American multinational pharmaceutical company Merck (NYSE:MRK) is joining hands with Japanese drug maker Daiichi Sankyo (OTCMKTS:DSKYF) to develop three cancer drugs. As per the deal, Merck will pay $4 billion upfront to Daiichi and another $1.5 billion over the next two years, pegging the deal value at $5.5 billion. Moreover, depending on the success of the drugs and certain future sales thresholds, Merck might pay an additional $16.5 billion to Daiichi.

Claim 70% Off TipRanks This Holiday Season

- Unlock hedge-fund level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Furthermore, Merck said that it will record a pre-tax expense of $5.5 billion ($1.70 per share) related to the deal payment in its fourth-quarter financials. Also, investments in the pipeline assets and financing costs are expected to impact its bottom line by $0.25 per share in the first 12 months following the transaction’s completion.

Merck and Daiichi will jointly develop the three cancer drugs, currently in different stages of clinical development, using Daiichi’s DXd antibody-drug conjugates (ADC) technology. Unlike other cancer treatments available in the market, ADCs do not harm healthy cells, but only target cancer cells. Both Merck and Daiichi stated that each of the three drug candidates has the potential to earn billions of dollars in commercial revenue by 2030. As per the deal, these drugs will be sold jointly across the globe except for in Japan, where Daiichi will hold exclusive selling rights.

Is Merck Stock a Buy, Sell, or Hold?

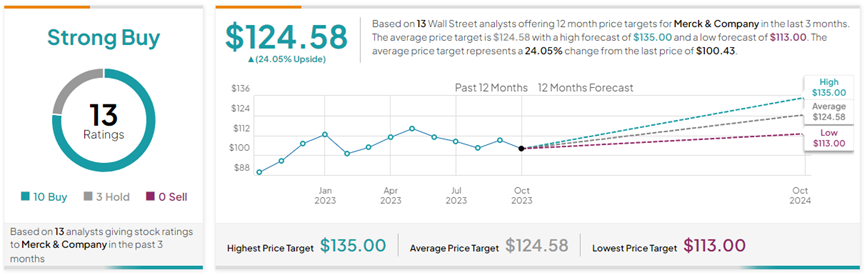

With 10 Buys and three Hold ratings, Merck stock has a Strong Buy consensus rating on TipRanks. The average Merck price forecast of $124.58 implies 24% upside potential to current levels. Year-to-date, MRK stock has lost 7.8%.