Shares of social media giant Meta Platforms (META) jumped in after-hours trading after reporting earnings for its first quarter of Fiscal Year 2025. Adjusted earnings per share came in at $6.43, which beat analysts’ consensus estimate of $5.24 per share.

In addition, sales increased by 16% year-over-year, with revenue hitting $42.31 billion. This also beat analysts’ expectations of $41.34 billion and was driven by a 5% increase in ad impressions, along with a 10% increase in average price per ad.

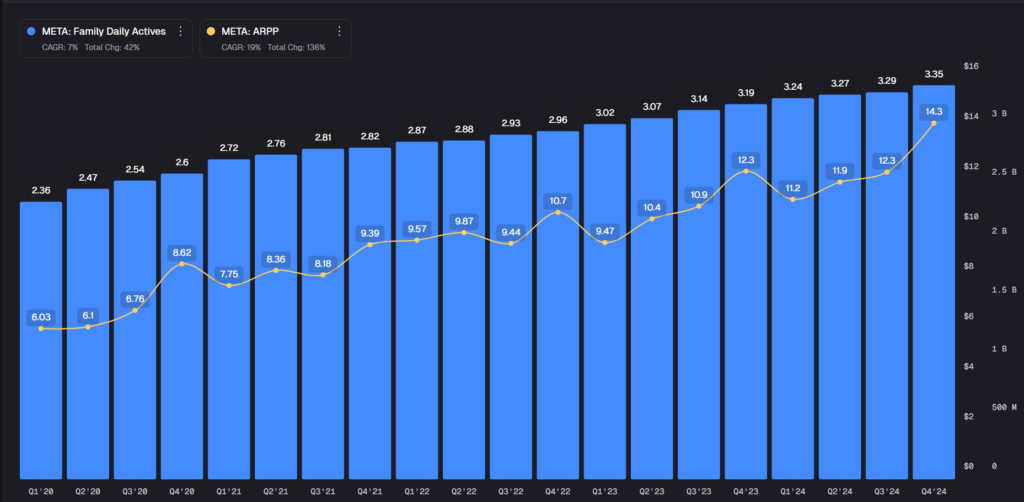

Turning to the company’s user base, family daily active people, which is defined as users who visited at least one of the company’s apps, averaged 3.43 billion in March 2025, a 6% year-over-year increase. As we can see from the Main Street Data image below, Meta is still continuing the trend of steady user and revenue growth it has enjoyed over the past five years.

META’s 2025 Outlook

Looking forward, management has provided the following outlook for 2025:

- Q2 revenue of between $42.5 billion and $45.5 billion versus analysts’ estimates of $43.81 billion

- FY expenses of between $113 billion and $118 billion

- FY capital expenditures in the range of $64 billion to $72 billion

As we can see, the company’s revenue outlook at the midpoint and earnings results were better than expected, which is what led to the stock’s rally in the after-hours session.

Is Meta a Buy, Sell, or Hold?

Turning to Wall Street, analysts have a Strong Buy consensus rating on META stock based on 36 Buys, one Hold, and one Sell assigned in the past three months, as indicated by the graphic below. Furthermore, the average META price target of $680.53 per share implies 25.9% upside potential. However, it’s worth noting that estimates will likely change following today’s earnings report.