It was bad news for Merck (NYSE:MRK) today as the drug maker found itself with a dud for a guided missile. A new cancer drug it developed along with Daiichi Sankyo (OTHEROTC:DSKYF) was declined for Food and Drug Administration (FDA) approval. That was bad news enough to send Merck down over 2% in Thursday afternoon’s trading.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The drug in question, a lung cancer treatment known as patritumab deruxtecan, is part of a larger family of drugs known as “antibody-drug conjugates” (ADCs). ADCs are described as “guided missiles” among cancer drugs for their ability to specifically target the disease.

As for why the FDA passed on approval, reports noted there were “outstanding questions,” though nothing apparently related to either safety data or efficacy numbers that Merck turned in. So, what exactly is left to complain about is somewhat unclear, but Merck plans to work with the FDA directly to address these “outstanding questions” and get its drug in play in a market that doesn’t have a whole lot of competition right now.

But What About Keytruda?

Merck already had something of a winner in Keytruda, a cancer immunotherapy that produced around $25 billion in sales back in 2023. That was roughly 40% of Merck’s overall revenue. But that also produced an unexpected development. Merck released the results of a Phase 3 study to an online database managed by the federal government…but offered no announcement to the public. This was regarded as unusual, especially given that Merck has previously been fairly brisk in releasing information around Keytruda.

Is Merck Stock a Good Buy?

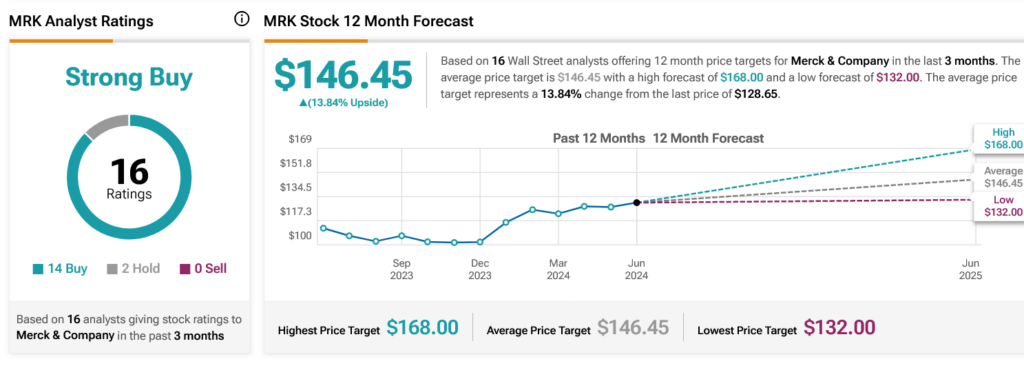

Turning to Wall Street, analysts have a Strong Buy consensus rating on MRK stock based on 14 Buys and two Holds assigned in the past three months, as indicated by the graphic below. After a 17.36% rally in its share price over the past year, the average MRK price target of $146.45 per share implies 13.84% upside potential.