For years, Target (TGT) was praised for its clean, well-organized stores. But recently, shoppers have complained about messier aisles, longer lines, locked-up items, and frequent out-of-stock items, according to CNBC. Unsurprisingly, these issues have hurt sales. To fix things, Target is changing how it handles online orders. Instead of having all stores pack and ship online purchases, it’s now assigning only certain locations to do that, allowing other stores to focus fully on in-person shopping. This strategy began as a pilot in Chicago and has now expanded to over half of Target’s 60 markets.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Interestingly, this is a change from Target’s 2017 plan to use every store as a fulfillment hub. That system helped digital sales grow rapidly—from $6.6 billion in 2020 to nearly $21 billion in 2025—but it also made the work more complex for store managers and employees, who had to juggle customer service and logistics. However, by limiting ship-from-store tasks to select locations, Target can improve customer service. For example, in Chicago, next-day delivery cutoffs moved from noon to 6 p.m., and stores that stopped packing boxes saw cleaner aisles, fewer out-of-stocks, and a 10% rise in customer satisfaction.

Still, problems remain. Store traffic has declined since February due to rising grocery prices, competition, and backlash over social issues. Customers also dislike locked-up products and slow checkout lines. While Target has limited self-checkout to 10 items to speed things up, its edge in in-store experience has narrowed. Some shoppers now prefer Walmart (WMT) due to better prices and tidier stores. Therefore, analysts say that Target must invest more in store improvements, staffing, and tech to compete.

Is Target Stock a Good Buy?

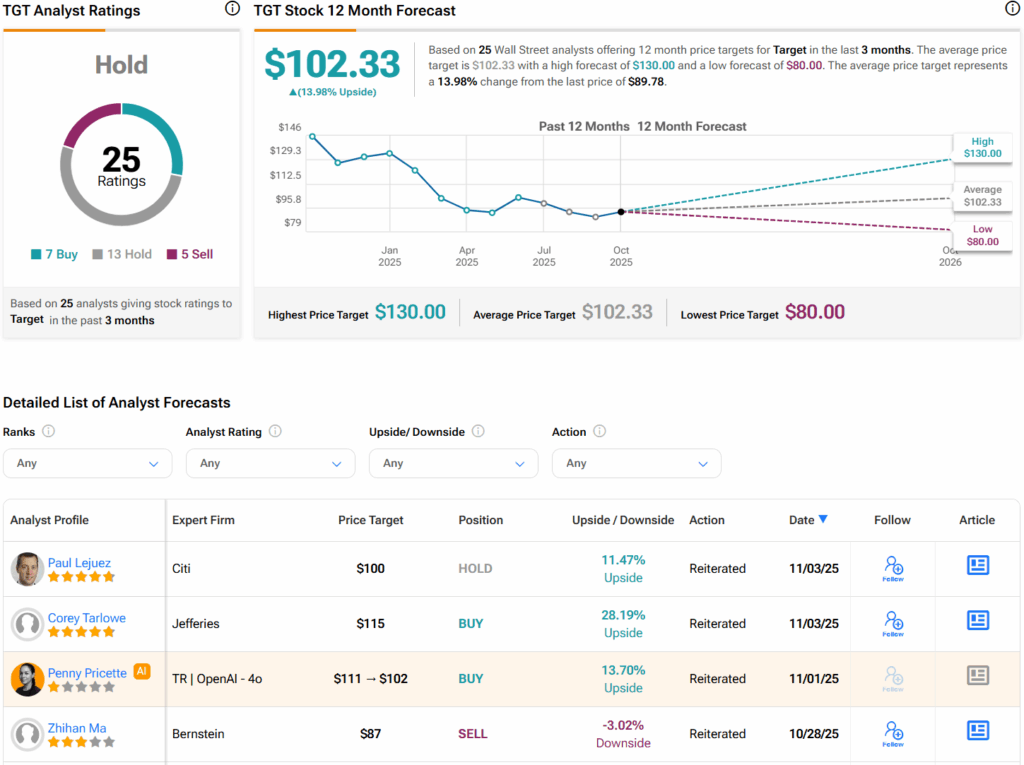

Turning to Wall Street, analysts have a Hold consensus rating on Target stock based on seven Buys, 13 Holds, and five Sells assigned in the past three months, as indicated by the graphic below. Furthermore, the average Target stock price target of $102.33 per share implies 14% upside potential.