moving to mutual funds, Putnam Asset Allocation Funds owns 3.87% of the stock.

Is META a Good Stock to Buy Now?

Overall, Wall Street has a Strong Buy consensus rating on Meta stock based on 37 Buys, six Holds, and one Sell recommendation. The average META stock price target of $824.90 indicates 26.31% upside potential.