Shares in British biopharmaceutical firm Mereo Biopharma (MREO) saw a wipeout of over 90% on Monday after two of its late-stage studies failed to achieve their main goals.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

London-based Mereo, which focuses on developing treatments for cancer and other rare diseases, announced that its Phase 3 trials, ORBIT and COSMIC, for the drug setrusumab failed to meet their main goals for patients with Osteogenesis Imperfecta, a rare bone-fragility disease.

What’s the Trial About and What Was Missed?

The key goals were missed as the trials did not show evidence of a statistically significant drop in yearly bone fractures, compared to patients who received a placebo treatment in the ORBIT trial or those who had bisphosphonates, the standard bone fracture prevention drugs, in the COSMIC trial.

Despite this failure in terms of the primary goals of both studies, the trials achieved success with their secondary goals. Both studies showed material gains in bone strength compared to the placebo and the bisphosphonates.

No safety problems emerged from the trials, Mereo noted, adding that it continues to study the trial data to determine the best way forward. In particular, the biopharma firm will examine the higher-risk fracture patient subgroup, which showed bone strength gains despite failing to achieve significant annual fracture reductions.

Mereo Tightens Finances after Trial Setback

Bullish analysts had anticipated that setrusumab could provide Mereo with a significant market opportunity by addressing the largely unmet need in Osteogenesis Imperfecta.

To manage the impact, Mereo noted that it will further tighten its purse strings. The biopharma company had a cash balance of $48.7 million at the end of its third-quarter 2025 period. It believes that the figure will be sufficient for its operations into 2027.

Other pharmaceutical companies, such as pharma giant AstraZeneca (AZN), Insmed (INSM), and Arcus Biosciences (RCUS), also recently reported market-moving trial failures.

Is MREO a Good Stock to Buy?

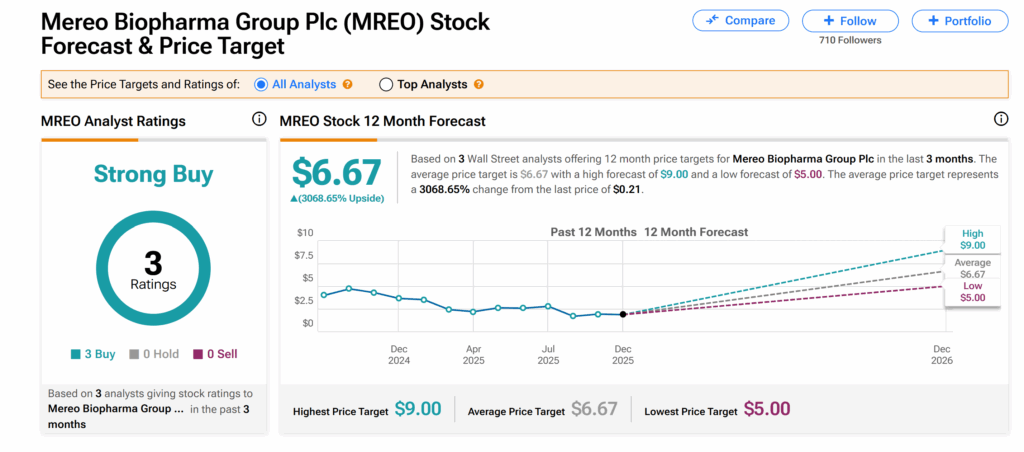

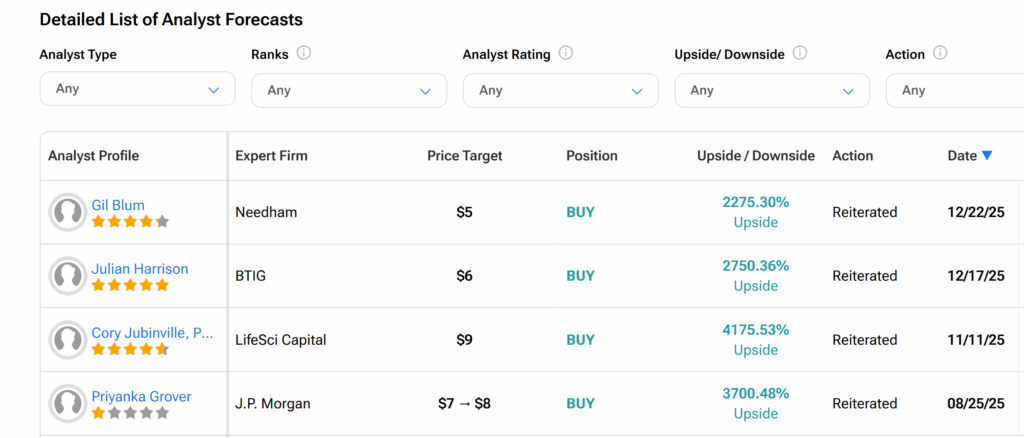

On Wall Street, Mereo Biopharma’s shares hold a Strong Buy consensus rating based on three Buys issued by analysts over the past three months.

Moreover, the average MREO price target of $6.67 implies a massive 3,000%-plus growth potential from current trading levels. However, it is important to note that these ratings could be subject to change as analysts reassess the stock following the latest development.